The banking industry has undergone a significant transformation in recent years, with customer experience becoming a critical differentiator — and undoubtedly one of the key factors for achieving success across the board in an increasingly competitive landscape.

Net Promoter Score es una metodología que sigue jugando uno de las principales métricas para medir que tan bien o mal lo estamos haciendo en este aspecto. Understanding Net Promoter Score (NPS) performance across financial institutions provides valuable insights into customer loyalty, satisfaction, and the overall health of banking relationships in the United States.

Based on our comprehensive Q1 2025 study of 1,000 participants involved in household purchasing decisions, we analyzed NPS performance across seven key industries, with banking and credit unions emerging as one of the top-performing sectors for customer loyalty.

What is NPS, and how is it calculated?

Net Promoter Score (NPS) is a customer loyalty metric that measures the likelihood of customers recommending a brand, product, or service to others. It serves as a powerful indicator of customer satisfaction and future business growth potential.

The NPS Calculation Process

NPS is calculated using a simple 11-point scale (0-10) based on the question:

“How likely are you to recommend [Company X] to your friends or colleagues?“

Respondents are categorized into three groups:

- Promoters (9-10): Loyal customers who actively promote your brand

- Passives (7-8): Satisfied but unenthusiastic customers who may switch to competitors

- Detractors (0-6): Unhappy customers who may damage your brand through negative word-of-mouth

NPS Formula:

% of Promoters – % of Detractors = NPS Score

The resulting score ranges from -100 to +100, with higher scores indicating stronger customer loyalty and advocacy.

What’s a Good NPS Score for the Banking Industry?

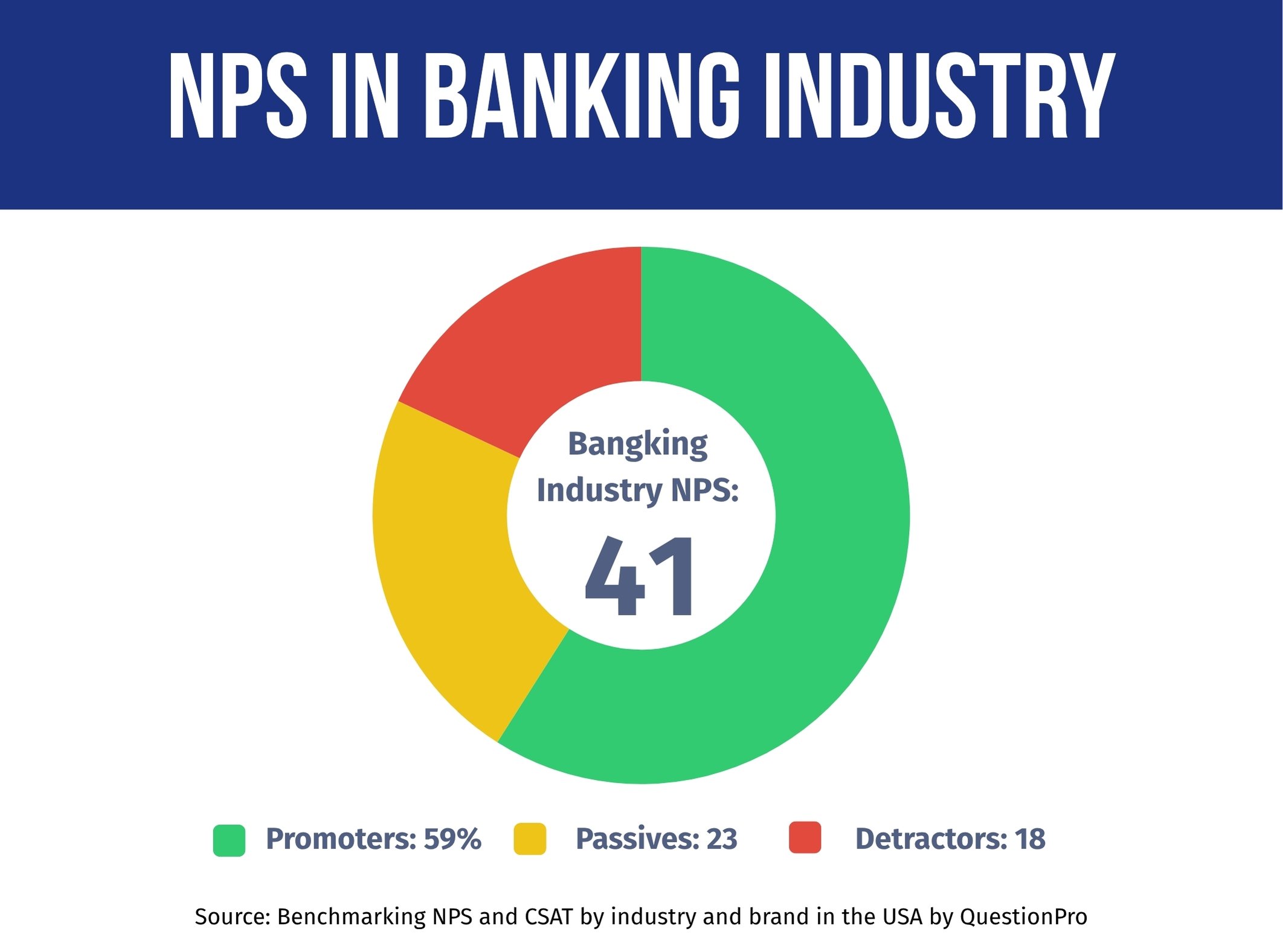

According to our Q1 2025 research, the banking and credit unions industry achieved an impressive NPS of 41, positioning it as the second-highest performing sector among the seven industries analyzed.

Industry Performance Context

To understand what constitutes a good NPS score in banking, consider these industry comparisons from our study:

- Hotel & Hospitality: 44 NPS (highest)

- Banking & Credit Unions: 41 NPS

- Automotive: 41 NPS

- Big Box Retail: 37 NPS

- Grocery Retail: 37 NPS

- Airlines: 33 NPS

- Insurance: 23 NPS (lowest)

The banking industry’s NPS of 41 significantly outperforms many other sectors, indicating that financial institutions are generally succeeding in building customer loyalty and advocacy.

NPS Score Interpretation for Banking

- Above 50: Excellent performance (world-class customer loyalty)

- 30-50: Good performance (strong customer advocacy)

- 0-30: Acceptable performance (room for improvement)

- Below 0: Poor performance (urgent attention needed)

With an industry average of 41, most banking institutions fall into the “good performance” category, though there’s clear room for improvement to reach excellence.

NPS Benchmarks in the Financial Industry: Top Performers vs. Laggards

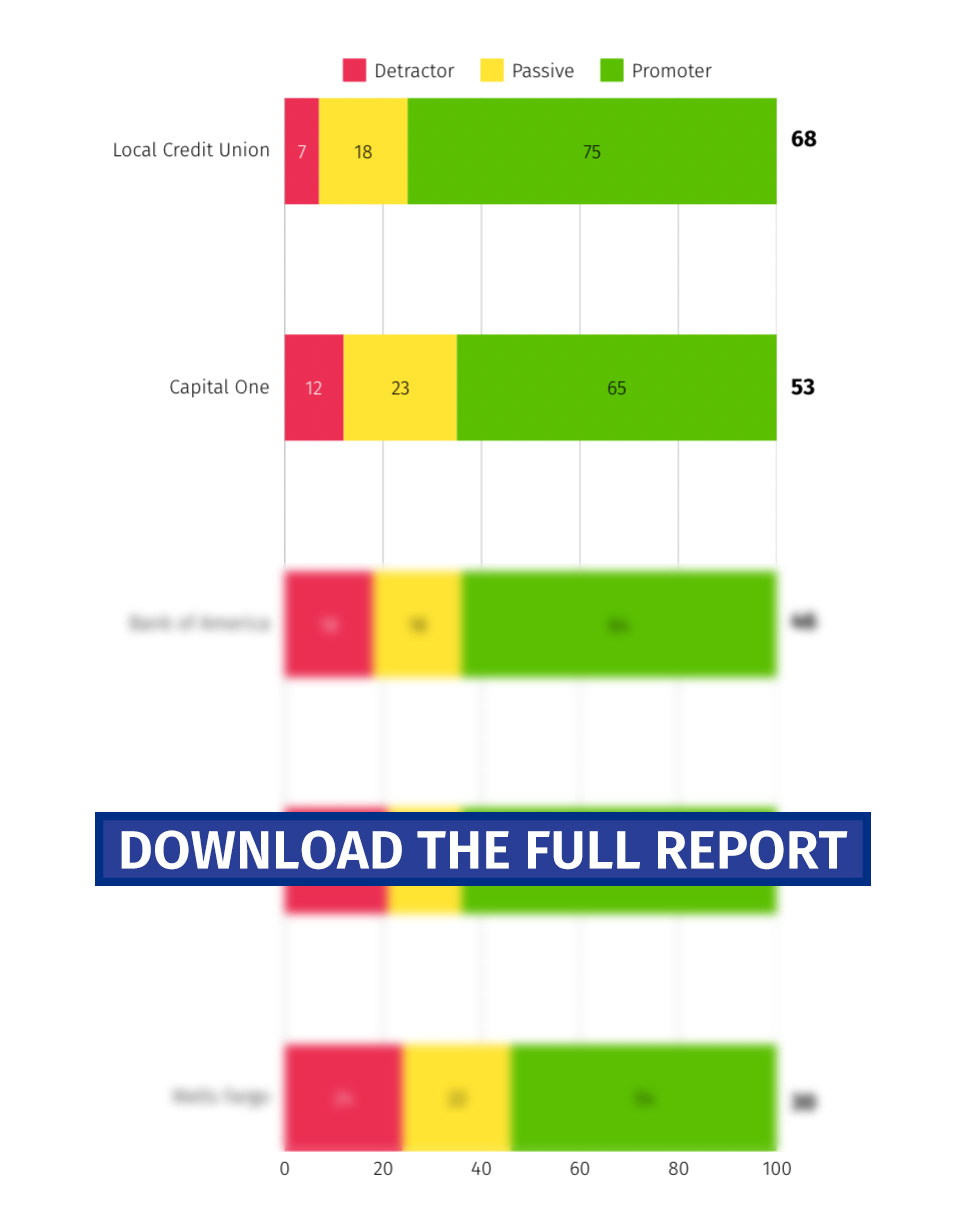

Our study reveals significant variation in NPS performance among major financial institutions, highlighting the impact of customer experience strategies on loyalty metrics.

For this study, we considered only those that are highly relevant. If you think we should have included any others, please let us know.

Top Performing Financial Institutions

- Local Credit Union: 68 NPS Leading the banking sector with an exceptional score of 68, local credit unions demonstrate the power of personalized service and community-focused banking relationships.

- Capital One: 53 NPS Capital One’s strong digital-first approach and innovative customer experience initiatives have resulted in solid customer advocacy.

These insights come from QuestionPro’s latest study, which surveyed 1,000 participants to measure NPS across leading companies and industries. The report is based on real customer feedback from Q1 2025 and is updated quarterly.

We invite you to download the full report. It’s a valuable resource for evaluating your company’s performance and determining your customers’ perceptions of you.

Discover What Major Brands are Doing to Achieve an Excellent NPS

Click here to access a detailed analysis of how the major banking institutions included in our study keep their customers satisfied and how this has affected their Net Promoter Score.

Local Credit Unions NPS

Credit Unions are leading the financial services industry in 2025 with an NPS of 68. Explore how they’re doing it, what the numbers reveal, and what other financial institutions can learn from their example.

Capital One NPS

Capital One is known for its disruptive and innovative approach in the financial sector. Explore Capital One’s NPS and key takeaways that can help you improve customer service in your own business.

Bank of America NPS

Bank of America has a higher percentage of promoters and a lower percentage of detractors, demonstrating strong customer advocacy. Explore the Bank of America NPS score to discover how it compares to other financial institutions.

JP Morgan Chase & Co NPS

JPMorgan Chase & Co. demonstrates solid customer loyalty. Explore how it compares to competitors in the banking sector and find out the key takeaways to help businesses refine their customer experience strategies.

Wells Fargo NPS

Wells Fargo is a global financial heavyweight, its customer reputation has real implications. Explore key insights into what’s driving satisfaction—and dissatisfaction—in banking today.

Key Performance Insights

The 38-point gap between the highest-performing (Local Credit Union at 68) and lowest-performing (Wells Fargo at 30) institutions demonstrates the significant impact of customer experience strategies on loyalty outcomes.

Distribution Analysis:

- Detractors: Range from 6% (Local Credit Union) to 24% (Wells Fargo)

- Passives: Range from 17% (Local Credit Union) to 33% (Wells Fargo)

- Promoters: Range from 43% (Wells Fargo) to 77% (Local Credit Union)

What We Can Learn from Banking NPS Leaders and Challenges

These numbers are no coincidence, and various factors have contributed to each institution’s place and recognition within the industry. Below, we list some of these successes that impact the overall NPS of these institutions.

- Personalized Customer Relationships: Local Credit Union’s exceptional 68 NPS score highlights the continued value of personalized service. Their low detractor rate (6%) and high promoter percentage (77%) demonstrate that customers still value human connection and tailored financial solutions.

- Digital Innovation Balance: Capital One’s success (53 NPS) shows that combining digital innovation with customer-centric design creates strong advocacy. Their focus on user experience in digital channels while maintaining service quality has paid dividends.

- A Great Service Ecosystem: Bank of America and Chase maintain competitive scores by offering comprehensive financial services that cater to diverse customer needs, ranging from basic banking to complex investment solutions. This proves that having a great brand doesn’t just depend on marketing efforts; providing incredible customer service and genuinely caring about your customer base can be a winning strategy all around.

Common Challenges and Learning Opportunities

- Scale vs. Personalization: Larger institutions face the challenge of maintaining a personal touch while serving millions of customers. The performance gap between local credit unions and major banks illustrates this ongoing challenge.

- Trust and Reputation Recovery: Wells Fargo’s lower NPS (30) reflects the ongoing impact of past reputation challenges, demonstrating how trust issues can have lasting effects on customer loyalty metrics.

- Digital Transformation Execution: The variation in scores suggests that successful digital transformation requires more than just technology implementation—it demands a customer-first approach to digital experience design.

Start Measuring and Improving Your Banking NPS

As they say, “what isn’t measured can’t be improved”, so we’d like to conclude this article by sharing some ideas and recommendations to help you begin measuring your NPS and find opportunities that will allow you to continue improving day after day.

- Establish Baseline Metrics: Begin by conducting regular NPS surveys to understand your current position relative to industry benchmarks. Use consistent timing and methodology to ensure comparable results.

- Segment Your Analysis: Analyze NPS by customer segments, products, and touchpoints to identify specific areas for improvement. Different customer groups may have varying expectations and satisfaction drivers.

- Monitor Regularly: Implement quarterly NPS tracking to identify trends and measure the impact of customer experience initiatives over time.

Although it may seem like a lot of steps, the reality is that there are tools that can simplify the entire process, with QuestionPro Customer Experience being one of the best on the market.

With it, you’ll be able to:

- Implement Closed-Loop Feedback Systems: Implement processes to follow up with both promoters and detractors to understand specific drivers of their ratings.

- Predictive Analytics: Use NPS trends to predict customer behavior and identify at-risk relationships before they result in defection.

- Cross-Channel Consistency: Ensure consistent experience quality across all customer touchpoints, from digital platforms to branch interactions, all visualized graphically so you can design and deeply understand your customer journey.

With QuestionPro Customer Experience, you can measure your Net Promoter Score in minutes, as well as implement initiatives and systems to maintain constant monitoring that allows you to keep your customers satisfied and stay on par with major leaders in your industry.

Conclusion: The Future of NPS in Banking

The banking industry’s strong NPS performance of 41 demonstrates the sector’s commitment to enhancing customer experience. However, the significant variation between institutions indicates that there is still considerable room for improvement.

Financial institutions that prioritize genuine customer relationships, invest in seamless digital experiences, and maintain consistent service quality across all touchpoints will continue to outperform their competitors in customer loyalty metrics.