Survey research is powerful, but waiting for real responses can be slow, expensive, and unpredictable. What if you could simulate responses before launching your survey? What if you could test hundreds of variations, stress-test your logic, or predict answer patterns all without exhausting your panel or burning through your budget? That’s where synthetic respondents come in.

These respondents are AI-generated participants that mimic real human responses to surveys. From answering multiple-choice questions to generating realistic open-ended feedback, these digital stand-ins help researchers design better surveys, test hypotheses faster, and forecast behavioral trends with greater flexibility.

In this blog, we’ll break down what synthetic respondents are, how they work, and how you can create them to optimize your research process.

What Are Synthetic Respondents?

Synthetic respondents are AI-generated participants. They mimic real human answers in surveys, polls, and market research. Using large language models (LLMs), these respondents analyze patterns from training data, such as survey datasets and other industry-related data sources.

Unlike real respondents who answer through traditional methods, a synthetic respondent answers algorithmically, a scalable and cost-effective option when real data is scarce or expensive. Their reliability depends on data quality and the sophistication of their AI models.

Synthetic respondents are useful for rapid testing and supplementing research where human input is limited. The challenge is keeping their answers accurate, unbiased, and true to real behavior.

How Synthetic Respondents Work in Market Research

Artificial intelligence is transforming market research with AI-generated customer insights. By analyzing diverse datasets, these tools enable researchers to gather feedback more quickly and cost-effectively than traditional methods.

1. Generating open-ended and closed-ended answers

Synthetic respondents can handle everything from Likert scales to complex open-ended questions. For open responses, natural language models are used to generate realistic, human-like text that reflects the tone, sentiment, and knowledge level of the target audience.

2. It Enhances Data Collection & Analysis

This approach allows researchers to test product concepts and marketing strategies using AI-generated synthetic datasets. Unlike traditional human responses, synthetic responses quickly scale to represent different consumer segments, providing valuable insights at lower costs.

3. Using machine learning to model behavior and preferences

Advanced models learn how different types of respondents by:

- Age.

- Region.

- Preferences.

Typically respond to various question types. These models then predict how a “synthetic person” with a similar profile would answer.

4. Simulating responses based on real-world data patterns

Synthetic respondents are trained on large datasets of actual survey responses, behavioral data, or demographic trends. This ensures that the generated answers mirror realistic patterns and variation, rather than random outputs. By blending AI efficiency with human judgment, market researchers gain deeper, faster insights.

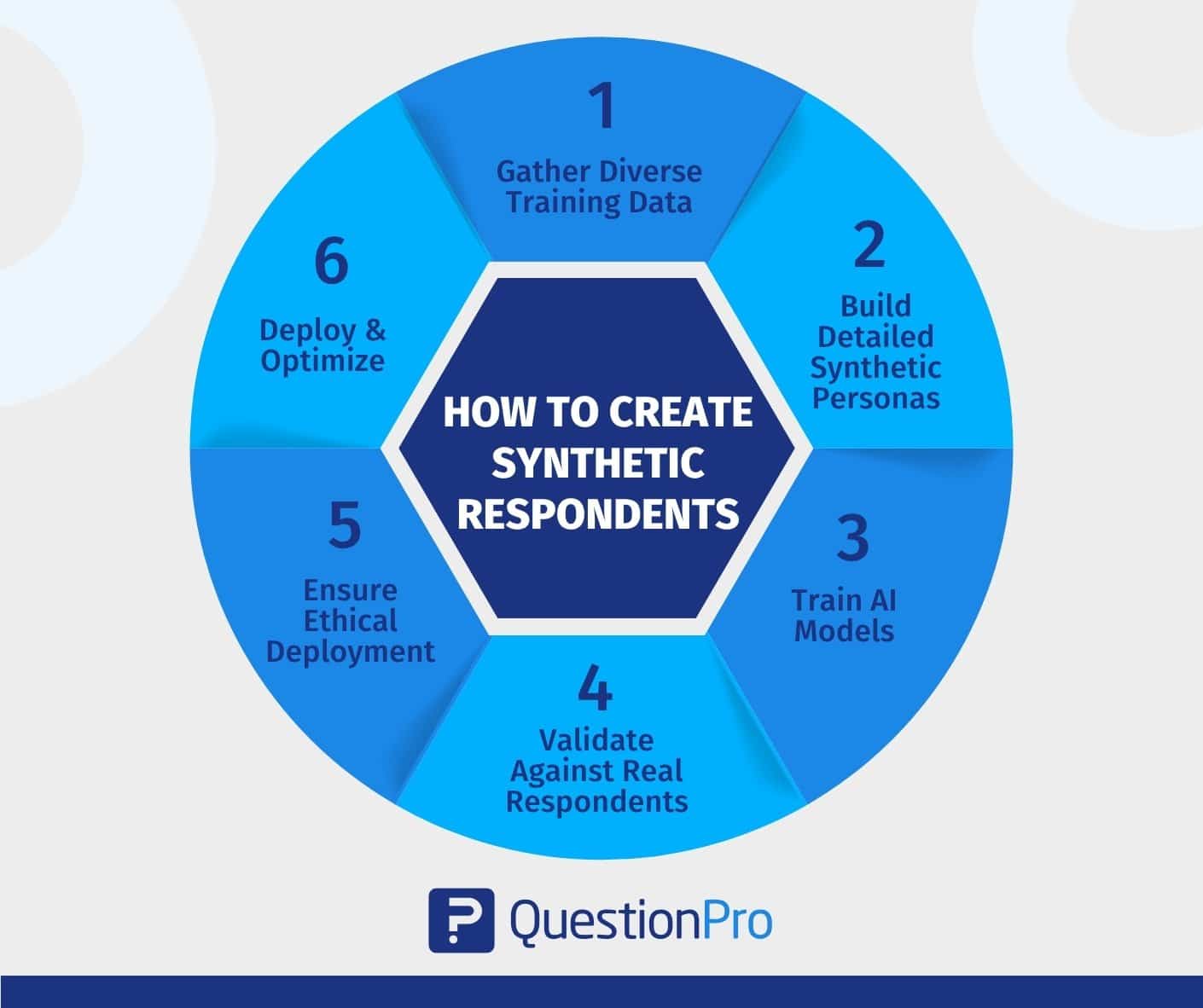

How to Create Synthetic Respondents

By combining AI with real-world data, you can create synthetic respondents and get faster insights for product testing and decision making.

- Gather Diverse Training Data: Start with real-world data from surveys, interviews, and existing datasets to ensure data quality. This is the foundation for synthetic models so they can mirror real human behaviour.

- Build Detailed Synthetic Personas: Analyse collected data sources to create detailed personas of different segments of your target audience. Include demographics, preferences, and behaviour for realism.

- Train AI Models: Use large language models (LLMs) or generative AI to process training data. The quality and diversity of input datasets directly impact the accuracy of synthetic responses.

- Validate Against Real Respondents: Test AI-generated responses against feedback from human respondents. This iterative approach refines synthetic models, reduces the risk of bias, and ensures data integrity.

- Ensure Ethical Deployment: Be transparent about using synthetic respondents. Document data used and decision pathways to uphold data quality and ethical standards in the research industry.

- Deploy & Optimize: Integrate fake respondents into market research along with traditional methods. Continuously monitor results, refine models, and balance with real data to get better decision-making.

By validating against real data and prioritising data quality, you get flexible and ethical tools to understand the market better.

Applications of Synthetic Respondents in Survey Research

Synthetic respondents open up new possibilities for designing, testing, and optimizing surveys. Here are some key use cases:

Pre-testing surveys to identify design flaws

Before launching a survey to real participants, AI-powered respondents can help test:

- Logic.

- Flow.

- Question clarity.

This allows researchers to catch confusing wording, biased phrasing, or faulty skip logic without burning budget on real respondents.

Running “what-if” simulations on market scenarios

Need to understand how different pricing strategies or product features might affect consumer preferences? Synthetic respondents can simulate thousands of potential responses instantly, helping teams explore scenarios and forecast likely outcomes.

Enhancing predictive models with synthetic participation

When real-world data is sparse or skewed, synthetic responses can augment existing datasets. This helps to improve the robustness of predictive models. Useful for tasks like:

- Customer segmentation.

- Demand forecasting.

- Behavioral predictions.

Especially valuable in early-stage research or when exploring niche markets.

Benefits of Using Synthetic Respondents

Synthetic respondents are changing how we approach survey research. They offer speed, scale, and flexibility without the usual resource constraints.

- Faster survey testing with zero recruitment time

Synthetic respondents allow you to test surveys instantly, with no need to wait for participant signups or panel responses.

- Reducing respondent fatigue and oversampling

You can avoid overusing the same target audience and reduce the risk of survey fatigue by supplementing with synthetic data.

- Cost-effective alternative for early-stage research

Before investing in full-scale fieldwork, synthetic respondents help test ideas and survey designs at a much lower cost.

- Scalable simulations for “what-if” scenario planning

Need to explore multiple products, pricing, or messaging strategies? AI-powered respondents let you model endless variations quickly.

- Privacy-safe insights without exposing personal data

Because synthetic data isn’t tied to real individuals, it offers a privacy-friendly way to gather insights without compliance concerns.

Synthetic Respondents vs. Synthetic Audiences

While both synthetic respondents and synthetic audiences use AI to simulate survey input, they serve different purposes. Here’s a quick comparison:

| Topic | Synthetic Respondents | Synthetic Audiences |

| Focus | Simulates individual answers. | Models group or segment-level behavior. |

| Use Case | Survey testing, response simulation. | Market sizing, campaign testing, audience forecasting. |

| Data Granularity | Generates detailed, respondent-level responses. | Produces aggregated patterns or trends. |

| Typical Output | Answer sets, open-text feedback, and completion time. | Group preferences, conversion potential, and reach estimates. |

| Best For | Fine-tuning surveys, predicting response distributions. | Strategic planning, audience targeting, and messaging scenarios. |

| Speed vs. Scale | Faster for small-scale, detailed feedback. | Scalable for broader audience insights. |

How QuestionPro Advances Synthetic Respondents

QuestionPro Research Suite changes market research by putting ethical, AI-powered respondents into its platform. By simulating human-like responses, the platform can enhance testing, insights, and overall survey quality without requiring real people for every step.

1. Pre-Test Surveys Instantly

QuestionPro generates thousands of synthetic responses to refine survey questions, eliminate bias, and predict real human behavior, replacing expensive pilot studies.

2. Improving survey design with AI-powered testing

Before sending a survey to real participants, QuestionPro can use synthetic respondents to test how people might answer. This helps:

- Spot confusing questions

- Catch bad logic or skip patterns.

- Identify poor survey structure.

- Improve quality before launch.

- Save time and effort.

3. Generating synthetic open-ended responses for text analytics

Synthetic respondents can also be used to create realistic open-text answers. These help test and fine-tune QuestionPro’s text analytics tools, showing what kinds of themes or topics might show up in real answers before the survey goes live.

4. Training AI models for better segmentation and insights

QuestionPro can use synthetic responses to fill gaps in real data. This extra data helps train smarter AI models that can find patterns, group people into segments, or make better predictions, especially in smaller studies or hard-to-reach markets.

Ethical Considerations and Responsible Use

To keep insights trustworthy and useful, researchers need to be careful with how synthetic data is created, used, and interpreted. Ethical use means these tools support, not distort, the research process.

- Don’t misuse or over-rely on synthetic data:

Synthetic data should support, not replace, real human feedback. Relying only on simulated responses will lead to wrong conclusions, especially for sensitive or complex topics.

- Be transparent about synthetic response data:

Researchers should clearly state when synthetic data is used. This will keep trust and ensure results are understood in context.

- Ensure diversity and fairness in simulated models:

Synthetic respondents reflect real-world diversity. If the training data is biased or limited, the simulated responses will be unfair or misleading, so review and test models carefully.

- Combining synthetic and real responses thoughtfully:

Blending synthetic and real data can be powerful, but requires balance. Use synthetic responses to explore scenarios or test questions, then validate findings with real participants to confirm accuracy.

Conclusion

Synthetic respondents in market research aren’t just a tech innovation; they’re redefining innovation in the research industry. By combining AI with real-world data, researchers can obtain answers faster, more cost-effectively, and more ethically than ever before.

Throughout this article, we’ve looked at how synthetic responses mimic real human behavior and address privacy and bias. They allow risk-free testing of new product ideas, access to niche audiences, and scalable decision-making.

Their real power is in balance. Synthetic respondents work best as complements to human respondents, not replacements. Tools like QuestionPro combine synthetic data with real data to get you answers without compromising data quality or ethics.

Frequently Asked Questions (FAQs)

Answer: Unlike real participants, synthetic respondents generate answers algorithmically, based on training data patterns, without human involvement.

Answer: Yes, they can produce human-like open-text answers using natural language models trained on diverse, real-world data.

Answer: They allow instant pre-testing of surveys to identify design flaws, logic errors, and confusing questions, saving time and cost.

Answer: Synthetic respondents simulate individual answers, while synthetic audiences model group or segment-level behaviors for broader strategy planning.

Answer: QuestionPro integrates synthetic respondents into its platform to pre-test surveys, simulate responses, support segmentation, and enhance text analytics.

Answer: No. They’re best used as a supplement helping researchers move faster and test more efficiently, but not replacing the depth of real human insight.