In a time when customer trust is more complex to earn and easier to lose, Credit Unions are standing out as quiet champions of satisfaction and loyalty. While traditional banks are investing in mobile apps and branch expansions, Credit Unions are quietly racking up loyalty points where it counts most: with their members.

Let’s look at how they’re doing it, what the numbers reveal, and what other financial institutions can learn from their example.

What Is NPS, and Why Does It Matter?

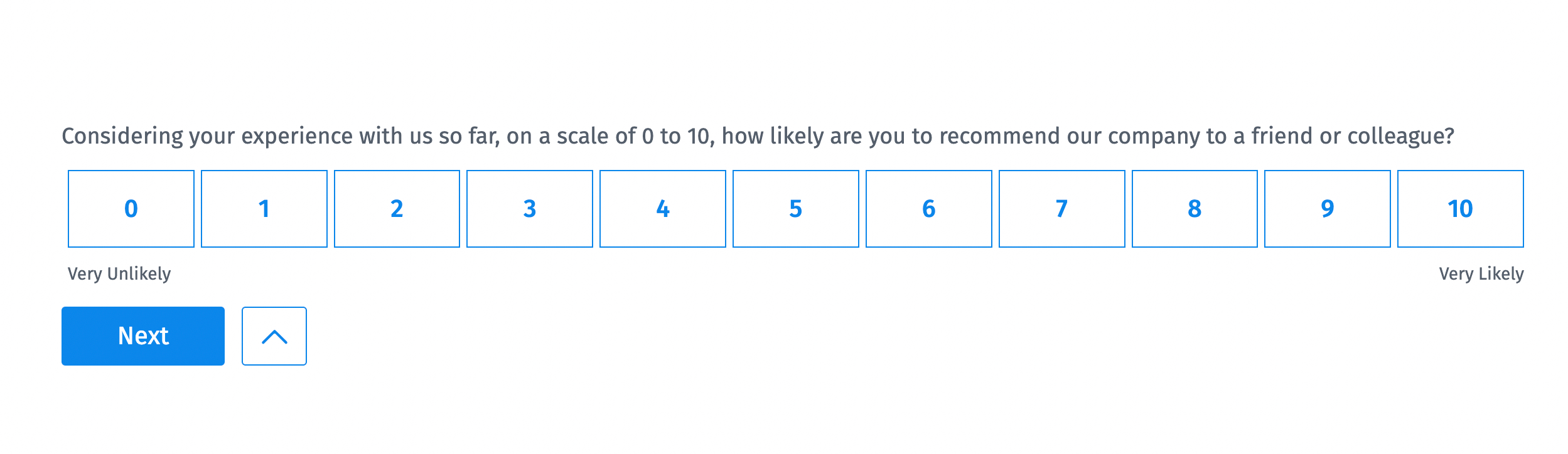

NPS (Net Promoter Score) is a quick measure of customer loyalty. It starts with one question:

“On a scale of 0 to 10, how likely are you to recommend us to a friend or colleague?”

Here’s how the answers break down:

- Promoters (9–10): Loyal fans who actively recommend you.

- Passives (7–8): Satisfied but quiet. Easy to lose.

- Detractors (0–6): Disappointed, and likely to spread negative feedback.

The formula is simple:

NPS = % Promoters – % Detractors

It’s a powerful signal of whether your brand builds real loyalty or survives on convenience.

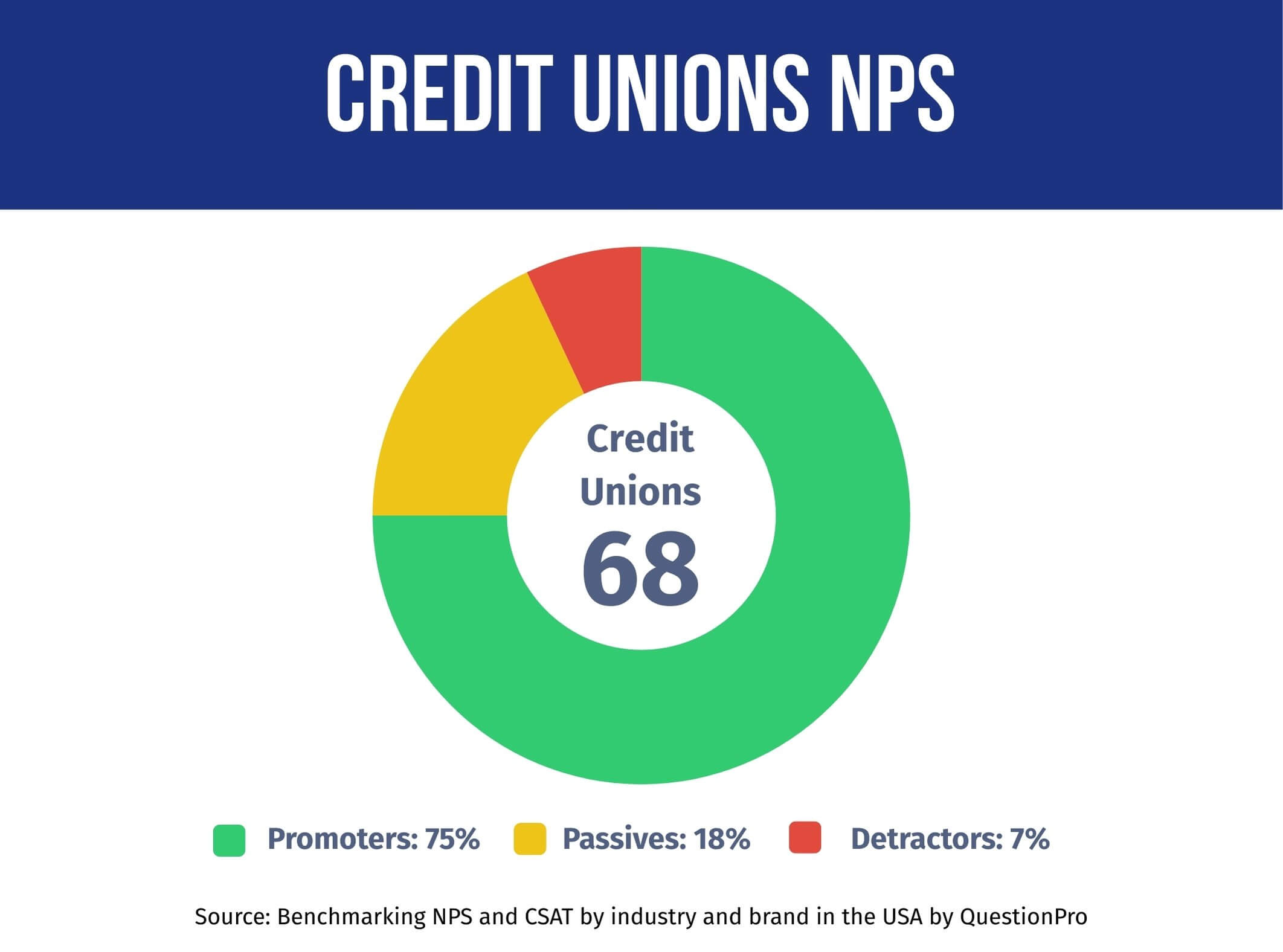

Credit Unions’ NPS Performance Score

According to QuestionPro’s 2025 Q1 Benchmarking Report, Credit Unions have surged ahead of the entire financial services industry in terms of Net Promoter Score and Customer Satisfaction (CSAT).

Credit Unions are leading the financial services industry in 2025 with an NPS of 68, well above the industry average of 41. That kind of gap shows they’re not just meeting expectations, they’re exceeding them.

Here’s the breakdown:

- Promoters: 75%

- Passives: 18%

- Detractors: 7%

This is a winning mix. Three out of four members actively recommend their credit union, while only a few are dissatisfied. That’s a recipe for long-term loyalty.

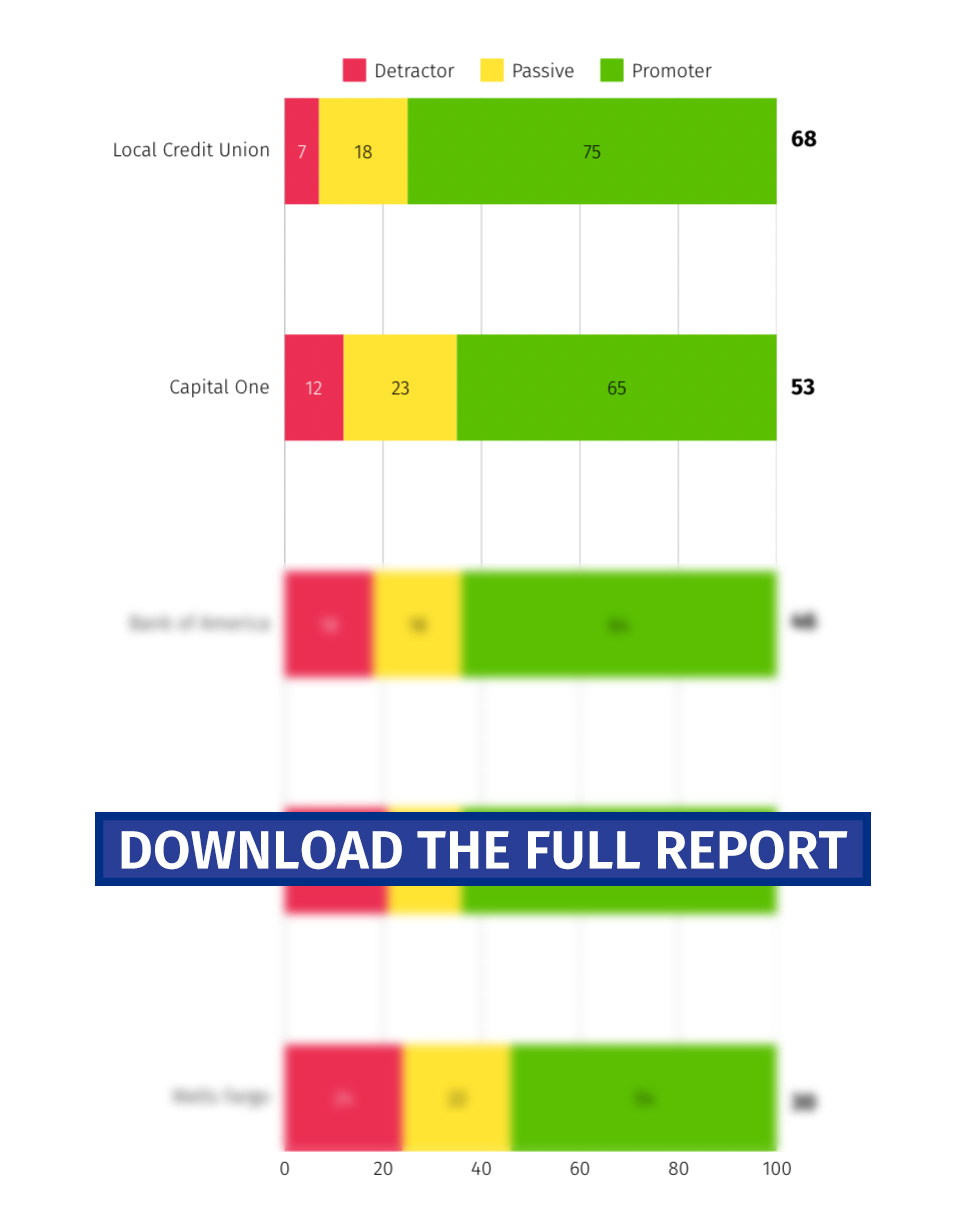

How Do Credit Unions Compare to Other Financial Institutions?

According to QuestionPro’s Q1 2025 Benchmarking Study, which surveyed 1,000 participants across the banking and financial services sector, the average industry NPS came in at 41, broken down as follows:

Compare that to Credit Unions, which scored a standout NPS of 68—a full 27 points higher than the industry average. Local Credit Unions lead the pack with a matching 68 NPS and an impressive 84% CSAT.

The takeaway? While many traditional banks deliver what’s expected, Credit Unions create memorable experiences that members feel good talking about. They’re not just providing financial services but earning trust and loyalty through consistent, people-first interactions.

Why Are Credit Unions Outperforming?

Several key factors help explain why Credit Unions are dominating loyalty rankings:

1. High Promoter Rates

With 75% of members identified as Promoters, Credit Unions are building strong emotional connections. These customers aren’t just satisfied—they’re proud to belong.

2. Very Few Detractors

Only 7% of members reported negative experiences. That’s significantly lower than the industry average and a sign that Credit Unions are effectively resolving pain points.

3. Strong Customer Satisfaction

With an 84% CSAT score, Credit Unions consistently meet or exceed expectations in service, support, and transparency.

4. Return Intent is High

When asked if they plan to continue using their Credit Union:

- 82% said Yes

- 11% said Maybe

- 7% said No

That means nearly 9 out of 10 customers are committed or open to staying. It’s a powerful sign that trust is firmly in place.

What’s Driving Credit Unions’ Loyalty?

Here’s why customers are choosing—and sticking with—Credit Unions:

- Personalized Service: Members often feel more recognized and cared for than in traditional banks.

- Community Connection: Many Credit Unions are locally owned and mission-driven.

- Transparent Practices: Fewer hidden fees and more straightforward communication.

- Value Over Volume: Focused more on relationship-building than aggressive scaling.

While larger banks may offer convenience, Credit Unions deliver meaningful, human-centered interactions. That’s what keeps members coming back and recommending them to others.

Steps to Improve Your NPS with QuestionPro

If your financial institution is looking to follow the Credit Union model, here’s how QuestionPro can help:

- Ask the Right Question

Start with the core 0–10 NPS question. Then add a follow-up AskWhy question like “Why did you give that score?” to capture real context.

- Break Down the Feedback

Look beyond averages. Use filters like product type, location, or customer tenure to understand where satisfaction is strongest and where it is slipping.

- Act on Detractor Feedback

Each negative response is an opportunity. Respond quickly, make improvements, and close the loop.

- Celebrate and Activate Promoters

Encourage top fans to leave reviews, refer friends, or join your advocacy program. Turn loyalty into amplification.

- Track and Benchmark Consistently

Customer experience isn’t one-and-done. Measure progress regularly and compare your NPS against industry leaders using QuestionPro’s Benchmark Report.

Want to Know How Your Brand Stacks Up?

The Q1 2025 NPS Benchmark Report offers a complete breakdown across the financial industry, retail, travel, and more. It’s your guide to understanding where you shine and where you can improve.

Do you need help turning your customer feedback into action? The team at QuestionPro is here to help you build a successful loyalty strategy.

Credit Unions isn’t the only company in the banking industry & financial services with valuable lessons for those looking to improve their customer service and experience. Below, we recommend a few articles where you can learn how other major brands manage to maintain a high NPS and a loyal customer base — you’ll surely find some useful insights along the way.