How do you know if you’re offering a service that stands out from your competitors? When this question comes into play, that’s where Net Promoter Score (NPS) appears as the best tool to keep track of your metrics related to the level of satisfaction your users are experiencing.

This metric uncovers how customers truly feel, beyond PR statements and ad campaigns, so knowing it is usually very important to understand the impact that your initiatives are having on your overall strategy. Therefore, in today’s article, we’ll break down Wells Fargo NPS score, compare it to the industry average, and share key insights into what’s driving satisfaction—and dissatisfaction—in banking today.

Let’s start with the basics… What is NPS?

NPS (Net Promoter Score) is a trusted measure of customer loyalty. It’s so widely used by so many companies that it has become the standard for understanding satisfaction levels.

It all starts with a simple question:

“On a scale of 0–10, how likely are you to recommend us to a friend or colleague?”

Participants can respond by selecting a number within the scale of 0 to 10, where 10 is the maximum level of satisfaction. Based on their responses, participants are usually:

- Detractors (0–6): Disappointed and likely to leave negative feedback.

- Passives (7–8): Neutral. Not unhappy, but not singing your praises either.

- Promoters (9–10): Loyal fans who boost your brand with word-of-mouth or by sharing their opinions with you in a kind way to keep improving.

Formula:

NPS = % Promoters – % Detractors

For this study, QuestionPro surveyed 1,000 individuals across the Banking and Financial Services industry to find out what perception users have of the main industries and companies, to establish NPS benchmarks for 2025.

Why Does Wells Fargo’s NPS Matter?

Wells Fargo is no small player. As the second-largest U.S. bank in deposits and a global financial heavyweight, its customer reputation has real implications.

The bank is making strides in digital transformation. With Wells Fargo Vantage℠, it offers a scalable, business-focused banking platform. And behind the scenes, its global IT and cybersecurity teams are focused on a unified mission: enabling safe, 24/7 access across digital, ATM, and branch channels.

But not everything shines. Customer reviews on platforms like Trustpilot flag serious concerns—lack of transparency, long waits, and poor service resolution. These pain points are more than anecdotes—they’re visible in the data.

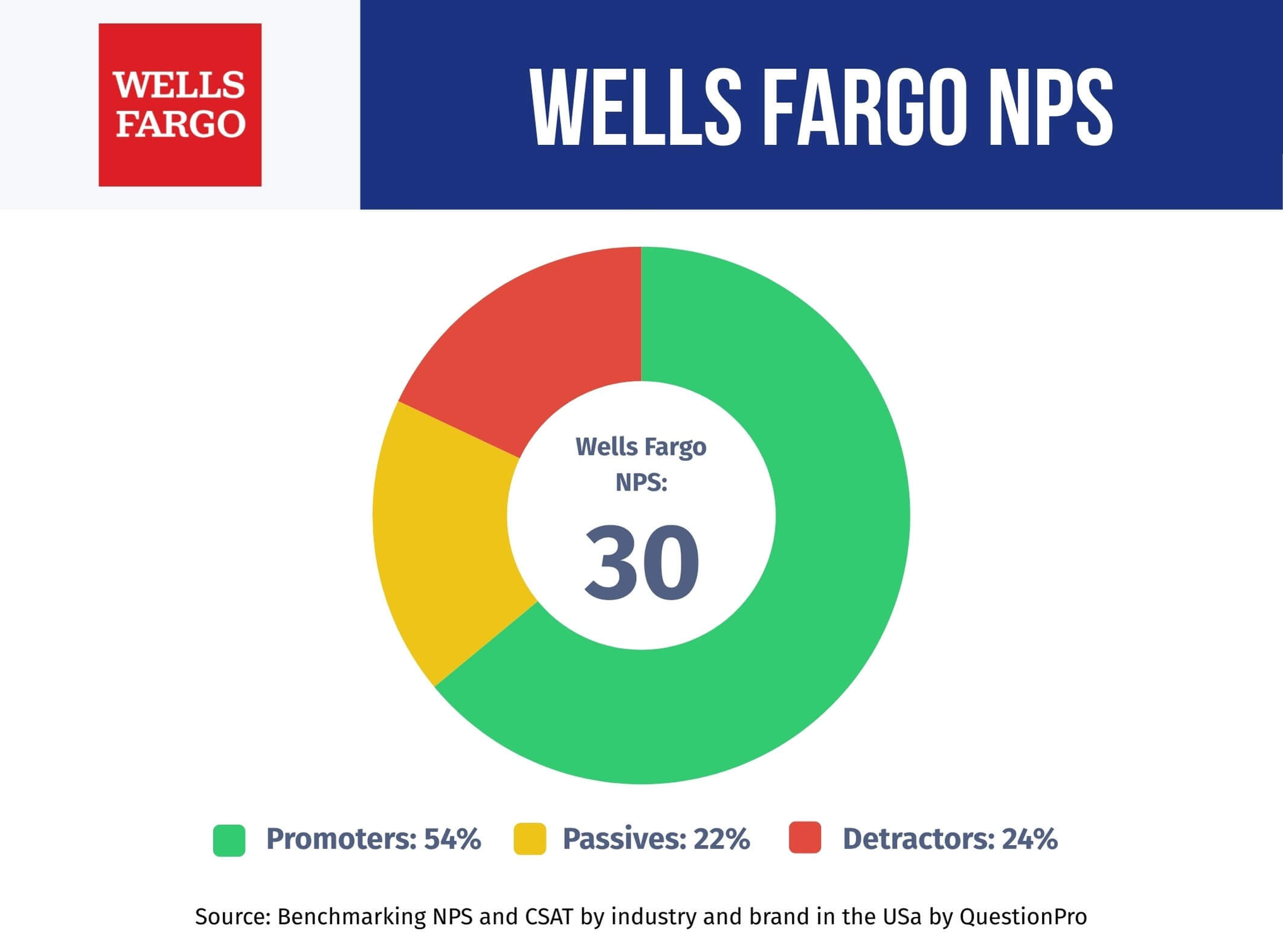

What is Wells Fargo NPS Score?

Answer: 30

Wells Fargo NPS of 30 falls below the industry average of 41, placing it as the banking institution with the worst score in the study on Benchmarking NPS and CSAT by industry and brands in the USA, by QuestionPro, revealing that customer satisfaction is an area with room for growth.

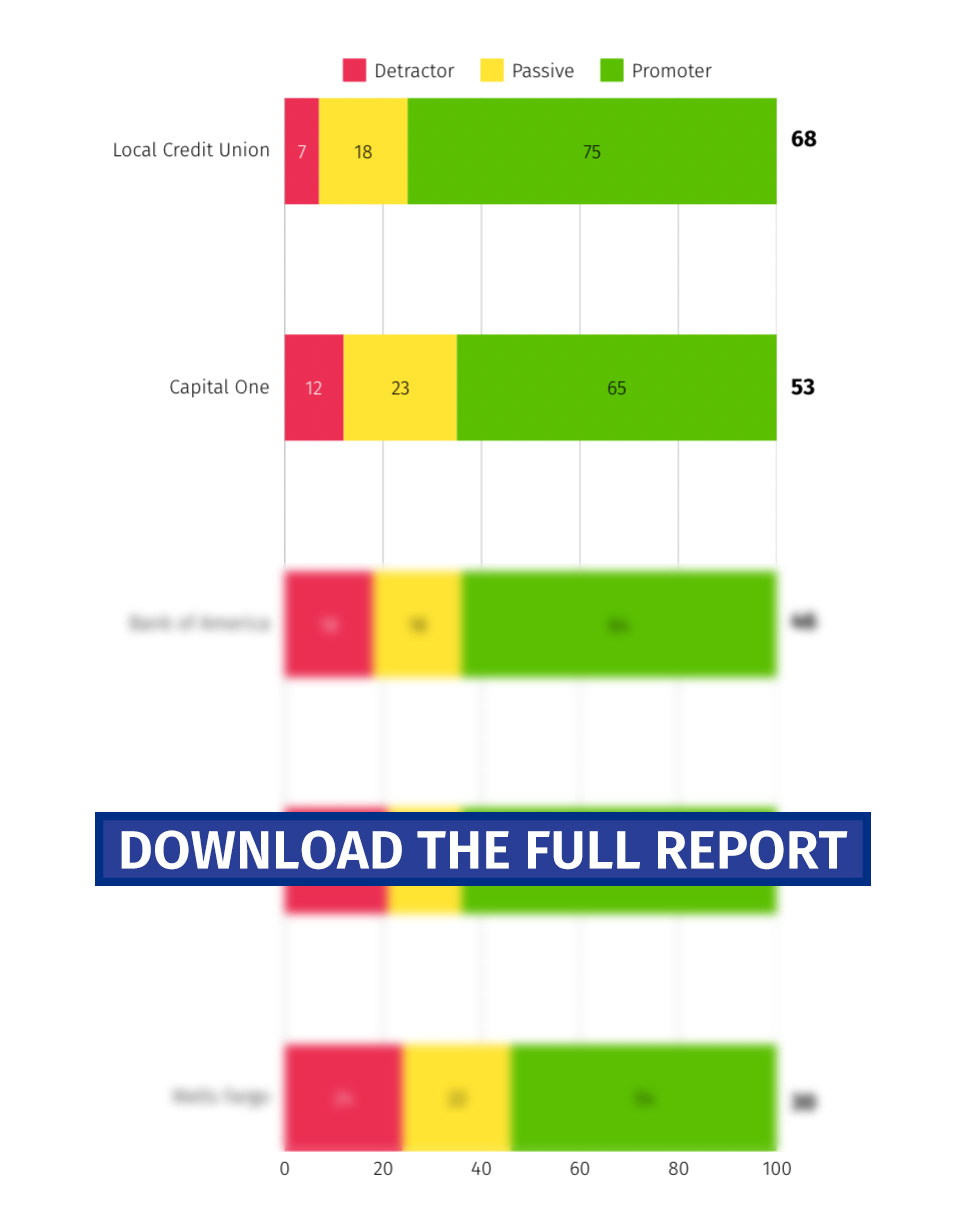

Industry Benchmarking: How Does Wells Fargo Compare?

Across the Banking and Financial Services industry, the average NPS is 41. That means, on average, banks are seeing more customer goodwill and fewer issues dragging down their scores.

Take JPMorgan Chase, for example. It’s been rolling out features like Chase Travel, Wealth Plan, and credit score tools—and customers are responding positively. Their NPS stands at 41, exactly matching the industry benchmark.

By contrast, Wells Fargo trails by 11 points. That’s not catastrophic, but in a competitive market where switching banks is easier than ever, there is a noticeable gap.

So what’s the takeaway?

- Wells Fargo is innovating, especially with digital banking tools like Vantage.

- But customer sentiment lags behind, likely due to ongoing concerns about service and transparency.

These insights are based on QuestionPro’s most recent study, where 1,000 participants were surveyed to measure the NPS across different companies and industries. The report represents genuine user feedback from Q1 2025 and is updated every quarter.

How to Calculate Your NPS?

Curious about your own organization’s standing? That’s a great starting point; the good news is that calculating it is quite simple. Here are some easy steps to achieve it:

- Create a Survey: Use QuestionPro’s ready-to-launch NPS survey template.

- Ask the Right Question: “How likely are you to recommend us?”

- Dig Deeper with AskWhy™: Understand what drives satisfaction or frustration.

- Distribute Easily: Email, embed on your site, share via QR or social. You can also use QuestionPro Audience to target specific groups, helping you reach the right respondents for more accurate insights.

- Analyze with Confidence: Get instant dashboards, segmentation, and trends.

Ready to Improve Your NPS?

Want to see how your business stacks up?

Download our 2025 Industry Benchmarks Report and discover where you shine—and where to focus. This study will be updated every quarter, offering you relevant and valuable information to keep learning from industry leaders’ good and bad practices.

Need expert help? Talk to a QuestionPro Consultant and turn customer feedback into growth.

Wells Fargo isn’t the only company in the banking industry & financial services with valuable lessons for those looking to improve their customer service and experience. Below, we recommend a few articles where you can learn how other major brands manage to maintain a high NPS and a loyal customer base — you’ll surely find some useful insights along the way.