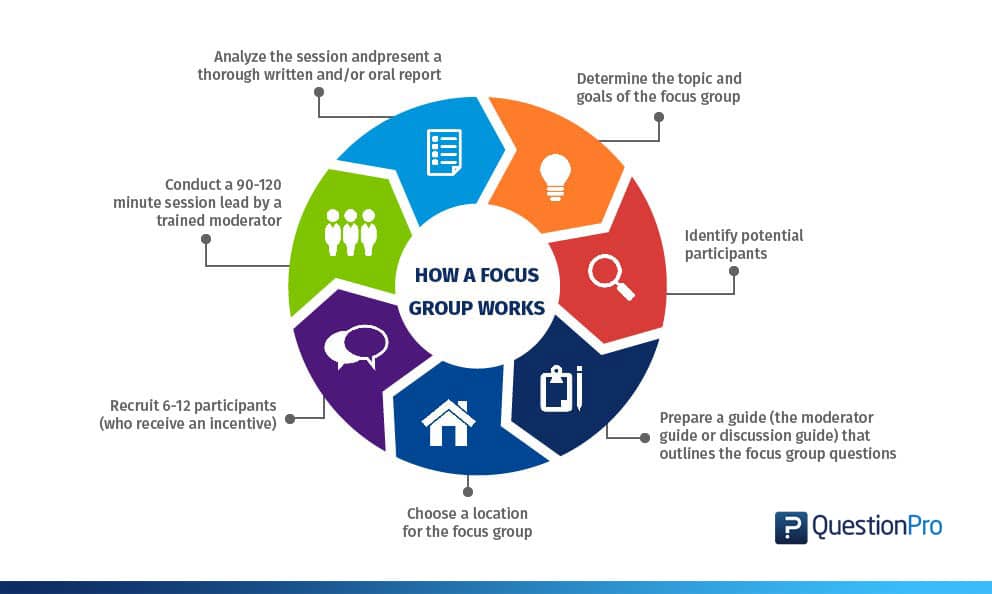

In 1991, marketing and psychological expert Ernest Dichter coined the name “Focus Group.” The term described meetings held with a limited group of participants with the objective of discussion.

This interactive setting allows researchers to gain deeper insights into consumer behavior, attitudes, and preferences that might not emerge from other research methods like surveys or one-on-one interviews. Market research, product development, and public opinion studies often use focus groups to capture diverse viewpoints and uncover trends or issues that help inform decision-making.

The group’s purpose is not to arrive at a consensus or agreement on the topic. Instead, it seeks to identify and understand customer perceptions of a brand, product, or service. We’ll cover what a focus group is, how to conduct one, and example questions and best practices below.

What is a Focus Group?

A focus group is best defined as a small group of carefully selected participants who contribute to open discussions for research. The hosting organization carefully selects participants for the study to represent the larger population they’re attempting to target.

The group might look at new products, feature updates, or other topics of interest to generalize the entire population’s reaction. This research includes a moderator. Their job is to ensure legitimate results and reduce bias in the discussions.

- You use a focus group in qualitative research. A group of 6-10 people, usually 8, meet to explore and discuss a topic, such as a new product. The group shares their feedback, opinions, knowledge, and insights about the topic at hand.

- Participants openly share opinions and are free to convince other participants of their ideas.

- The mediator takes notes on the focus group discussion and opinions of group members.

- The right group members affect the results of your research, so it’s vital to be picky when selecting members.

These groups possess a distinct advantage over other market research and market research methods. They capitalize on the moderator’s communication with participants and the flexibility to move the discussion. It allows you to extract meaningful insights and opinions.

Explore our latest article delving into real-world examples of qualitative data in education. Why not take a look and gather more insights from the valuable information we’ve shared?

The Main Pillars of a Focus Group

The main pillars of a focus group are crucial for ensuring a productive and insightful session. Here are the key elements:

1. Participant

A crucial step in conducting a focus group is participant selection. The main criteria for selecting the participants must be their knowledge of the subject. If you need help selecting members, look for a market research-based organization that matches you with qualified participants.

2. The Role of a Moderator

The moderator conducts the focus group confidently and leads members through the questions. They must be impartial throughout the process. As the researcher, you can also be the moderator, so long as you remain objective. You can also hire a suitable professional moderator to run your survey.

3. Discussion Guide

A well-structured discussion guide ensures that the conversation stays focused and covers all necessary topics. It includes key questions, follow-ups, and prompts that encourage open and insightful discussions. A good discussion guide balances structure and flexibility, allowing participants to share their thoughts while keeping the session productive.

4. Group Dynamics

The interaction between participants plays a vital role in gathering rich insights. Encouraging open dialogue and creating a comfortable environment helps generate authentic opinions. A diverse yet balanced group allows for different perspectives while avoiding dominance by a single participant.

5. Recording and Analysis

Accurate data collection is essential for deriving meaningful conclusions. Focus groups can be recorded through audio, video, or transcripts, ensuring that all insights are captured for later analysis. Researchers should systematically review and interpret responses to identify trends, patterns, and key takeaways.

Remember it is possible to generate deeper insights, improve research accuracy, and provide valuable feedback for decision-making by paying attention to the right elements in your focus group.

Types of Focus Groups

Your choice of focus group depends on the needs of your action research. To maximize the success of your project, it’s crucial to understand the main pillars that will give meaning to conversation, balance participation, and access to better insights. Types include:

- Dual moderator: There are two moderators for this event. One ensures smooth execution, and the other guarantees the discussion of each question.

- Two-way: A two-way group involves two separate groups having discussions on the topic at different times. As one group conducts its study, the other group observes the discussion. In the end, the group that observed the first session performed their conversation. The second group can use insights gained from watching the first discussion to dive deeper into the topic and offer more perspective.

- Mini: This type of small group restricts participants to 4-5 members instead of the usual 6-10.

- Client-involvement: Use this group when clients ask you to conduct a focus group and invite those who ask.

- Participant-moderated: One or more participants provisionally take up the role of moderator.

- Online: These groups employ online mediums to gather opinions and feedback. There are three categories of people in an online panel: observer, moderator, and respondent.

Benefits of Conducting Focus Groups

With a right setting, we’re now able to observe non-verbal cues, engage in follow-up questioning, and encourage group synergy, where participants build on each other’s ideas. Let’s better understand how focus groups can enhance your research by exploreing their key benefits.

- Deeper Insights: Focus groups encourage open-ended conversations as they allow participants to explain their thoughts in detail. Instead of just checking a box, people can share the “why” behind their opinions, helping uncover richer feedback.

- Real-Time Reactions: To learn how customers feel about a new product or idea, focus groups let us see their immediate reactions. We can track excitement, hesitation, or confusion, for example. We can get unfiltered responses that can help fine-tune the approach before launching something new.

- Follow-Up Flexibility: One of the biggest advantages of a focus group is that it’s interactive. If a participant gives an interesting answer, the moderator can ask follow-up questions to dig deeper.

- Observation of Non-Verbal Cues: Sometimes, what people don’t say is just as important as what they do say. Focus groups allows picking up on body language, facial expressions, and tone of voice, all of which can provide valuable context to the responses.

- Group Synergy: When people bounce ideas off each other, new insights emerge. Focus groups create a space where participants can react to each other’s comments, build on shared experiences, and generate fresh perspectives that wouldn’t surface in one-on-one interviews.

- Exploration of Unexpected Topics: Sometimes, the most valuable insights come from the unexpected. In a focus group, participants might bring up issues or perspectives that researchers hadn’t considered, leading to new ideas and opportunities.

- Flexibility in Format: They can be conducted in-person, online, or as a hybrid session. Focus groups can adapt to different research needs.

- Engagement with Key Stakeholders: Focus groups allow businesses to bring in the voices that matter most by involving real people in the research process. This way, companies can make informed decisions based on direct feedback rather than assumptions.

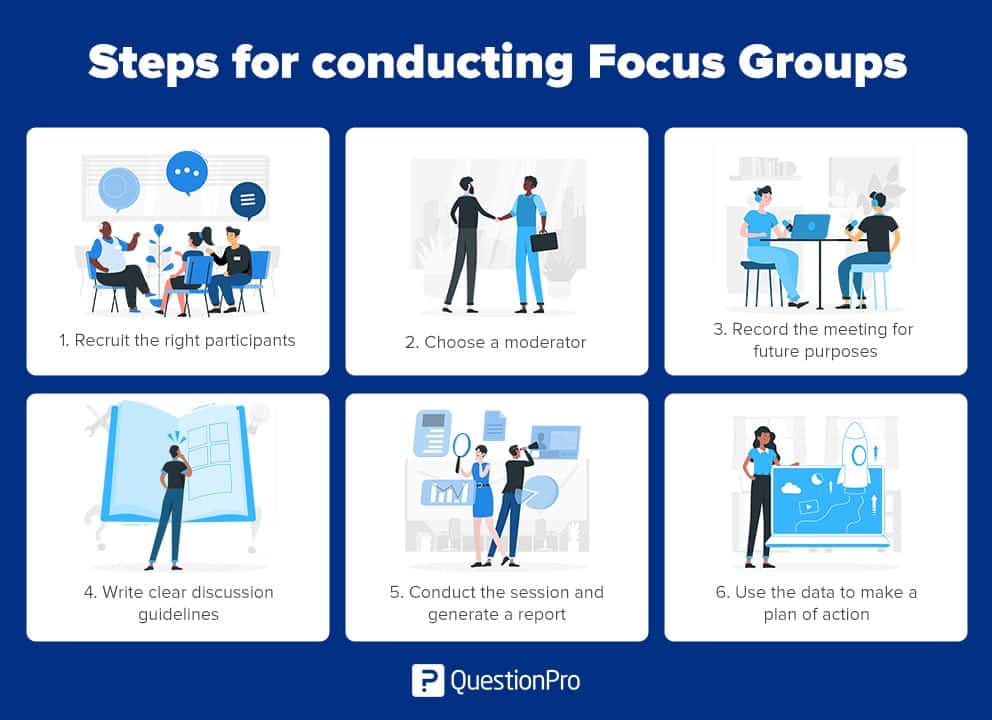

Steps for Conducting Focus Groups

A focus group is a research method or technique that is used to collect opinions and ideas regarding a concept, service, or product. Follow the below steps to conduct focus groups:

01. Recruit The Right Participants

A researcher must be careful while recruiting participants. Members need adequate knowledge of the topic to contribute to the conversation.

02. Choose a Moderator

Your moderator should understand the topic of discussion and possess the following qualities:

- Ensures participation from all members of the group.

- Regulates dominant group members so others may speak.

- Motivates inattentive members through supportive words and positive body language.

- Should it become too heated, the executive decides to end or continue a discussion.

Verify that your moderator doesn’t know any of the participants. Existing relationships between a member and moderator can cause bias and skew your data.

03. Record The Meeting for Future Purposes

Recording the sessions or meetings while conducting a focus group is essential. A researcher can record the discussion through audio or video. It would help to let participants know you’re planning to record the event and get their consent.

04. Write Clear Discussion Guidelines

Writing down clear session guidelines before the session starts is crucial. Include key questions, expectations of focus group members, whether you’re recording the discussion, and methods of sharing results. Give out the instructions in advance and ask participants to comply with them.

05. Conduct The Session and Generate a Report

Once participants understand their role, the moderator leads the survey. You can ask members to fill out a feedback form to collect quantitative data from the event. Use your data collection to generate reports on your study’s overall findings.

06. Use The Data to Make a Plan of Action

Share your report with stakeholders and decision-makers in your organization. The focus group feedback shows that a good report helps you design actionable plans to improve products or services. Update the group members on the changes you make and the results of those changes.

Focus Group Examples

Focus groups are common in three situations:

- Initial stages of a research study

- While creating a plan of action during research

- After the completion of the study to establish the results

For example, a laptop company needs customer feedback about an upcoming product. Focus group provides direct information about the marketing research from actual consumers.

The company chooses eight individuals representing their target market for a constructive discussion. The moderator asks questions regarding customer preference for laptop size and features.

Group members discuss why they do or do not like certain aspects of a laptop. The company uses the opinions of the participants to create a product that fits customer needs and wants

Best Practices for Focus Group Research

Follow these five steps to create a market research focus group:

1. Have a Clear Plan for Focus Group Members

The group’s goal must be clear before inviting participants to join. For example, does the researcher intend to discuss new products or the effect of current marketing campaigns? Use a written explanation to clarify the objective to members.

2. With a plan in Place, Begin Writing Your Focus Group Survey Questions

Questions should align with the research objective and complement one another. Start the discussion with the most crucial research problems and end with the least important ones. Asking open-ended questions increases the effectiveness of your research.

3. Schedule The Time, Place, and Duration of The Discussion

Be sure to inform members in advance so they can plan accordingly.

4. You Can Host It in Person or Through an Online Community

Offline groups meet in person at a physical location to conduct the discussion. An in-person event requires a venue that includes bathrooms and refreshments so participants are comfortable.

On the other hand, online groups meet virtually through an online discussion platform. Invitations and reminders for online discussions need to be sent out several times before the event. This helps participants remember your online event.

5. Create Informational Brochures or Forum

Create informational brochures and posts with a welcome note, the meeting agenda, and the overall rules of the group discussion.

Focus Group Advantages and Disadvantages

Focus group is a well-liked research technique due to its simple setup and the insightful data it can yield. It has advantages and disadvantages much, like other research techniques.

Advantages

- A great complement to other mediums like online surveys and online polls. Focus groups give you access to why a customer feels a certain way about a product, and surveys help you collect supporting feedback in large batches.

- Immediate access to customer opinions, making data collection and analysis quick and convenient.

- Highly flexible to adapt to the needs and opinions of the group members.

- Easy to conduct regular discussions to eliminate inaccurate results due to current market outlooks.

- Focus groups are perfect sources to understand the true feelings and perceptions of your selected target audience.

Disadvantages

- Creating a representative sample is tough. Small-size sample makes focus groups unreliable.

- Due to the limited sample size, you cannot guarantee respondent anonymity, which may affect their willingness to speak freely.

- Getting honest opinions on sensitive topics can make the depth of analysis difficult.

- Data analysis is vulnerable to inaccuracy and observer research bias.

Focus Group Question Examples

When using a focus group in market research, you must ask the right questions for accurate results. Good group questions have the following characteristics:

- A friendly and conversational tone

- Language or phrases that resonate with focus group participants

- Straightforward and accurate

- Each item includes one aspect and doesn’t merge multiple topics

- Clarify complex questions for more precise answers

Avoid asking questions to specific individuals to ensure the inclusion of all participants. Restrict discussion time per question to 5-20 minutes to keep the conversation efficient.

There are four categories:

There are four categories:

1. Primary question: This first open-ended question initiates the entire discussion.

Example:

- We are here to discuss ____. What are your thoughts about it?

2. Probe questions: These questions dig deeper into the discussion of the primary question.

For example:

- What do you know about ____?

- How familiar are you with this organizational program?

- What do you love about our organization?

3. Questions to follow up: After establishing the overall knowledge and feelings of the group, the moderator identifies specific insights.

For example:

- What do you think are the pros and cons of this product?

- According to you, where can we improve to provide better customer service?

- Which factors prompted you to purchase our products/services?

- What is the likelihood of recommending our products to your friends and colleagues?

4. Questions for the conclusion: Review previous questions to avoid overlooking the main points. It is the time when a moderator can revisit specific topics to gather more data.

For example:

- Is there anything other than the already discussed questions you would like to talk about?

- Do you want to add to what is already spoken about?

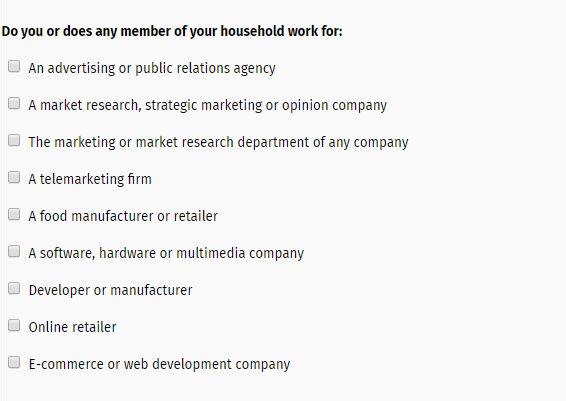

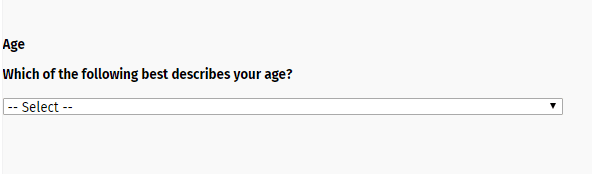

Focus Group Questions to Recruit Participants

Here are some questions you may ask to recruit participants:

- Do you or any of your family members work in any of the following sectors?

- Select your age range:

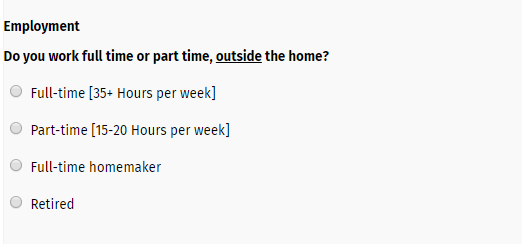

- Kindly select your employment type:

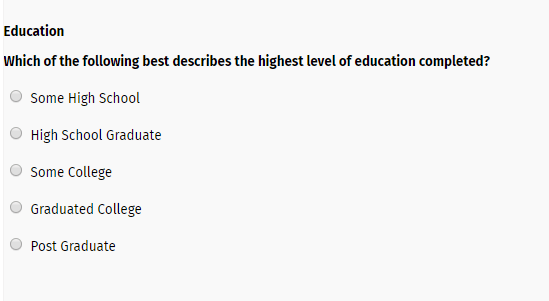

- Please specify your level of education:

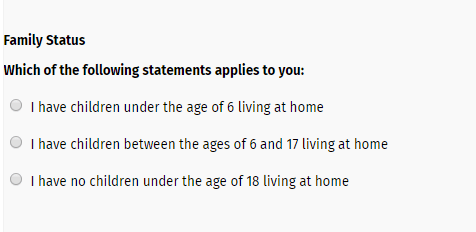

- Please state your family status:

Our focus group recruitment questionnaire template gives you a range of survey question types for maximum responses. These responses also help you make the best choice in recruiting the appropriate group members.

Best Online Focus Group Software: QuestionPro Communities

Online focus groups remove the need for a physical location. Like in-person groups, online groups involve 6-10 participants who share their opinions. Many researchers prefer online focus groups for convenience and cost-effectiveness.

QuestionPro Communities is an online focus group software. It’s a highly-effective market research tool that helps researchers find online focus groups for their research purposes, including market research.

QuestionPro Communities software includes:

- Discussions: Organizations invite participants to a moderated online discussion forum. Participants may answer questions at any time suitable to them.

- Idea Board: The Idea Board allows respondents to share their ideas. Other group members can analyze, write feedback, and even vote on submissions.

- Topics: Users can submit topics, cast their votes in existing posts, and leave comments or feedback instantly.

Conclusion

Organizations can ensure that they gather the most valuable insights from their focus groups by carefully planning, recruiting, and conducting the sessions. The examples provided highlight the versatility of focus groups, highlighting the wide range of applications for this research method.

Organizations can gain a deeper understanding of their customers and make more informed decisions that drive success by leveraging the power of focus groups.

QuestionPro Communities is the only online focus group software available on desktop and mobile. Go mobile and take Discussions, Idea Board, and Topics anywhere your respondents go.

Start conducting online focus group surveys with participants from across the globe with QuestionPro Communities today.

Frequently Asked Questions (FAQs)

A focus group is typically led by a trained moderator who guides participants through a series of questions and discussions. The session may be recorded (with permission) for analysis, and notes are taken to capture key points and insights.

Focus groups allow researchers to collect in-depth feedback on attitudes, beliefs, and motivations. They are beneficial for gathering qualitative data, generating new ideas, testing concepts, and gaining a deeper understanding of group dynamics.

Most focus group sessions last between 1 to 2 hours. This length allows time for participants to share in-depth thoughts without fatigue setting in.

Yes, online focus groups are a convenient and cost-effective alternative to in-person sessions.