A personalized survey allows us to better understand customer behavior within the market. With a good survey design, it is possible to gather the necessary information that allows us to have a better strategy for decision making, prevent problems and maintain a constant improvement of the company.

The right survey design can become the determining factor in the success of your projects. To achieve it in the best way possible, we have created the 10 steps to design a survey properly.

10 Steps to a good survey design

The most important part of the survey process is to create questions that accurately measure respondents" opinions and behavior. Response rates will be wasted if the information gathered is based on biased questions. Gathering good feedback involves both writing good questions and using a good survey design to organize those questions.

1. Identify what you want to cover in a survey.

Even before you finalize the survey design, it is vital to think about the objective of deploying a survey. Identify what you want to cover in a study and make sure the topic is clear at once. Once there is clarity obtained on what the survey will be about, other steps will follow.

Split your core objective into multiple unique points. The brief should answer some basic questions: What kind of demographic details do you want to capture? Do you want to calculate Net Promoter Score Will it be a micro or macro survey? How many questions do you want to have? What type of questions should be open-ended? Do you want to add variables to personalize surveys for respondents?

Effective online surveys will have distinct blocks designed to guide the respondent through the process. Here is what the most common survey blocks will look like:

Introduction: Sets the respondent"s expectations – may also be covered in the survey invite.

Survey duration: Give respondents a realistic time estimate and remind them their opinions are secure.

Screeners: Questions designed to ensure the respondent meets your criteria.

Typical screeners include demographics (age, gender, region), level of responsibility or purchase ability (B2B), product/service usage, or brand/company awareness. Screeners are useful for establishing quotas.

Body: The bulk of the survey. Questions on usage, attitudes, awareness, concept testing, competitive perceptions, etc.

Demographics: Questions used for profiling or segmenting the respondents. No need to repeat any demographics used as screeners.

Final thoughts: Close with an open-ended question asking for any additional ideas.

Redirects: Could be a simple thank you page, a redirect to your website, or back to a panel provider.

2. Put the essential questions.

Now that you have your core objectives brief ready, it is time for you to convert these core points to real survey questions. It is rather easy to start deviating from the core objectives and boundaries once it starts creating the survey on QuestionPro, given the amount of freedom and choices that the platform provides. However, it is essential to stick to what you had already decided unless you know that the objectives need some alterations to make your survey better.

3. Keep it short and straightforward.

Respondents may get irritated and less likely to complete the survey if a topic is not precise and tend to bounce back and forth. Therefore, follow a logical order in placing the questions and stick to a specific topic. If the survey is too lengthy, respondents might not stay interested in filling out the entire study, and survey results might get compromised. Hence, keep it short and straightforward.

4. Ask one question at a time.

Branching questions or asking more than one question at a time can confuse respondents, and they might not be able to choose the correct option/options from the list of answer options provided to them. Therefore, it is advisable to ask one question at a time, to give clarity to respondents.

QuestionPro features over 20 advanced logic mechanisms to make a survey more systematic, and in most cases, it also helps make them shorter. Another advantage of using logic in your surveys is making them more user friendly by simplifying the answers.

5. Avoid using jargon.

For respondents to respond to the survey, avoid using jargon and too many technical terms. Using a language that is easily understood by respondents will help them understand and respond to surveys better.

Language is extremely important while designing a survey. The idea must be to make it as simple as possible for the respondent to answer your survey. The more complicated it becomes, the more likely it is that respondents will leave their surveys incomplete.

6. Open-ended questions or closed-ended questions?

It is always the tricky part, whether to ask open-ended questions or closed-ended questions. The trick here is, balance out both these options. Try and include descriptive and objective questions to balance the survey. Again question types should be carefully sorted as it defines the tone and importance of asking a question in the first place.

7. Spend time to design your survey.

When preparing for an initial client meeting, make sure you prepare questions regarding the nature of the problem, including their "gut feelings", as well as asking for any relevant information about their business operation in which you might not already know.

Market research, or research in general, does not thrive if it is kept in a vacuum. Therefore researchers need to be proactive in communications with internal and external clients. Management is likely only to see the "result" of a problem, such as a decline in sales or a downtrend in customer satisfaction ratings. The cause of these problems, e.g., a shift in market preferences, can only be identified when we look below the surface. Researchers" job is to query clients to understand what is known (a decline in sales) and to identify possible causes of the problem that we quantify via our research efforts.

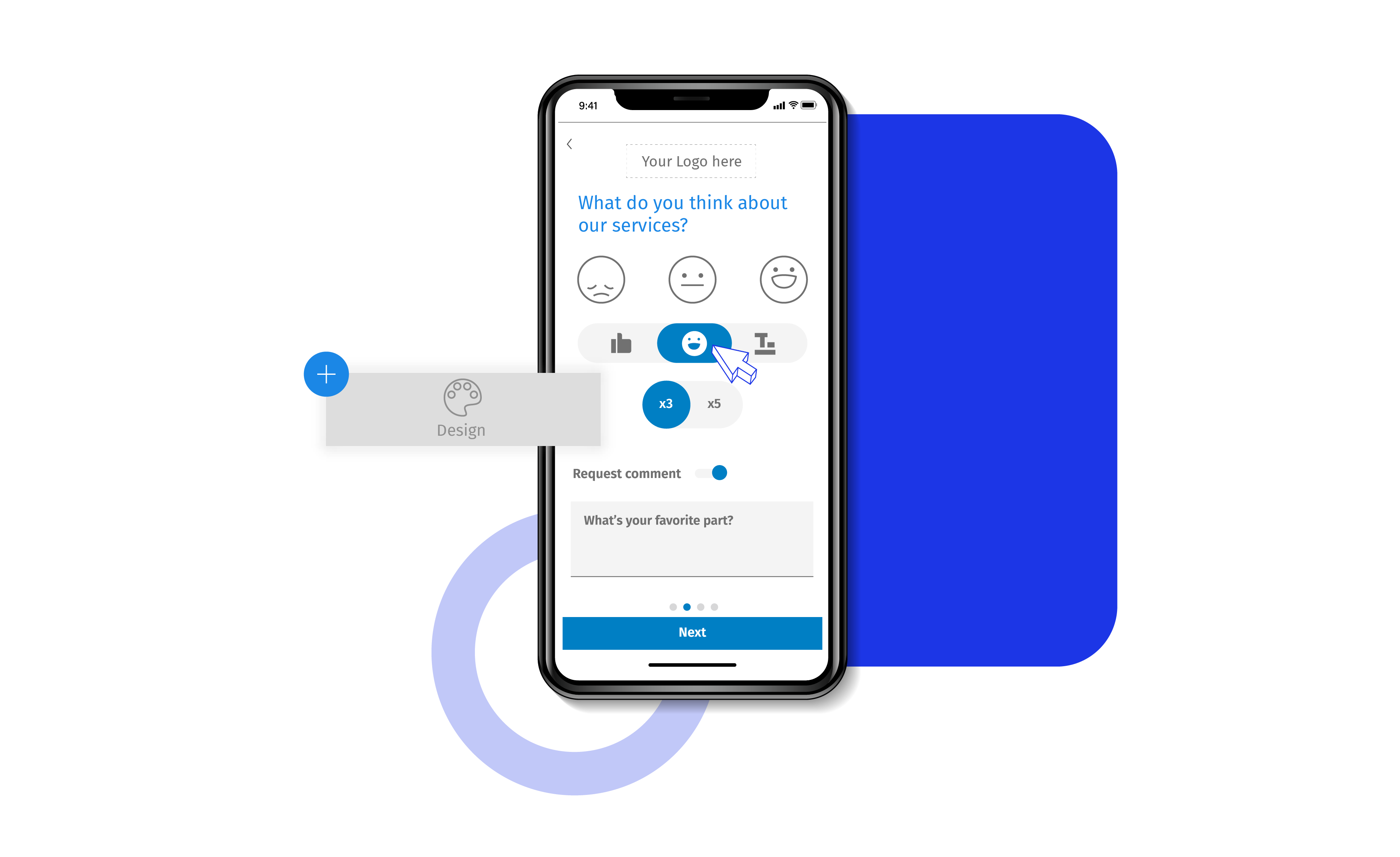

A survey needs to create brand awareness with respondents. For this, the survey creator can use the brand language (brand logo and brand color), so respondents can correlate with it.

QuestionPro lets you fully own your surveys through self-branding with logos. You can also personalize your research studies for your respondents using customer variables. It is useful for capturing responses in earlier questions from your target audience and use them to create automated form fills that personalize the following questions. For example, obtaining the respondent"s key demographics at the beginning of the survey allows you to set questions that use this data and personalizes the survey.

8. Analyze the responses.

Once you"ve sent out the survey, collect all the responses, and maintain a document or excel sheet for the collected responses. This excel sheet should have all the mentioned classifications of the survey to have all the data in place.

You need to make sure you follow this step and categorize data into Behaviour, Psychographics, and Demographics. Any researcher needs to have organized data so that analyzing, predicting outcomes, and writing reports become easy.

9. Put a summary report together.

After collecting responses and analyzing it, share your analysis with your customers using a summary report. You should have all the data gathered from surveys in a particular format by this stage. The readers should get a clear picture of your goal, i.e., what were you trying to attain from the survey? Make sure you cover questions such as do users prefer/use a particular product or service? Which product do the users prefer? Any comment?

10. Conclude your plan of action.

Prepare your final action plan based on your goal, responses put together and conclude. Mend your final plan and start executing the changes.

A survey creator may direct a pre-testing of the survey to a focus group during the development process to better understand how respondents in that group may respond. Pre-testing is a good practice as a survey creator can comprehend in the initial stages if there are any changes required in the survey.

Popular questions in survey design

Clients may want 40 minutes of a respondent"s time, but respondents are not always willing to go that long. First, online survey design best practices are to break longer surveys into shorter projects. If you know your intended audience and know the overarching research questions that need to be answered to drive decisions, you can create a useful survey. An effective survey balances the client"s informational needs while respecting the respondent"s time and willingness to share their opinions.

Survey design is about asking the right questions to the right people at the right time. How we ask those questions directly impacts the insights we provide.

Multiple choice (Single select)

Multiple choice single select is a simple question type that lets respondents choose one option from the many. To allow them to decide quickly, add options that are clear and distinct.

Multiple choice (Multiple response)

Multiple choice multiple response" questions lets respondents choose various options from the many. The data gathered by this question type is easy to analyze and offer detailed insights.

Side by side matrix question

Side by side matrix question lets market researchers collect multi-dimensional data. Each column can have sub-columns with a scale having opposites on its end. For each option in the row, the respondent needs to select one of the sub-columns.

Rank order question

With this question type, respondents can rank the answer options in the order they like. The one they like most is ranked highest. Rank order question lets market researchers know the importance of each option for the respondents.

Constant sum question

Constant sum question lets respondents allocate points for each answer item. The total number of points can be configured by the survey creator while designing the survey.

Image type question

Image chooser question lets respondents select one image from many options. This question type improves respondents" survey experience and gives a break from answering all textual questions.

Open-Ended question

Open-ended question allows respondents to add detailed textual feedback. They can share their experience and suggest improvement areas.

Survey design features - QuestionPro survey design - Formatting considerations

Lists vs. Dropdowns – Questions involving categories (both single or multiple select) can be presented either as a visible list or via the dropdown menu. If your survey page is getting crowded, then consider dropdowns. The key is to be consistent in your use and not mix formatting types on the same page.

Branded vs. Blind – Surveys are communications just like websites or emails and should use your accepted brand standards. Competitive intelligence research is an exception. In this use case, avoid colors and logos that could sway respondents in favor of your brand.

Number of questions per page – It comes down to scrolling vs. clicking. Keep the number of questions per page to a reasonable number (1 – 4). Some survey designers prefer the single question per page, but you can move beyond that with dropdowns. However, always keep an eye out for visual clutter.

Fonts – Use fonts that can be viewed clearly across multiple devices. Typically sans serif fonts such as Arial or Helvetica work best.

Use of space – Leverage visual space in survey design to reduce the cognitive load faced by the respondent. You can accomplish in a few ways:

- Limiting the number of questions per page, especially when PC or tablet design

- Use of pages that provide a mental break – for example, a text slide that thanks the respondent for their participation so far and lets them know what to expect as they progress toward completion.

Text – Leverage section headings when shifting between survey blocks. It provides a visual cue that the nature of the questions is changing. Descriptive writing is called when the process requires the respondent to have a deep focus, such as considering product scenarios. Keep these as brief as possible.

Tips for writing great questions for survey design

Writing great questions is an art that, like all arts, requires a significant amount of work, practice, and help from others. The following discussion is one that identifies some of the common pitfalls in creating a great questionnaire.

Avoid loaded or leading words or questions: Slight wording changes can produce significant differences in results. Could, Should, Might all sound almost the same, but may provide a 20% difference in agreement to a question (The supreme court could/should/might have forced the breakup of Microsoft Corporation). Strong words that represent control or action, such as prohibit produces similar results (Do you believe that congress should prohibit insurance companies from raising rates?) Sometimes wording is just biassed: You wouldn"t want to go to Rudolpho"s Restaurant for the company"s annual party, would you?

Misplaced questions: Questions placed out of order or out of context should be avoided. In general, a funnel approach is advised. Broad and general questions at the beginning of the questionnaire as a warm-up. Then more specific questions, followed by more general easy to answer questions like demographics.

Mutually non-exclusive response categories: Multiple choice response categories should be mutually exclusive to make clear choices. Non-exclusive answers frustrate the respondent and make interpretation difficult at best.

Non-specific questions: Do you like orange juice? It is very unclear about what it asks. Taste, texture, nutritional content, Vitamin C, the current price, concentrate, fresh squeezed? Be specific in what you want to know. For example, do you watch TV regularly? It is not clear if one should answer yes or no, because "regularly" is a subjective term.

Confusing or unfamiliar words: Asking about caloric content, bits, bytes, MBs, and other industry-specific jargon and acronyms are confusing. Make sure your audience understands your language level, terminology, and above all, what you are asking.

Non-directed questions give respondents excessive latitude: What suggestions do you have for improving tomato juice? The question is about taste, but the respondent may offer suggestions about texture, the type of can or bottle, mixing juices, or something related to use as a mixer or in recipes.

Forcing answers: Respondents may not want or may not be able to provide the information requested. Privacy is an essential issue for most people. Questions about income, occupation, finances, family life, personal hygiene, and beliefs (personal, political, religious) can be too intrusive and rejected by the respondent.

Non-exhaustive listings: Do you have all of the options covered? If you are unsure, conduct a pretest using the "Other (please specify) __________" option. Then revise the question making sure that you cover at least 90% of the respondent answers.

Unbalanced listings: Unbalanced scales may be appropriate for some situations and biased in others. When measuring alcohol consumption patterns, One study used a quantity scale that made the heavy drinker appear in the middle of the scale. The polar ends reflected no consumption and an impossible amount to consume. However, we expect all hospitals to offer proper care and may use a scale of excellent, very good, good, fair. We do not expect poor care.

Double-barreled questions: What is the fastest and most convenient Internet service for you? The quickest is undoubtedly not the most economical.

Dichotomous questions: Make sure the answers are independent. For example, the question "Do you think basketball players are independent agents or as employees of their team?" Some believe that yes, they are both.

Long questions: Multiple choice questions are the longest and most complex. Free text answers are the shortest and easiest to answer. When you Increase the length of questions and surveys, you decrease the chance of receiving a completed response.

Questions on future intentions: Forecasts are rarely accurate for more than a few weeks or, in some cases, months ahead. Avoid asking questions that will require participants to overthink.

Creating a survey design the right way is possible with QuestionPro

QuestionPro offers a number of functions for the optimal creation of a survey design. It is possible to offer an excellent user experience, increase response rates and project confidence in respondents.

In addition, our survey software has a wide range of methodologies tied to the types of questions and analysis of collected data such as Net Promoter Score, Trend Analysis and HeatMap. Start with a free account or, if you prefer, contact us to schedule a demo with one of our agents, it will be a pleasure to answer all your questions.

Learn how to set up and use this feature with our help file on the custom survey theme.

Survey Software Easy to use and accessible for everyone. Design, send and analyze online surveys.

Research Suite A suite of enterprise-grade research tools for market research professionals.

Customer Experience Experiences change the world. Deliver the best with our CX management software.

Employee Experience Create the best employee experience and act on real-time data from end to end.