Imagine filing a claim after a fender bender or storm damages your home. Instead of delays and confusion, your agent steps in quickly to simplify the process and keep you informed. You think, “This is why I chose State Farm. I should let others know.”

That’s the power of a strong Net Promoter Score (NPS). For insurers like State Farm, NPS measures how likely customers are to recommend their services, reflecting trust and satisfaction during critical moments.

In this article, we’ll break down State Farm NPS, how it reflects customer loyalty in insurance, and how the company works to turn policyholders into advocates.

What is NPS?

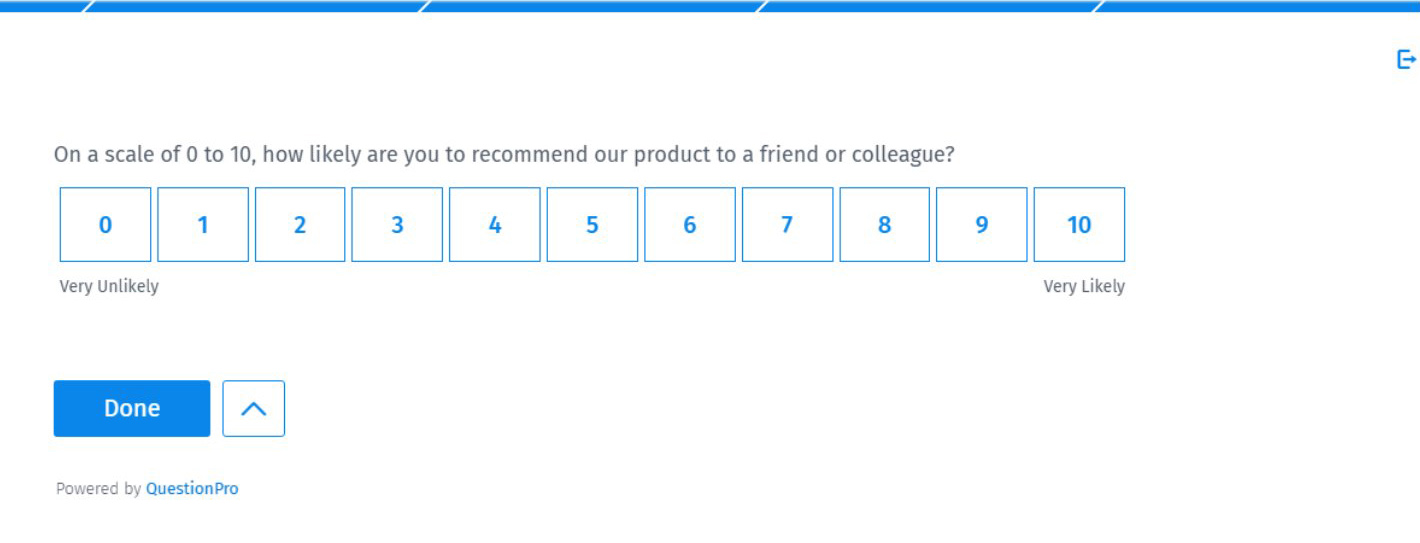

The Net Promoter Score (NPS) is a simple metric to gauge customer loyalty using one question:

“On a scale of 0–10, how likely are you to recommend our products or services to a friend or colleague?”

Responses categorize customers into three groups:

- Promoters (9–10): Loyal advocates who enthusiastically recommend State Farm.

- Passives (7–8): Satisfied but indifferent, unlikely to promote the brand.

- Detractors (0–6): Unhappy customers who may share negative feedback.

Here is the formula to calculate NPS:

NPS = % of Promoters – % of Detractors

For insurers, NPS highlights how well they deliver support, transparency, and peace of mind.

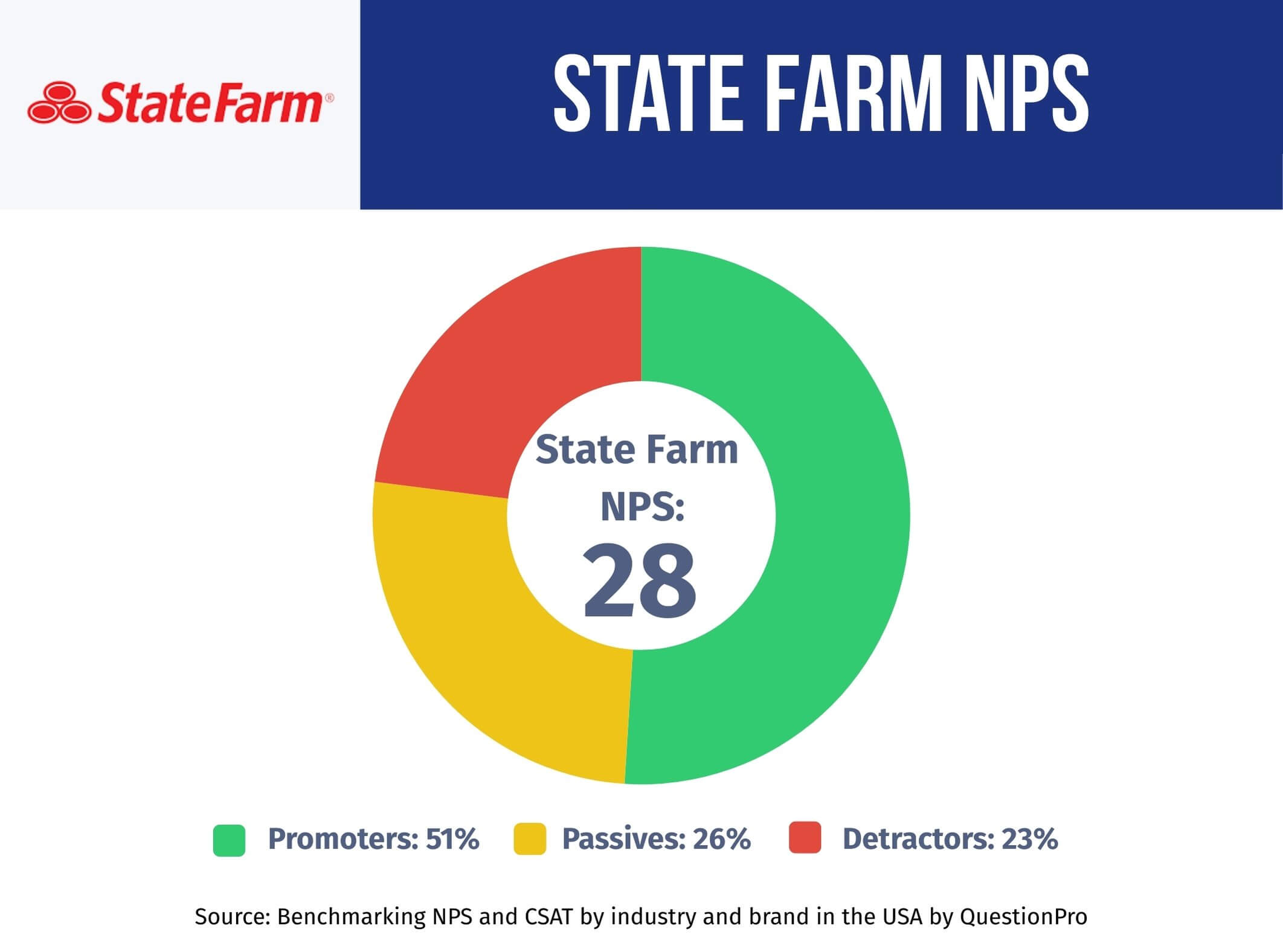

State Farm NPS Performance and Breakdown

According to QuestionPro’s Q1 2025 Benchmarking NPS and CSAT Report, State Farm’s NPS is 28, reflecting a balance of loyalty and areas for growth.

Breakdown of State Farm’s NPS:

- Promoters: 51%

- Passives: 26%

- Detractors: 23%

With over half of its customers willing to recommend State Farm, the company demonstrates a solid foundation of trust. However, 23% of detractors indicate opportunities to enhance service and resolve pain points.

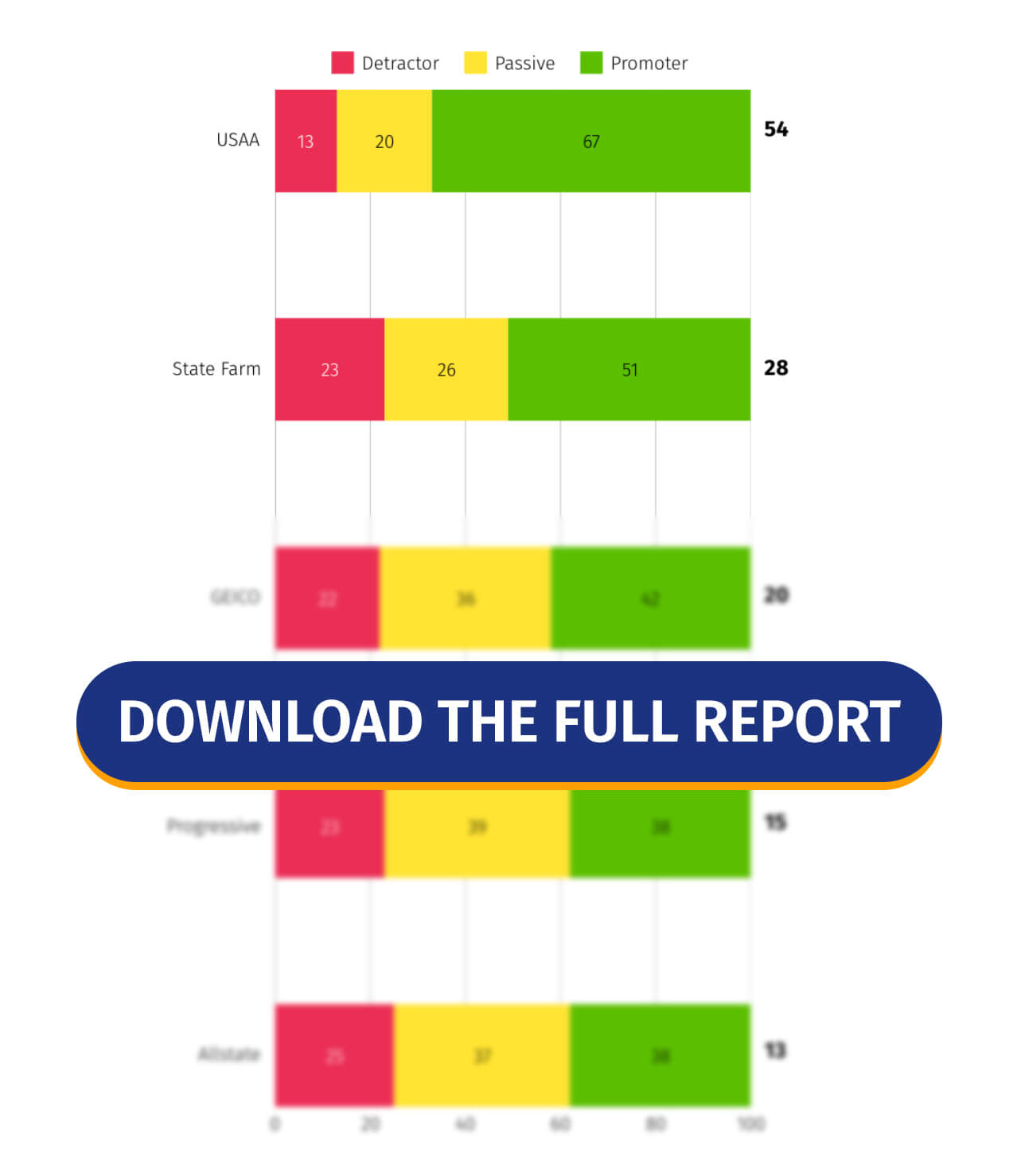

How Does State Farm Compare to Industry Benchmarks?

While many insurance companies struggle with low customer trust and satisfaction, State Farm NPS score of 28 reflects a commitment to steady improvement in a competitive market. Key strengths include:

- Agent Accessibility: Local agents provide personalized guidance, helping customers choose suitable policies.

- Nationwide Reliability: A vast network ensures support is available during emergencies, from claims to roadside assistance.

- Community Engagement: Long-standing partnerships with local causes and safe driving initiatives build emotional connections.

- Product Variety: Bundled home, auto, and life insurance options cater to diverse needs.

These factors position State Farm as a trusted choice for customers valuing familiarity and accessibility.

These insights come from QuestionPro’s latest study, which surveyed 1,000 participants to measure NPS across leading companies and industries. The report is based on real customer feedback from Q1 2025 and is updated quarterly.

We invite you to download the full report. It’s a valuable resource for evaluating your company’s performance and determining your customers’ perceptions of you.

What Influences State Farm’s High NPS And Customer Loyalty?

State Farm’s NPS is shaped by priorities that resonate with policyholders:

- Consistent Service: Agents prioritize long-term relationships, offering reminders for policy updates and seasonal risks.

- Efficient Claims Process: Digital tools and 24/7 support streamline filing, though some customers seek faster resolutions.

- Transparency: Clear policy terms and no-surprise pricing foster trust, though detractors cite occasional communication gaps.

- Educational Resources: Safe driving tips and disaster preparedness guides add value beyond insurance.

By focusing on reliability and community, State Farm strengthens loyalty even as it addresses detractors’ concerns.

How to Measure and Enhance Your NPS?

Want to know how to calculate and enhance your Net Promoter Score (NPS) like State Farm? With QuestionPro, the process is simple and built to move real results. Here’s how to get started:

1. Launch an NPS Survey

Use the QuestionPro NPS survey template, which includes the following key questions:

Add the AskWhy feature to uncover insights behind scores.

Send it by email, text, QR code, or just drop a link, whatever works best for your audience. With QuestionPro Audience, you can reach people based on where they live, how they travel, or other key traits.

3. Track Responses in Real Time

Your NPS is automatically calculated as results come in. A clean, visual dashboard lets you see who your Promoters, Passives, and Detractors are. There is no guesswork, just real, actionable feedback.

4. Turn Feedback Into Action

Use what your customers tell you to enhance the experience where it matters most. QuestionPro’s benchmarking tools also help you compare your NPS with others in your industry.

With QuestionPro, you’re not just measuring scores. You’re building stronger relationships, improving service, and making every customer experience better than the last.

Stay Informed with the Latest NPS Trends

Want to know how leading Insurance companies earn loyalty and high NPS? Get the Q1 2025 NPS Benchmark Report to see how leading companies drive customer satisfaction and find strategies to keep their customers returning.

Want to increase your NPS? Contact the experts at QuestionPro for proper advice on measuring and improving customer satisfaction.