The insurance world isn’t just about policies and premiums anymore. It’s about experiences, trust, and how customers feel after interacting with their insurer. In an industry built on long-term relationships, NPS has become a critical measure of loyalty and brand health.

In this article, we unpack the NPS performance of leading insurance brands in 2025 and offer guidance on how to interpret and improve these scores.

What is NPS, and How to Calculate?

Net Promoter Score (NPS) is a widely used loyalty metric that helps you understand whether your customers are likely to recommend your brand to others. It’s based on a simple but telling question:

“How likely are you to recommend [Company Z] to a friend or colleague?”

Responses fall into three categories:

- Promoters (9–10): Loyal fans who fuel growth through positive word of mouth.

- Passives (7–8): Satisfied but unenthusiastic customers who might switch to competitors.

- Detractors (0–6): Unhappy customers who could damage your brand’s reputation.

The formula is simple:

NPS = % Promoters – % Detractors

Your score can range from -100 to +100. The higher, the better.

The QuestionPro NPS Calculator makes it easy to calculate your Net Promoter Score in just a few clicks. Whether you’re entering the number of promoters, passives, and detractors manually or using its built-in goal-setting feature, the tool instantly shows your NPS score, giving you a clear picture of customer loyalty.

From email surveys to in-store kiosks, QuestionPro helps you collect, calculate, and improve your NPS—all from one easy-to-use platform.

Insurance Industry NPS in 2025: Where Do Things Stand?

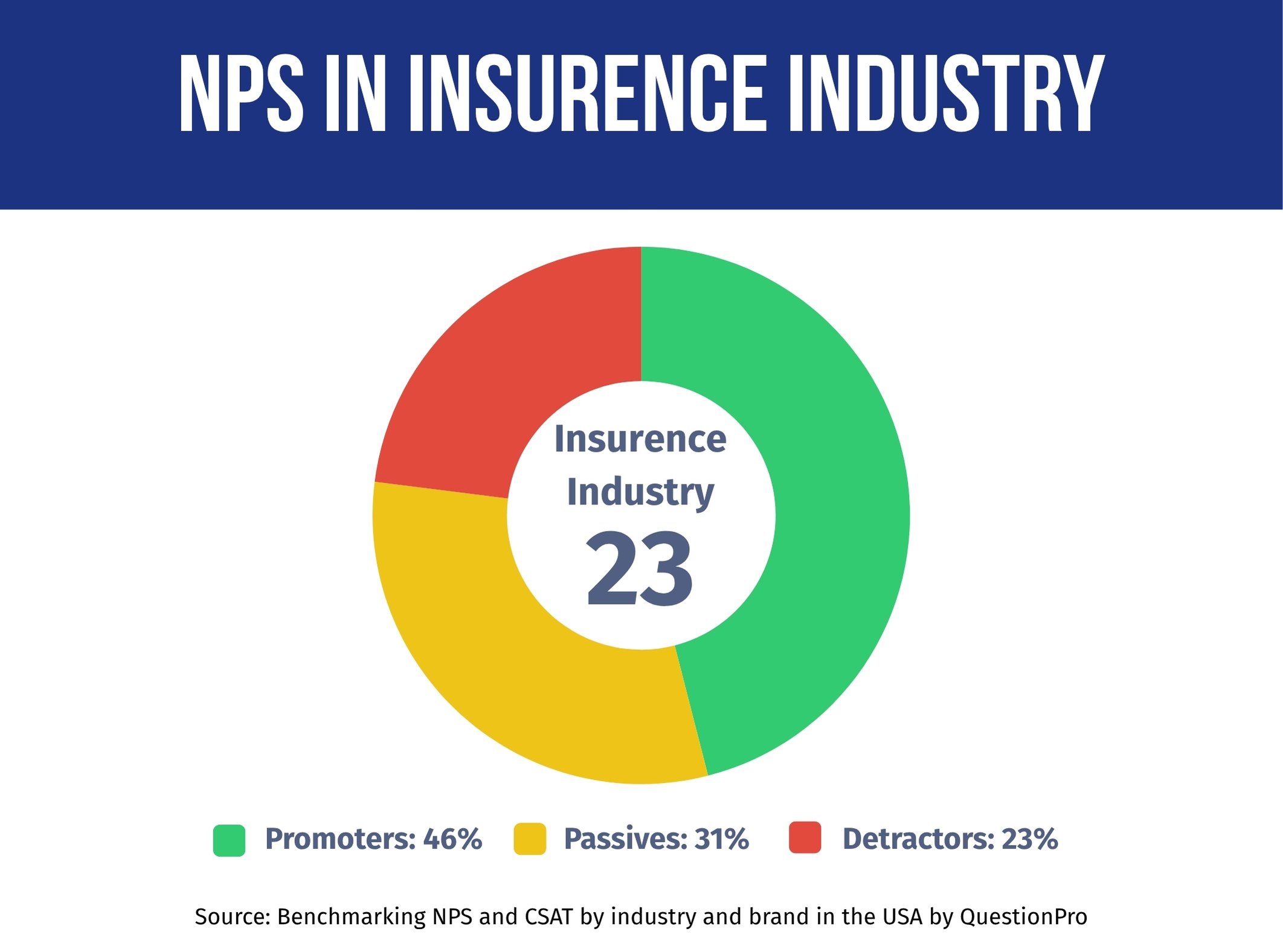

According to QuestionPro’s Q1 2025 Benchmarking NPS and CSAT Report, the insurance industry has an average NPS of 23, the lowest among all seven industries surveyed.

- Promoters: 46%

- Passives: 31%

- Detractors: 23%

Customer Satisfaction Score (CSAT): 70%

This indicates that while nearly half of customers are loyal advocates, a significant number are either dissatisfied or neutral, putting pressure on insurers to improve service consistency and personalization.

How Does Insurance Stack Up Against Other Industries?

Let’s take a look at where the insurance sector stands compared to others:

| Industry | NPS |

| Hotel & Hospitality | 44 |

| Banking & Credit Unions | 41 |

| Automotive | 41 |

| Big Box Retail | 37 |

| Grocery Retail | 37 |

| Airlines | 33 |

| Insurance | 23 |

This comparison underscores that the insurance sector has room to grow in fostering loyalty and trust, particularly in an environment where digital transformation and customer expectations are evolving rapidly.

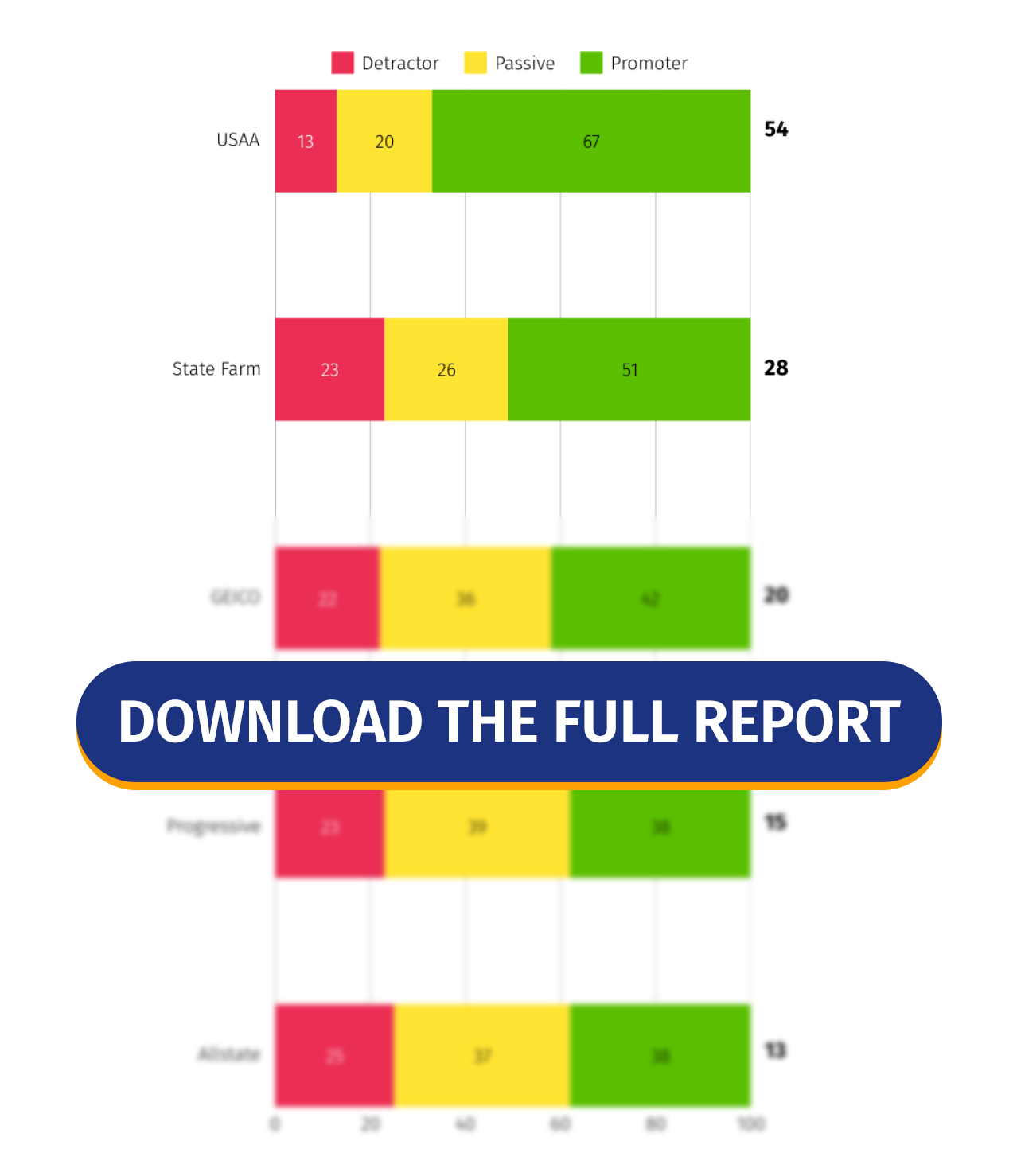

Despite a modest industry average, some insurance providers are outperforming by focusing on customer-centric strategies. Here’s a snapshot of the top five brands:

| Brand | NPS |

| USAA | 54 |

| State Farm | 28 |

| GEICO | 20 |

| Progressive | 15 |

| Allstate | 13 |

- USAA Leads the Pack

With an impressive NPS of 54, USAA stands out as a leader in the insurance industry. Their success is driven by strong trust, a clear customer-first approach, and exceptional service, especially among military families.

- Midfield Players: State Farm and GEICO

State Farm scores a 28 NPS, with a respectable 51% of Promoters. While their numbers reflect decent loyalty, a sizable base of Passives and Detractors remains, indicating inconsistent customer experiences. GEICO, with an NPS of 20, appears to be struggling despite its brand recognition, particularly in terms of emotional connection and service delivery.

- Challenged Brands: Progressive and Allstate

Progressive and Allstate lag with NPS scores of 15 and 13, respectively. Allstate, in particular, has a Detractor rate of 35%, which is a clear red flag. These brands need to focus on recovery strategies, enhancing digital experiences, and delivering empathetic service.

These insights come from QuestionPro’s latest study, which surveyed 1,000 participants to measure NPS across leading companies and industries. The report is based on real customer feedback from Q1 2025 and is updated quarterly.

We invite you to download the full report. It’s a valuable resource for evaluating your company’s performance and determining your customers’ perceptions of you.

What Do These Scores Tell Us?

The data reveals important lessons about what works — and what doesn’t — when it comes to loyalty in insurance:

What’s Working:

- High-Touch Service Builds Loyalty: Brands like USAA win by offering personalized support that builds deep customer trust.

- Clear Communication & Transparency: Customers value brands that make policies, billing, and claims easy to understand.

- Efficient Claims Handling: Fast, fair claims processing often correlates with higher Promoter rates.

Where Challenges Persist:

- Inconsistent Service Experiences: Some brands struggle to deliver a consistent service experience across their agents, apps, and branches.

- Reputation Recovery: Brands with a high number of detractors often carry the baggage of past service issues or negative publicity.

- Tech Integration Without the Human Element: While self-service is critical, it must be balanced with empathetic support when needed.

Discover What Major Brands are Doing to Achieve an Excellent NPS

Click here to access a detailed analysis of how the major Insurance industries included in our study maintain customer satisfaction and how this has impacted their Net Promoter Score.

USAA NPS

With an impressive NPS of 54, USAA leads the pack in customer loyalty. Known for putting members first, USAA has earned deep trust—particularly among military families—through outstanding service, tailored solutions, and a reputation for reliability.

State Farm NPS

State Farm’s NPS of 28 reflects moderate loyalty. While many customers value its wide agent network and accessible services, inconsistent experiences leave a notable share of customers as Passives or Detractors, suggesting room for improvement in overall satisfaction.

GEICO NPS

GEICO, scoring an NPS of 20, lags behind despite strong brand recognition and competitive pricing. The relatively low score points to challenges in building stronger emotional connections and improving service experiences to match its marketing reach.

Allstate NPS

At an NPS of 13, Allstate ranks the lowest among major insurers. Despite its established reputation, the brand faces difficulties in creating positive, lasting impressions, with many customers citing issues in claims handling and service consistency.

Progressive NPS

Progressive posts an NPS of 15, signaling weak customer advocacy. While known for its innovative offerings and competitive rates, the insurer struggles with delivering consistent service experiences that foster long-term loyalty.

How to Measure and Improve Your Insurance NPS

To stay competitive and meet rising customer expectations, insurers must commit to consistent measurement and actionable improvements:

- Set Your Baseline

Use tools like QuestionPro’s NPS survey templates to benchmark performance. Standardize survey timing and formats for accurate tracking and reporting.

- Segment Results

Analyze feedback by policy type (auto, life, health), customer tenure, and channel (agent vs. digital). Each segment may reveal different friction points or moments of delight.

- Track Progress Quarterly

Seasonality, claims volume, and renewal cycles all impact satisfaction. Regular quarterly reviews help spot patterns and measure the effect of service initiatives.

- Close the Feedback Loop

Respond promptly to low scores. Offer recovery calls, personalized follow-ups, or quick fixes to convert detractors into loyalists.

- Use Predictive Insights

Leverage NPS trend data to flag at-risk policyholders and proactively engage them before churn occurs.

With QuestionPro Customer Experience, you can measure your Net Promoter Score in minutes, as well as implement initiatives and systems to maintain constant monitoring that allows you to keep your customers satisfied and stay on par with major leaders in your industry.

Conclusion: The Road Ahead for Insurance Brands

The insurance industry’s average NPS of 23 in 2025 shows there’s plenty of ground to cover when it comes to customer loyalty. But there’s also a clear blueprint for growth.

Brands that focus on empathetic service, seamless digital experiences, and real-time responsiveness can bridge the loyalty gap and outperform the competition. As USAA demonstrates, trust isn’t built on price alone. It’s earned through every interaction that makes customers feel seen, heard, and supported.

To learn how your brand compares and to start your own journey toward loyalty leadership, explore the tools and insights available in QuestionPro Customer Experience.