Marketing funnel surveys help you understand what people actually think and feel as they move from first contact to decision. Instead of guessing why leads drop off or stall, you collect direct feedback at each step. For teams in the USA working with crowded markets and rising acquisition costs, marketing funnel surveys are often the fastest way to spot weak messaging, unclear offers, or trust gaps before they hurt performance.

In this blog, we’ll explain how marketing funnel surveys work, when to use them, and how to design them so the results are useful, not just interesting.

What are marketing funnel surveys and why do they matter?

Marketing funnel surveys are structured questionnaires designed for specific stages of the funnel. Each survey focuses on one moment in the customer journey rather than asking everyone the same broad questions.

They matter because behavior alone does not explain intent. Customer journey analytics might show a drop in conversions, but only surveys explain why. In the US market, where buyers compare options quickly and switch with little friction, missing that context can cost real revenue.

Good funnel surveys help you:

- Understand how people interpret your message

- Identify friction before it affects revenue

- Align marketing, sales, and product teams around real feedback

How do marketing funnel surveys differ from general customer surveys?

General surveys often try to do too much at once. They mix awareness, evaluation, and satisfaction questions in a single flow. That creates noisy data and vague takeaways.

Marketing funnel surveys are different because:

- Each survey matches one funnel stage

- Questions reflect the mindset at that moment

- Results point to specific actions

This is why they are often called funnel stage surveys or customer journey surveys. The focus is context first, metrics second.

Learn about: How customer journey mapping helps define moments in CX

How do awareness stage surveys improve first impressions?

Awareness stage surveys focus on people who just encountered your brand. This could be after viewing an ad, landing on a homepage, or seeing a social post.

The goal is not persuasion. It is clarity.

Awareness stage surveys help you check:

- Whether people understand what you offer

- What problem they think you solve

- Where confusion appears immediately

Simple marketing funnel survey questions work best here:

- What do you think this company does?

- What caught your attention first?

- How relevant does this feel to you?

In the USA, where audiences are exposed to thousands of messages daily, unclear positioning usually means instant drop off. These surveys show whether your message survives first contact.

Learn more: How to use a brand awareness survey for market research

What should you measure during the consideration stage?

During consideration, people are comparing options, reading details, and looking for proof. This is where interest turns into intent or disappears quietly.

Funnel stage surveys at this point help you understand:

- What criteria people use to compare options

- What information they feel is missing

- What doubts slow down decisions

This is also where customer journey surveys reveal gaps between what marketing says and what buyers expect.

Typical questions include:

- What matters most when choosing a solution like this?

- What concerns do you still have?

- Which alternatives are you considering?

For B2B teams in the USA, this stage often reveals pricing confusion, unclear differentiation, or trust issues related to data security or support.

Learn about: Questions, examples, and tips for product testing surveys

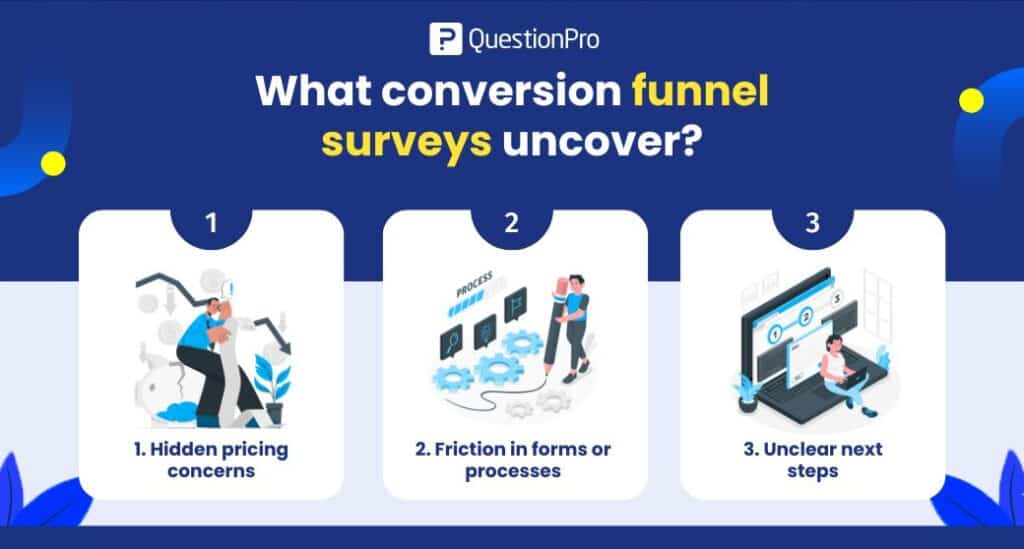

How do conversion funnel surveys reduce last minute drop offs?

Conversion funnel surveys focus on the moment just before action. Signup, demo request, checkout, or contact form submission.

These surveys are short and targeted. The goal is to capture hesitation while it is fresh.

Conversion funnel surveys often uncover:

- Hidden pricing concerns

- Friction in forms or processes

- Unclear next steps

Effective questions include:

- What almost stopped you from completing this?

- Was anything confusing or unexpected?

- What would have made this easier?

Even small insights here can have a big impact. Fixing one unclear field or one misleading message can lift conversion rates across the funnel.

Discover more: Website feedback survey template

Where do lead qualification surveys fit in the funnel?

Lead qualification surveys help you understand who your leads really are and whether they are a good fit. They usually appear after initial interest but before heavy sales engagement.

Instead of long forms, these surveys focus on intent and readiness:

- What problem are you trying to solve?

- How soon are you looking for a solution?

- What role do you play in the decision?

For US based sales teams, lead qualification surveys reduce wasted follow ups and improve handoffs between marketing and sales. They also help prioritize leads without relying only on firmographics or guesswork.

Learn more: What is customer segmentation, and what are the types

How should marketing funnel surveys be connected to campaigns?

Marketing funnel surveys work best when tied to real campaigns, not abstract journeys. Campaign specific surveys show how messaging performs in context.

This is especially useful when testing:

- New positioning

- Paid media messaging

- Content offers

A good place to connect these insights is within broader marketing campaigns. Campaign level feedback helps teams adjust fast, especially in competitive US markets where timing matters.

What makes marketing funnel surveys trustworthy and actionable?

Trustworthy surveys follow a few simple rules:

- Ask one idea per survey

- Use plain language, not internal jargon

- Avoid leading or loaded questions

- Combine ratings with one open-ended question

To support credibility, align your survey design with established research principles. The American Association for Public Opinion Research provides solid guidance on survey standards and ethics, especially relevant for research conducted in the USA.

When surveys are clean and focused, teams trust the results and actually act on them.

How to use funnel survey data in practice?

The value of marketing funnel surveys shows up in decisions, not dashboards.

You can use insights to:

- Rewrite landing page headlines

- Adjust ad targeting or creative

- Simplify pricing pages

- Train sales teams on common objections

The strongest teams review funnel survey data regularly and compare it with behavior analytics. When both tell the same story, confidence goes up. When they conflict, surveys usually explain why.

Once you understand where and why friction happens, the next challenge is executing surveys consistently and at the right moments.

How does QuestionPro support marketing funnel surveys?

QuestionPro makes it easier to design, launch, and manage marketing funnel surveys without overcomplicating the process. You can trigger surveys based on behavior, page visits, or campaign touchpoints, which helps ensure feedback matches the right funnel stage.

You can use QuestionPro to:

- Create short, targeted surveys for each funnel stage

- Segment responses by audience type, source, or intent

- Combine quantitative ratings with open-ended feedback

- Share insights across marketing, sales, and CX teams

Because everything lives in one platform, it is easier to connect survey feedback with campaigns, lead quality, and follow-up actions, which is especially useful for growing teams in the USA that need speed and clarity.

Conclusion

Marketing funnel surveys work best when they are focused, timely, and tied to real decisions. They help teams move away from assumptions and understand what people actually experience at each step of the journey.

When used consistently, they highlight where messaging breaks down, where trust is lost, and where intent fades. For teams operating in competitive US markets, that clarity often makes the difference between incremental improvements and meaningful growth.

Frequently Asked Questions (FAQs)

Answer: Yes. Small teams benefit even more because surveys reduce wasted spend. One short survey can replace weeks of guesswork.

Answer: Usually 3 to 6 questions. Anything longer risks a drop off and vague answers.

Answer: Yes. Each stage has a different mindset. Mixing them weakens insights.

Answer: No. They complement analytics. Surveys explain intent, analytics show behavior.

Answer: Review them quarterly or when launching new campaigns, products, or messaging, especially in fast moving US markets.