In the connected digital age, the concept of a synthetic identity, a constructed persona that combines real and fake information, is becoming both a tool and a problem. Unlike traditional identities tied to one person, synthetic identities combine legitimate data with entirely made-up information, such as a fake name, address, or date of birth.

These hybrid profiles exist in a grey area. They are not tied to a real person but can interact with systems as if they were real. In this article, we will discuss both the good and the evil parts of synthetic identity.

What is Synthetic Identity?

A synthetic identity is a persona created by combining real and fake personal information. By combining real and invented details, synthetic identities can bypass traditional verification methods and live in a space where reality and fiction coexist.

Key Components

- Real Data: Stolen or borrowed (e.g., Social Security numbers of minors, the deceased, or unused IDs).

- Fake Data: Made-up elements (e.g., names, addresses, or employment history).

- Blended Profiles: The final identity combines real and fake parts to look credible.

Synthetic identities are a double-edged sword. They enable innovation and privacy but challenge systems that rely on trust. Understanding how they work is key to leveraging the benefits while mitigating the risks.

Benefits of Synthetic Identities

While synthetic identities are often associated with fraud( like financial fraud and identity fraud), they have legitimate uses. Here’s how you can use it for good, avoiding fraudulent activity:

1. Better Privacy

Synthetic identities allow individuals to go online without exposing their real personal information. For example:

- Anonymous Participation: Users can join forums, social media, or e-commerce sites without linking their activity to their real identity.

- Data Masking: Researchers or testers use synthetic profiles to avoid handling sensitive personal data.

2. Using in Research

Developers and companies can use synthetic identities for research purposes. You can use software like QuestionPro Research Suite to get synthetic data to create identities for your research projects.

3. Creative Digital Interactions

Synthetic identities enable secure and fun digital experiences:

- Gaming & Metaverse: Users create avatars or personas that operate independently of their real-world identity.

- AI Chatbots: Brands use synthetic personas for customer service, blending human-like interaction with anonymity.

4. Inclusive Access

In some cases, synthetic identities can help individuals bypass systemic barriers:

- Financial Inclusion: Unbanked populations might use synthetic profiles to access digital services (though this overlaps with regulatory gray areas).

- Geographic Flexibility: Users in restricted regions can use synthetic details to engage with global platforms.

5. Business Risk Mitigation

Companies use synthetic identities to:

- Protect Sensitive Transactions: Mask real customer data during vendor interactions.

- Conduct Market Research: Analyze consumer behavior without compromising user privacy.

By using synthetic identities responsibly, industries can open up new opportunities while keeping privacy and security in check in this digital age.

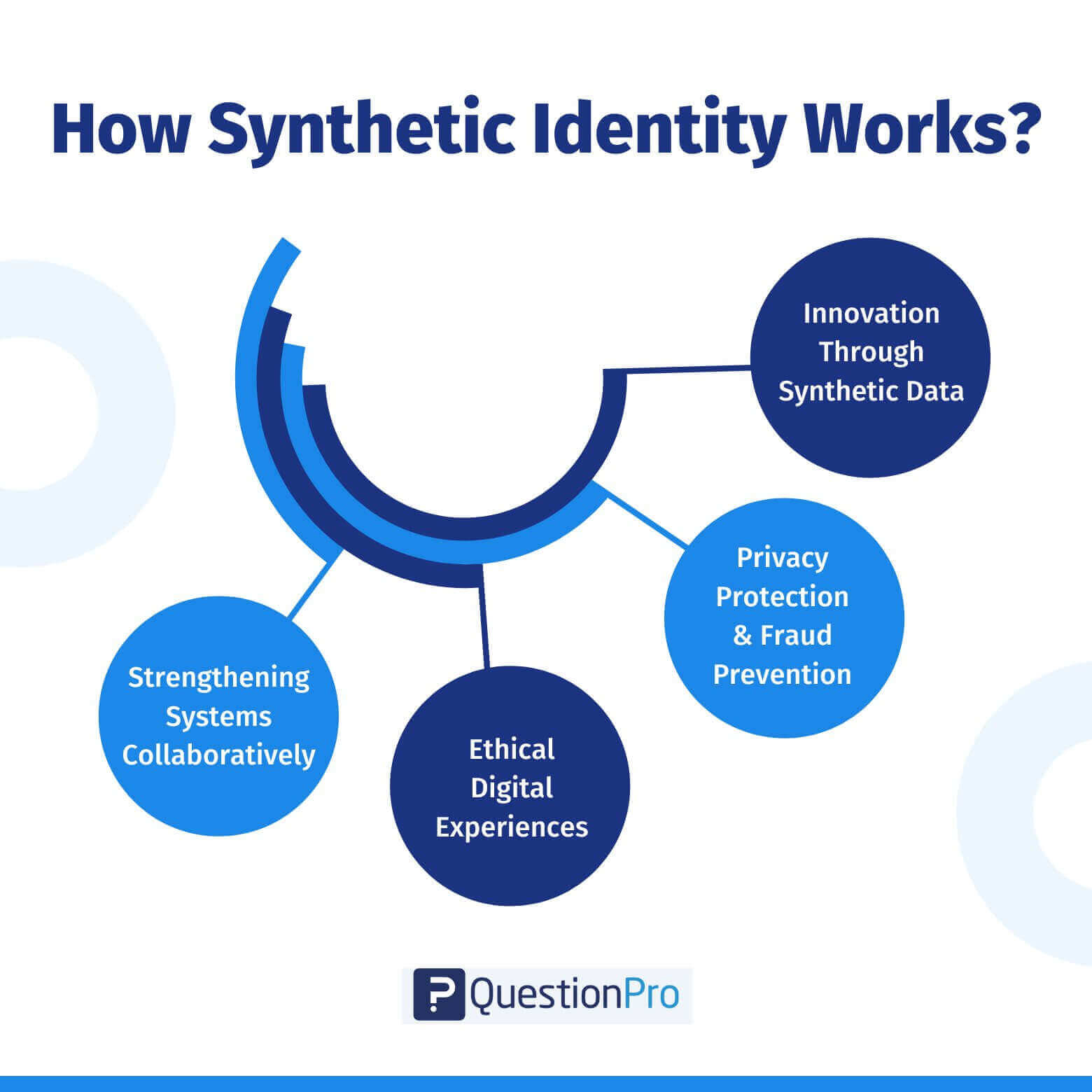

How Synthetic Identity Works?

A synthetic identity created by combining real data (e.g., anonymized Social Security numbers) with fictitious identity elements gives organizations a safe innovation tool.

These fake identity profiles allow reseach institutions, tech teams, and users to protect privacy, test systems, and build inclusive solutions while mitigating risks like synthetic fraud.

1. Innovation Through Synthetic Data

Researchers can use synthetic identity-created models to simulate multiple identities and user behaviors without compromising real credit history or sensitive data.

For example, research institutions use synthetic profiles to create demographic insights, while AI teams train fraud detection systems using fabricated transaction accounts.

2. Privacy Protection & Fraud Prevention

Individuals can use fake identity personas on social media or gaming platforms to avoid exposing personal details, reducing vulnerability to data breaches.

Meanwhile, government agencies like the Federal Reserve encourage financial institutions to mask customer accounts with synthetic data during transactions, adding security layers against synthetic fraud.

3. Ethical Digital Experiences

Virtual worlds thrive on fictitious identity avatars that let users express themselves without real-world ties. Brands deploy synthetic AI agents for customer service, ensuring employee privacy while preventing misuse of multiple identities.

4. Strengthening Systems Collaboratively

Tech teams simulate synthetic fraud attacks using fake identity profiles to find vulnerabilities in banking or identity verification tools. Collaboration between financial institutions, government agencies, and platforms ensures that synthetic data aligns with regulations, such as the Federal Reserve’s guidelines on ethical AI use.

When done right, synthetic identity-created solutions let industries innovate while protecting credit history data and user accounts.

Organizations can stay ahead of synthetic fraud risks by working with government agencies and using synthetic profiles to mimic multiple identities. The key is to balance creativity with compliance and turn fictitious identity tools into catalysts for safe, ethical progress.

What is Synthetic Identity Fraud and How to Prevent it?

Synthetic identity fraud, the most advanced form of identity theft, involves criminals creating a new identity by combining stolen personally identifiable information (PII), like Social Security numbers, with fake details.

Unlike traditional identity theft, which targets existing individuals, this type of fraud creates hybrid profiles that are “groomed” over time to build legitimacy in credit reports and evade detection.

Fraudsters use these synthetic identities to get loans, manipulate financial systems, or commit scams and disappear.

Proactive Steps to Combat Synthetic Identity Theft

- Strengthen Identity Verification

- Biometric Authentication: Use facial recognition, fingerprint scans, or voice ID to link identities to physical traits.

- Document Checks: Cross-check IDs with government databases and public records to flag mismatches (e.g., SSNs do not match birth years).

- Trusted Data Sources: Use compliant platforms like QuestionPro to generate synthetic data and ethically protect personally identifiable information during testing.

- Use AI for Fraud Detection

- Analyze credit reports for anomalies like sudden score spikes, duplicate SSNs, or addresses tied to multiple names.

- Deploy machine learning to detect “grooming” behaviors (e.g., small repeated transactions) that indicate potential fraud.

- Cross-Institutional Collaboration

- Share data among banks, credit bureaus, and agencies to detect synthetic identities reused across systems.

- Join coalitions like the Synthetic Identity Fraud Mitigation Coalition to align on identity verification standards.

- Monitor Vulnerable PII

- Track SSNs of minors, deceased, or inactive credit reports—common targets for synthetic identity theft.

- Set alerts for unexpected activity on dormant SSNs to stop fraud early.

- Comply with Regulations

- Use tools like the SSA’s eCBSV to validate SSNs against public records and ensure lawful identity verification.

- Push for stricter penalties to deter this evolving type of fraud.

By strengthening identity verification and protecting personally identifiable information, you can reduce risk while allowing for the ethical use of synthetic data for innovation. Be proactive.

Challenges of Using Synthetic Identities

Synthetic identity theft is the fastest-growing financial crime. It blends real stolen data (e.g., Social Security numbers) with fake details to create undetectable hybrid identities.

Using synthetic identities becomes challenging because of fraudulent purchases or crimes caused by fake identities.

- Fastest-Growing Crime: Synthetic identity theft is more complex than traditional identity theft and uses blended data to conceal it.

- Blending Real and Fake Data: Thieves combine stolen SSNs (info to create) with false information (e.g., fake addresses) to create hybrid profiles. These identities get access to accounts and buy fraudulently, and criminals steal money.

- Evasion Tactics: Unlike regular identity theft, synthetic identities aren’t initially tied to real victims, so they don’t trigger traditional fraud alerts. Criminals groom synthetic identities over time to mimic good credit behavior so they can’t be flagged.

- Detection Challenges: Financial systems can’t stop synthetic identity fraud with current tools.

Conclusion

Synthetic identities are a double-edged sword in the digital age. They are a powerful tool for innovation and privacy, but a big problem for security and trust.

However, synthetic identity fraud, crafted over time to evade detection, requires proactive strategies. Advanced verification tools, AI-driven analytics, cross-industry collaboration, and regulatory frameworks are key to mitigating the risks without stifling innovation.

As technology moves forward, so must we. Industries can benefit from synthetic identities without abuse by setting standards, being transparent, and investing in robust detection systems.

The future of digital trust depends on our responsibility for innovation, so synthetic identities are a force for good in a connected world.

Frequently Asked Questions(FAQs)

Answer: A synthetic identity is a persona created by combining real and fake personal information. By combining real and invented details, synthetic identities can bypass traditional verification methods and live in a space where reality and fiction coexist.

Answer: Synthetic identity fraud is a refined form of identity theft in which criminals create a new identity by blending stolen personally identifiable information (PII), such as a real Social Security number (SSN), with entirely fabricated details (e.g., fake names, addresses, or birthdates).

Answer: Yes. Organizations use synthetic identities to protect privacy, simulate user behavior for testing, and enable inclusive access. For example, financial institutions use synthetic data to train fraud detection systems, while individuals use fake identity personas to participate anonymously online without risking their real personal information (PII).

Answer: Traditional identity theft involves stealing and misusing an existing person’s personally identifiable information (PII). Synthetic identity fraud, however, creates a new identity by combining real and fake data (e.g., a valid SSN with a fictitious identity). These profiles are groomed over time to build fake credit histories and bypass checks, making them harder to detect.

Answer: Potential synthetic identity is a suspected fake identity that combines real (e.g., stolen Social Security numbers) and fabricated information (e.g., fake names or addresses) to mimic a legitimate person. For example, a dormant SSN suddenly linked to a new credit application could signal a synthetic identity in development.