Online Market Research

For those of us that can still remember market research in the “

For those of us that can still remember market research in the “good old days”, the ability to gather insane amounts of intelligence from your kitchen, desk or poolside never gets old. But the biggest problem with having so much information at your fingertips has to be overwhelming. I mean, where do you begin? And how do you choose the most important bits of data or information that will help you not only cut costs on market research but get decision-making insights as well.

If you’re new to the world of small business market research, here’s a quick how-to guide on leveraging the mountains of market research that you can collect online.

Rather than follow the rigid path of secondary and primary processes, I’ve decided to give you the right-brained version of how online market research happens in real life, for small business owners and non-research professionals. This means that there is a lot of brainstorming, back and forth, trial-and-error and general messy inelegance in the process. That’s because you are feeling your way through. Without the benefit of having a professional market research department, you’re going to be trading your time and effort for the money you can’t afford to pay. Them’s just the ropes.

I apologize in advance for any hard and fast market research rules I’m breaking here.

Set clear goals – and free yourself to recalculate

This step never changes. If you were to search on the phrase “tips online market research” or some derivative of that, almost every article will start with setting goals. What I think that we forget, however, is that not all goals are so clearly defined at the start of any market research project.

You might start with a larger, broader goal such as “Sell more widgets” and after bouncing around the rest of these steps, you will find yourself crafting and refining this goal to something more specific such as “Sell more widgets to IT companies.”

I bring this up because so many experts say “set goals” as if these goals were self-evident and a lot of times they simply aren’t. I like to think of setting goals for a market research project a lot like driving to a destination in a city I’ve never been to. I have a goal (the address) and I have directions, but I’m bound to make a few wrong turns along the way. I don’t berate myself, instead, my GPS simply “recalculates” the route until I reach my goal.

Start with the broadest goal, then work your way down to specifics. I always ask myself “Under what circumstances would you move forward with this project?” This gets my brain generating decision-making criteria such as “If 300 people said they would pay $50 for this.” Notice that simply stating some kind of result, I can begin generating goals or criteria for my online research.

Identify your target audience

“You can’t sell anything to everyone.” This is one of those laws of marketing that you can’t ignore. Part of your research has to include brainstorming the ideal customer for your product,

- Who are they?

- Where do they hang out?

- What’s important to them when they are considering your product or service?

- What problems are they having that your product will solve?

Again, this might be crystal clear, and it might not. And either is ok. Your goal in this step of the process is to GET to a target audience. This might include some exploratory research which might involve social media conversations, online polls or online surveys to get a clearer picture of exactly who your target audience is.

Brainstorm engaging conversation

The idea in this phase of the process isn’t just to come up with survey questions — not at all, the idea is to come up with questions that lead to conversations. You might start with what you want to know — “How likely are people to make ice cream at home?” But to get the ball rolling, you might get into a conversation around favorite ice cream flavors. On social media channels you might post fun facts or posts such as “What your favorite ice cream flavor says about you.”

Instead of just focusing on asking questions and getting answers – focus on the core conversations that your target audience is having. Participate in those conversations and see what insights you get.

Troll the web

I’m sure I don’t even have to mention this as a step, these days it’s our default reaction to starting any task. Hit the web and start trolling and exploring around your topic.

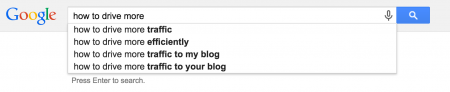

- Keyword Research: Start by typing in phrases in Google. Don’t forget to stop and take note what phrases you’re typing in – because these might be the very phrases your target customer is using. Also remember the Google sneaky tip — when you start typing in Google, the auto complete choices are the most popular.

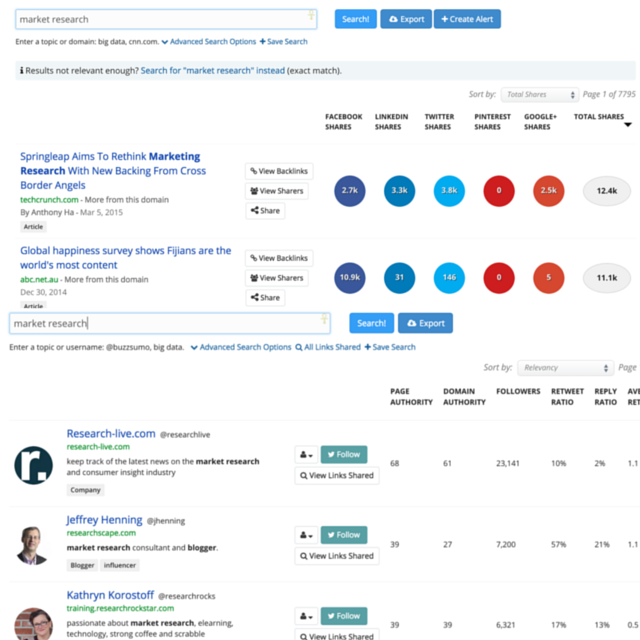

- Identify popular articles, blogs and experts. One of my favorite tools is BuzzSumo because it allows you to type in a phrase and see the most popular articles on the web. Better still, it allows you to search for influencers and experts on that topic. Definitely take advantage of this free tool to help you in your research.

- Look at public records – Another often forgotten resource are the big data resources such as Acxiom or PRIZM these are fantastic ways to start collecting demographic and psychographic information about your target audience.

You wouldn’t go to a nightclub to survey nurses, so why blast your research efforts all over the internet? If you’ve done the upfront work of selecting an audience and brainstorming some questions, this next step will be fairly easy.

Identify the channels where your target customer hangs out. This will mean doing a little snooping around different channels.

- Search out LinkedIn and Facebook groups that are focused on the topic or audience.

- Identify and search out hashtags on Twitter and Google+

- Search for Public Twitter lists around the topic of your choosing

I always like to start with social communities because it’s fairly easy to listen and see exactly who the participants are and if they are a good fit.

This next step is important. Each social channel has it’s own style and personality. While it may seem like a time saver to blast the same content out to each channel I would advise against it.

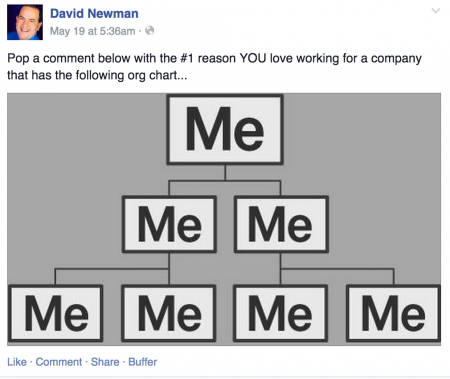

Facebook is more personal and if you’re participating in a group discussion you will have to conform to whatever rules and culture they have set up. Check out this post from David Newman, it’s on his personal page and while it looks innocuous, I’ll bet he’s testing the waters of his audience for a speech or a new program.

Twitter is a little more “removed” so my recommendation is to watch and follow those hashtags and lists, then get into individual conversations. At first, this may feel uncomfortable, but it’s really like any new networking conversation. Take the time to read and process what the person is sharing. Then ask a question about the content. For example “I really like the story you tell about hiking in the Sierras, what was your favorite piece of equipment?”

So, find a channel where your target audience is active and simply interact with them in a fun and creative way. Give them the opportunity to share with you and give them content and questions to engage around.

There are so many more creative ways to collect marketing research online, these are just a few that I’ve tried. I’m curious about what’s worked best for you, share some of your tips in the comments below.