Financial companies are always looking for smarter, safer ways to innovate without risking sensitive data. Synthetic financial data is one of the best solutions available today. It offers the power of realistic synthetic datasets without the legal and ethical complications of using actual customer information.

In this blog, we’ll break down what synthetic financial data really is, why organizations are using it, and how it’s transforming the way we build, test, and improve financial systems—all without risking customer privacy.

What is Synthetic Financial Data?

Synthetic financial data is artificially created data that closely resembles real financial information. It’s not taken from actual customers or real-life transactions, but it behaves just like the real thing. This type of data can include:

- Fake versions of things like credit card transactions

- Bank account activity

- Loan records or

- Investment data

It’s generated using smart computer programs or machine learning models that study real financial data and then create new, synthetic data that follows similar patterns. The goal is to make the data look and act real, just without any of the privacy concerns that come with using actual personal data.

Also Check: The Impact Of Synthetic Data On Modern Research

Why Organizations Use Synthetic Financial Data?

Businesses deal with tons of financial data every day—bank transactions, credit card records, investment details, and more. This data is incredibly valuable, but it’s also sensitive and private. That’s why using it for testing, training, or research can be risky.

To solve this, many organizations now turn to synthetic financial data—a smart alternative that looks and behaves like real data but is completely fake and safe to use.

1. To Protect Customer Privacy

Privacy is a big deal. Real financial data contains sensitive information like:

- Names

- Account numbers and

- Spending habits

If it falls into the wrong hands, it can cause serious damage. With synthetic data, there’s no risk of exposing real customers. It’s all made up, so even if there’s a leak, there’s nothing personal to lose.

2. For Safe and Fast Testing

When companies build new apps, websites, or software tools, they need to test them using real-like data. But using real data can be risky, slow, and expensive.

Synthetic data generation lets developers test and experiment freely without waiting for permission or worrying about breaking privacy laws. It makes the process faster, cheaper, and safer.

3. To Train AI and Machine Learning Models

AI tools and fraud detection systems need a lot of data to learn and get smarter. But training them with real financial data can be tricky because of legal restrictions.

Synthetic financial data gives these systems the practice they need without putting real users at risk. It helps companies build smarter tools responsibly.

4. For Research and Innovation

Researchers in finance often need to explore patterns, test theories, or build models. But accessing real data is difficult due to confidentiality rules. Synthetic data makes it possible. It offers realistic, detailed data that researchers can use without hitting any legal or ethical roadblocks.

5. To Simulate Rare or Extreme Scenarios

In the real world, some financial events are rare, like a stock market crash or a big fraud case. It’s hard to find enough real data for these situations. With synthetic data, companies can create those scenarios and see how their systems would handle them. This is especially useful for risk management and stress testing.

Synthetic data helps organizations stay compliant. Since it doesn’t come from real people, it avoids all the legal headaches that come with using actual customer information.

Understand More About: Synthetic Data vs Real Data: Benefits and Challenges

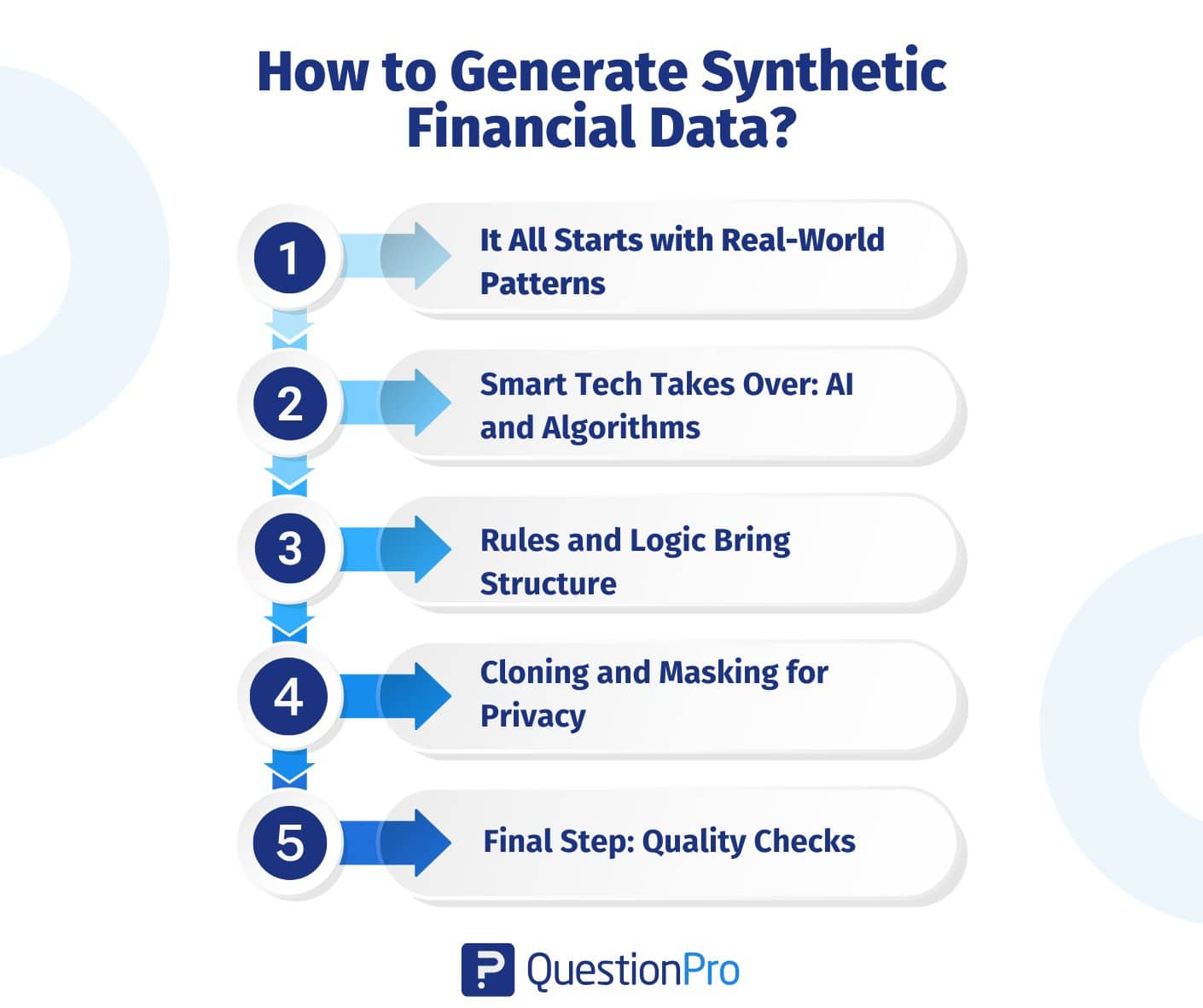

How to Generate Synthetic Financial Data?

Creating synthetic financial data might sound like a job for a rocket scientist, but the concept is more approachable than you think. It’s all about generating realistic, yet entirely fake, financial data that mirrors the patterns of the real world without touching any actual accounts or identities.

So, how is this artificial financial world brought to life? Let’s break it down in a simple, clear way.

1. It All Starts with Real-World Patterns

Before creating synthetic data, experts look at how real financial data behaves. This means analyzing things like:

- Stock price movements

- Trading volumes

- Market volatility

- Interest rate changes

The goal? Understand the rhythm and flow of the market, not the identities behind the data.

2. Smart Tech Takes Over: AI and Algorithms

Once those patterns are understood, data scientists turn to advanced tools like:

- Generative AI (including GANs, VAEs, and GPT-like models)

- Machine learning models

- Statistical algorithms

These tools are trained to mimic the behavior of financial markets. Think of it like teaching a machine how to think like the stock market without giving it any personal data.

3. Rules and Logic Bring Structure

Some systems rely on a rules-based approach, where business logic and financial regulations guide the generation of synthetic data. For example:

- A payment might always follow an invoice

- A stock trade might be linked to a price threshold

This adds structure to the fake data, making it feel even more lifelike and functional for testing purposes.

4. Cloning and Masking for Privacy

In cases where companies want to replicate existing synthetic datasets, entity cloning is used. This means copying the behavior of a real customer or investor but changing their identifying details. It’s like building a digital twin—same behavior, different name.

Data masking also plays a big role. It swaps out sensitive data like names or account numbers with artificial versions, ensuring privacy while preserving the relationships within the data.

5. Quality Checks

Once the synthetic financial data is created, it goes through a series of tests to make sure it:

- Makes sense

- Matches real-world behavior

- Keeps sensitive info safe

If anything feels off, like unrealistic transaction patterns or missing logic, it’s refined until it meets the mark.

Discover More: Synthetic Data Generation Tools & Platforms

Applications of Synthetic Financial Data

Artificially created financial data is a safe and smart choice for companies that want to test systems, train models, or simulate financial scenarios without touching real customer information.

Let’s take a closer look at the most important ways synthetic financial data is being used today.

Testing Financial Systems and Software

Before launching financial software, such as banking apps, investment platforms, or accounting tools, companies need to test how it works. However, testing with real customer data is risky and often restricted.

Using synthetic financial data allows developers to:

- Test apps safely in realistic conditions.

- Find bugs or errors early.

- Ensure systems handle data correctly without risking privacy.

Training AI and Machine Learning Models

AI is being used more and more in finance for fraud detection, stock predictions, and customer service. But, training AI models requires large amounts of data.

Synthetic data helps by:

- Providing massive, high-quality datasets.

- Protecting personal and financial information.

- Creating scenarios that may not be present in real data, like rare market crashes.

- This allows financial institutions to build smarter and safer AI tools.

Simulating Market Scenarios

What would happen to an investment portfolio if the market suddenly dropped? Or if interest rates doubled?

With synthetic data, financial analysts can:

- Run simulations based on different economic events.

- Test how portfolios would perform under stress.

- Make better decisions with these insights.

This is called stress testing, and it’s crucial for managing financial risks.

Supporting Compliance and Data Privacy

Financial companies must follow strict rules about customer data, especially regarding privacy. Sometimes, they need to test systems to ensure they meet these regulations but can’t use real data.

Synthetic data makes this easier by:

- Allowing system testing without exposing personal information.

- Ensuring that systems work as expected in a safe, controlled environment.

Research and Development

Researchers often need access to financial data to study trends, behavior, or market activity. However, getting access to this data can be difficult due to legal and ethical concerns.

Synthetic data solves this by:

- Providing realistic synthetic data for experimentation.

- Helping economists and data scientists explore theories and test models.

- Supporting innovation in financial organizations.

Training New Employees

New traders, analysts, or finance professionals need to practice working with real-world data but without the risk of making mistakes that impact actual clients.

Synthetic financial data helps by:

- Offering a hands-on training environment.

- Allowing employees to work with data that feels real.

- Building confidence and skills before handling live financial systems.

Also Read: Synthetic Data Use Cases: Solve Real Problems with Fake Data

Conclusion

We have learned that synthetic financial data is not just a clever workaround; it’s a powerful solution for many modern financial challenges. By replicating real-world financial behavior without using actual customer data, synthetic data allows businesses to innovate confidently and responsibly.

From testing financial systems and training AI models to simulating rare market scenarios and ensuring compliance, the applications of fake financial data are wide-ranging and impactful. It also provides a safe learning ground for researchers and new professionals alike without putting real user data at risk.

If you’re looking for advanced tools to collect, manage, and test financial data securely, platforms like QuestionPro can help. QuestionPro offers robust solutions for data collection and data simulation, making it easier for organizations to use synthetic data in research, testing, and analytics while staying compliant and customer-focused.

Frequently Asked Questions (FAQs)

Answer: Companies use Synthetic Financial Data to test software, train AI models, conduct research, and stay compliant with privacy regulations without risking real user data.

Answer: Synthetic Financial Data is created using machine learning algorithms, statistical models, or rule-based systems that analyze real data patterns and generate realistic but fake data.

Answer: Yes, Synthetic Financial Data is safe because it doesn’t contain any actual user information. It eliminates privacy concerns and meets data protection regulations like GDPR and CCPA.

Answer: Applications of Synthetic Financial Data include system testing, AI model training, market simulation, risk management strategies, research, and employee training.

Answer: Synthetic Financial Data supports innovation by enabling safe experimentation, rapid development, and compliance-friendly research without exposing real user data.