What makes policyholders not just sign up for insurance but stay with a provider—and even recommend it to others? For GEICO, it’s not just about competitive pricing or clever advertising. It’s about how customers feel when they need help, file a claim, or simply try to make a change to their policy.

Customer loyalty like this doesn’t happen by chance. It’s tracked using a tool called Net Promoter Score (NPS), which measures how likely people are to recommend a company based on their experience.

In this blog, we’ll take a closer look at GEICO NPS score, see how it compares to the insurance industry average, and explore the real-world experiences that are influencing how customers feel about the brand.

What is Net Promoter Score?

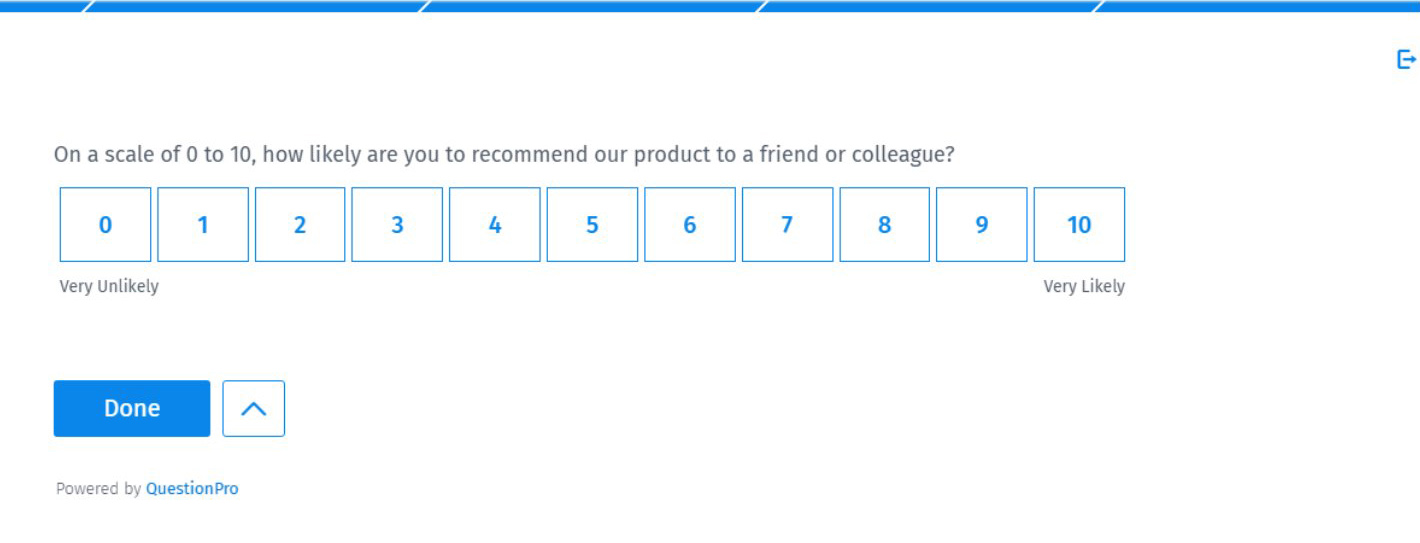

Net Promoter Score, or NPS, is a simple way for businesses to find out how happy their customers are. It’s based on just one important question:

“On a scale of 0 to 10, how likely are you to recommend our product or service to a friend or colleague?”

Based on their answers, customers are put into three groups:

- Promoters (score 9–10): These are your happiest customers. They love what you offer and are likely to tell others about it.

- Passives (score 7–8): These people are fairly satisfied but not super excited. They probably won’t go out of their way to promote you.

- Detractors (score 0–6): These are unhappy customers. They might even tell others not to use your service.

To figure out your NPS, you take the percentage of Promoters and subtract the percentage of Detractors.

NPS = % Promoters – % Detractors

The result is a number between -100 and +100. If 60% are Promoters and 20% are Detractors, your NPS is 40.

NPS helps companies see how customers really feel. A high score means people like your brand and are spreading the word. A low score is a sign that something needs to change.

It’s a quick and powerful way to measure customer satisfaction and loyalty.

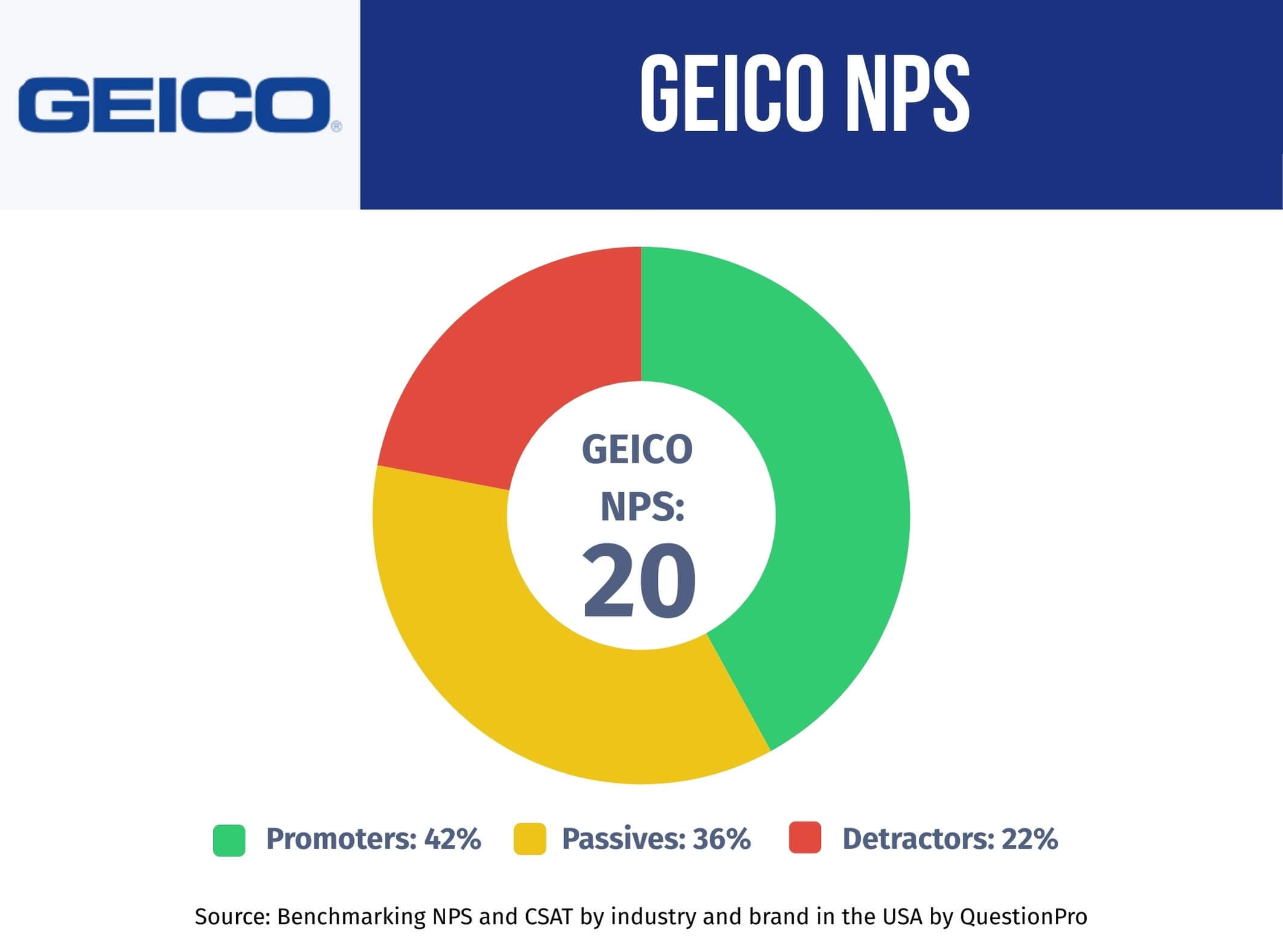

GEICO NPS Performance Score and Breakdown

GEICO holds a Net Promoter Score (NPS) of 20, which falls slightly below the insurance industry average of 23, according to QuestionPro’s Q1 2025 Benchmarking NPS and CSAT Report. This score indicates that while many customers are satisfied, there is scope for improvement in overall loyalty and brand advocacy.

Here’s a breakdown of GEICO’s customer feedback:

- Promoters: 42%

- Passives: 36%

- Detractors: 22%

With nearly a quarter of its customers falling into the Detractor category and a significant portion categorized as passive, GEICO faces the challenge of converting more of its satisfied customers into loyal advocates. Increasing customer engagement, addressing pain points, and enhancing service experience could help GEICO boost its NPS and better compete in a crowded insurance market.

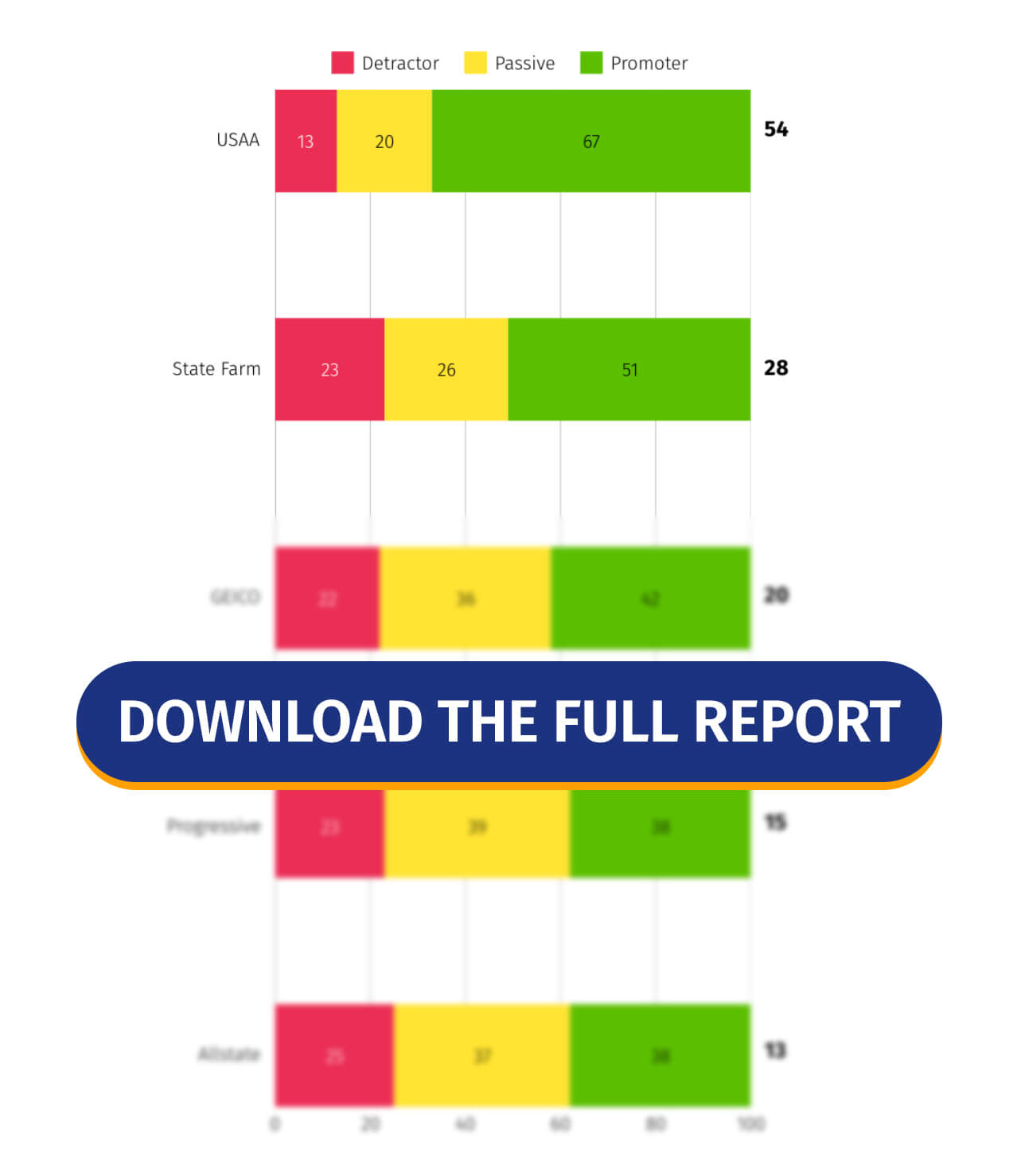

How GEICO NPS Score Compares to Automotive Industry Benchmarks?

GEICO’s Net Promoter Score (NPS) of 20 places it slightly below the insurance industry average of 23, as reported in QuestionPro’s Q1 2025 Benchmarking NPS and CSAT Report. While not far off the mark, the score suggests there is room for improvement in customer satisfaction and brand loyalty.

Although GEICO has a solid base of satisfied customers, the relatively high percentage of Passives and Detractors indicates that many policyholders are either neutral or dissatisfied with their experience. Compared to other insurance providers, GEICO remains competitive but does not lead the pack in customer loyalty.

Improving service responsiveness, claims handling, or personalization could help GEICO turn more customers into loyal advocates and surpass the industry average in future reports.

These insights are based on feedback from 1,000 participants in QuestionPro’s Q1 2025 report, offering a clear view of how customers feel about top airline brands.

What is Impacting GEICO’s NPS?

GEICO’s Net Promoter Score (NPS) of 20, which falls below the insurance industry average, reflects growing customer frustration across several key areas. Here are some major factors impacting GEICO’s NPS:

- Poor Customer Service and Communication

Many customers report long wait times, difficulty reaching a real human agent, and repeated transfers without resolution. The lack of clear, proactive communication—especially regarding billing, policy changes, or claim status—is a major source of irritation.

- Unexpected Rate Increases

Numerous long-time policyholders have seen sharp and unexplained premium hikes despite clean driving records and no recent claims. This creates a perception of unfair pricing and contributes heavily to customer churn.

- Claims Handling and Payout Issues

A recurring theme in reviews is dissatisfaction with how claims are handled. Customers claim delays, underpayment, and denial of legitimate claims, especially after weather events or not-at-fault accidents, as reasons they no longer trust the company.

- Aggressive or Misleading Practices

Several users mentioned being bombarded with emails, texts, and mail, even after switching providers. Others shared concerns about being accused of fraud or having unnecessary people added to their policy, leading to increased charges.

- Lack of Loyalty and Transparency

Long-term customers feel abandoned when problems arise. Many shared stories of being with GEICO for 10–20+ years, only to be treated like strangers when they needed support. This causes trust issues and leads loyal policyholders to leave for competitors.

To improve its standing and regain customer trust, GEICO will need to make meaningful changes, starting with better communication, fairer pricing practices, and a more customer-centric approach to support and claims resolution.

How to Measure and Enhance Your NPS?

Want to see how your Net Promoter Score (NPS) stacks up against your competitors? With QuestionPro, it’s easier than you think to measure and improve your NPS.

1. Launch an NPS Survey

Start by using QuestionPro’s ready-made NPS survey template. It includes the standard 0–10 rating question and a follow-up “AskWhy question feature to understand the reason behind each score.

Distribute your survey via SMS, email, QR codes, or a direct link. Need a specific audience? QuestionPro Audience lets you target by industry, location, or demographics.

3. View Real-Time Results

As responses come in, your NPS is automatically calculated. The dashboard clearly shows promoters, passives, and detractors—helping you identify trends fast.

4. Take Smart Action

Use your results to improve customer experience. Focus on areas where scores are low, and track progress with benchmarking tools that show how you compare to others in your industry.

With QuestionPro, NPS tracking becomes an easy, continuous process to boost loyalty and satisfaction.

Stay Ahead with the Latest NPS Insights

Download the Q1 2025 NPS Benchmark Report and uncover how industry leaders are building strong customer loyalty through exceptional experiences.

Looking to elevate your Net Promoter Score? Contact the experts at QuestionPro for personalized strategies and tools to measure, track, and improve customer satisfaction at every touchpoint.