Market research is the fuel that propels products, services, and even ideas. In fact, market research might also be more important than the fuel metaphor, since crashing a campaign or initiative is more severe than sputtering at the gate. As award-winning social media scientist and author Dan Zarrella once said, “Marketing without data is like driving with your eyes closed.”

Unfortunately, nagging myths about market research often stall and crash brands as they navigate shifting times full of digital breakthroughs and sophisticated audiences.

By dispelling market research myths, you’ll be halfway on the road to achieving goals that fully activate your customers or clients. You’ll be myth-informed.

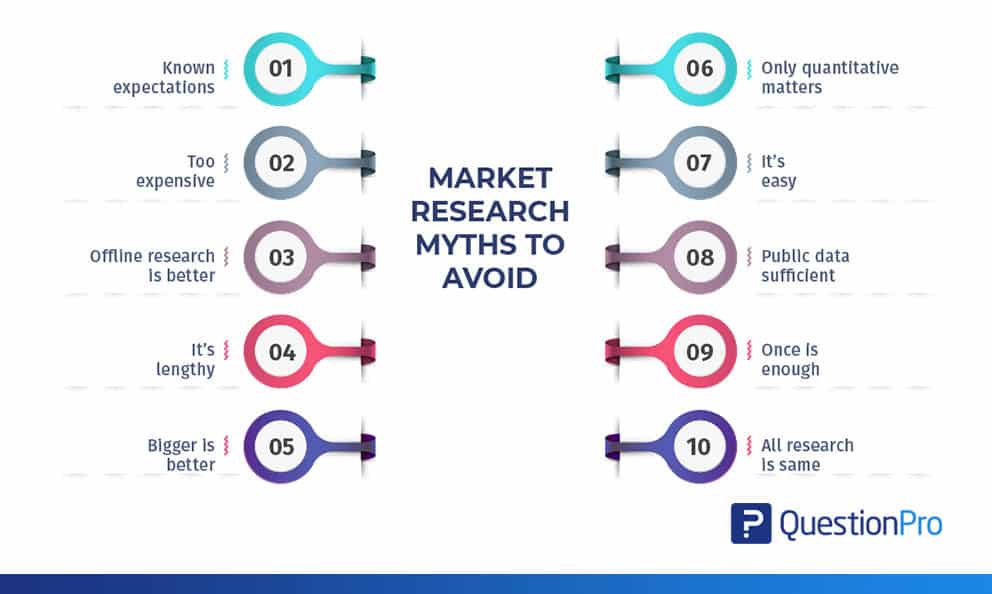

The top ten market research myths that can harm your brand

Many myths around market research can harm your brand. Market research is an approach and a tool that is used to help overcome marketing challenges. It plays a pivotal role in the decision-making process by providing accurate, relevant, and up-to-date information for decision making. Marketing research helps to identify problems, spot growth opportunities, formulate marketing strategies, determine consumer needs, forecast sales, and improve sales activities, introduce new products, and to revitalize a brand.

Here are the top ten market research myths that can harm your brand:

1. Buyer expectations known

Most organizations know who they are serving, but don’t take into consideration subtle shifts in audience needs and potential blind spots. In these hyper-competitive times, trends are evolving at a fast pace. A change in consumer preference in social media or a minor dislike in a product feature can make a huge difference.

What’s more, continuous research can unveil hidden motivations and desires in audiences, which is potentially game-changing for a brand.

Imagine a world where Blockbuster had understood the public’s growing appetite for streaming or video home delivery, or Myspace had listened to the swelling dissatisfaction with clunky, spam-ridden profiles? Great examples, for sure, but you get the big picture of audience research.

2. Market research is too expensive

As they say, that dog just won’t hunt – especially in a digital age that offers affordable and scalable research solutions. Below we’ll mention some cost-effective, qualitative research tools, but online survey platforms (like QuestionPro) and quick-hacks like Twitter surveys make data-collection very approachable. Email marketing platforms can cost close to nothing for reaching audiences.

Don’t worry about building a focus group room in your office or funding a phone interview study. There is a digital avenue out there that fits your budget.

3. Offline research trumps online research

We might as well quickly address this myth now.

For qualitative research, an argument on accuracy can be made, although not by much. For quantitative research analysis, online is a widely-accepted methodology for quick turnaround and keeping your data collection cost manageable. In fact, we’ve talked about the importance of market research:

- Allows marketers to gather opinions from a broad market spread

- Results compiled quickly and can capture varying trends

- Allows for seamless sampling within specific regions or zip codes

- Effective at protecting respondent personal information

And again…it’s better on your wallet.

4. Market research is lengthy

Let’s stress one more time the digital age we live in today. Yes, research should be as accurate and meticulous as possible. That doesn’t mean, however, going on a grand experiment until you find the market research God Particle.

As an article in B2B Marketing explains:

“Most research projects should not require a six-month engagement. In fact, some would argue that long gone are the days of the lengthy survey timeline. Thanks to new technologies and new data sources, researchers and marketers alike have more options than ever to gather different types of insights that come in all shapes and sizes, fit all budgets. They can take anywhere from three days to three months.”

In short, the market research world is yours for the taking…

5. Bigger samples are better

In today’s research world, size doesn’t have to matter. This is more so in a mobile device era and short-attention-span culture. Research reveals that for most projects now, marketers can expect up to 40% response on smartphone screens.

Brands don’t need titanic surveys. In fact, studies show that response fatigue sets in after 20 minutes of any research — so, a tight, short questionnaire is a better approach. The study also reveals the following:

“They found survey respondents exert less effort and spend less time thinking about their answers as respondents get deeper into the survey.”

6. Only quantitative research matters

Well-crafted surveys go a long way in bringing useful data. But the “why” of the data can be as crucial. A survey may explain that a particular demographic isn’t frequenting a store at certain hours, but without knowing “why,” it’s hard to customize a solution. That’s where such solutions as open-ended questions, post-participation interviews, or competitive-analysis come in.

Honestly, it should never be qualitative research versus quantitative research. Instead, it should be a healthy balance for quality market research. In reality, such solutions as webcams, eye-tracking, and neuromarketing make qualitative research available to many organizations.

Moreover, qualitative research is making a comeback as companies increasingly explore the “why” to ensure they nurture the right clients or customers for the long haul.

7. Researching is easy

Just because you can draw from digital solutions and audiences like “short and sweet” doesn’t mean it’s a cakewalk.

Marketers and researchers should still work hard at research, being as meticulous as possible. From designing an effective questionnaire to systematically analyzing (and re-analyzing) data, you’ll get out what you put in.

Or as an Oracle marketing thought-leader said:

“Marketing research is supposed to be difficult. If it weren’t difficult, everyone would do it. Of course, we all know there is research being done all the time — lots of people are doing it, but very few are doing it right. And by “right,” I mean conducting true marketing research with quantifiable and qualifiable results.”

8. Public data is enough

Guess what?

Your competitors have the same access to statistics from government agencies, corporation balance sheets, and trade associations.

Also, data points from different sources have varying methodologies. You may be unable to draw precise comparisons to answer your business questions strategically.

Furthermore, pure syndicated market research helps find the story behind public data, which gets your brand ahead of the pack.

9. Researching once is sufficient

By now, the key theme in this article about changing times and audiences should be apparent. Even in a legacy, non-digital world, market research should be ongoing. Sadly, companies often stop at market research before the release of a product or only touch on audiences for initial reactions.

As one expert said, market research ought to be conducted “every six months to accurately capture the feel of the market, customers, and competitors, ensuring that one’s company does not miss out on valuable opportunities.”

Your mileage may vary, of course, but don’t accept that data-gathering ever ends (if you want to stay competitive and grow your brand).

10. All market research companies are similar

If you decide to use a research partner, it’s just the same as if you choose to leverage an agency for branding or digital marketing. Market research companies come in all sizes and specialties. For example, QuestionPro Audience specializes in providing its clients with hard to reach audiences for research – veterinarians, general contractors, business travelers, registered voters, just to name a few. Other providers have their own mojo or research methodology they focus on.

In short, do some market research if you want to utilize a market research firm. Just as important, always keep your organization’s tank full of the best possible market research fuel. Your brand or services will thank you later — and so will your audiences.

QuestionPro Audience provides our clients with access to more than 22 million active respondents, who are strategically recruited to participate in quantitative research and live discussions. By implementing various recruitment methodologies, we make sure to provide the right kinds of respondents for your research. With industry knowledge and innovative tools, QuestionPro Audience always meets the rigorous demands of our clients. Contact for your next research project.