Understanding what customers really want isn’t always easy. People may say one thing in a survey but act differently when making a purchase. That’s where conjoint analysis comes in. It’s a research method that helps businesses determine which features, prices, or options truly matter to customers when they choose between products or services.

There are different types of conjoint analysis, each designed to answer slightly different questions. Some focus on showing customers complete product profiles, while others let them choose between sets of options, just like they would in a real shopping situation. A few even adapt in real time, making the survey more engaging and accurate.

By using the correct type of conjoint analysis, businesses can test product ideas, predict market share, and develop more effective pricing strategies. In this article, we will explain the types of conjoint analysis, how they work with practical examples, and show how tools like QuestionPro can help you apply them effectively to make smarter business decisions.

What is Conjoint Analysis?

Conjoint analysis is a survey-based statistical analysis technique used in market research to understand consumer preferences. Instead of asking people directly which product features they like, it recreates real-life trade-offs where customers must choose between different product profiles or product configurations.

This method reveals the relative importance of various attributes, such as pricing strategies, brand reputation, or even fuel efficiency, in the purchase process. With the right sample size, a conjoint study can generate valuable insights into what truly drives purchase decisions.

By analyzing the choices of survey respondents, researchers can assign a utility value to each attribute level. These utility values show how much each factor influences respondent preference and the perceived value of a product or service.

Key Types of Conjoint Analysis for Market Research

Conjoint analysis has become one of the most trusted statistical techniques in market research because it helps businesses see which product attributes matter most to their target customers.

Since not all products or purchase processes are the same, researchers can choose from different conjoint methods. Let’s look at the two main types and then review other approaches that are also widely used.

1. Choice-Based Conjoint (CBC) Analysis

Also known as Discrete Choice Conjoint Analysis, CBC is the most widely used and realistic form today. In this method, survey respondents are presented with sets of product profiles, for example, three smartphone options with varying prices, storage sizes, and brand reputations, and asked to pick the one they would most likely purchase.

- Mimics real-world shopping situations.

- Produces accurate market simulations.

- Works well with multiple attributes.

- Estimates choice probability.

How to use CBC: Imagine you want to study the market for a new coffee machine. You create profiles that vary by price, brand reputation, and special features. Respondents are shown 3–4 brand options at a time and asked which one they would buy.

The results show how much each attribute (price, brand, or feature) contributes to the final choice, helping you design the product configuration that maximizes sales.

When to use CBC: Use CBC if you want to predict market share, test pricing strategies, or see how customer preferences shift across different market scenarios.

2. Adaptive Conjoint Analysis (ACA)

Adaptive Conjoint Analysis is designed for studies with a large number of attributes that would overwhelm respondents if shown all at once. The survey adapts in real time, asking more detailed questions about the product characteristics respondents care most about and fewer about those they find less relevant.

This keeps the survey engaging while still delivering accurate conjoint analysis results.

- Adjusts dynamically based on previous responses.

- Works well with complex product concepts.

- Reduces survey fatigue while capturing detailed insights.

How to use ACA: Suppose you’re studying a new car model with dozens of features, including fuel efficiency, safety technology, design style, pricing, and more. Instead of asking respondents to compare every combination, ACA first asks them to rate which features matter most.

If someone values fuel efficiency and safety highly, the survey will show them more trade-off questions focused on those attributes, while asking fewer questions about design or accessories. This way, you still get accurate data without overwhelming them.

When to use ACA: Best for products with many attribute levels or complex configurations, such as automobiles, financial services, or enterprise software bundles.

Other Types of Conjoint Analysis

Beyond CBC and ACA, researchers often use other conjoint analyses to fit different research goals. These approaches are useful when products have many attributes, when customers combine options into bundles, or when businesses want to prioritize which product features matter most.

- Adaptive Choice-Based Conjoint (ACBC): ACBC blends the flexibility of ACA with the realism of CBC. Respondents start by indicating which features are essential or unacceptable, and then they face more detailed choice tasks. It is great for products with multiple attributes and different configurations, such as laptops, where people have clear “must-haves.”

- Menu-Based Conjoint (MBC): Instead of picking one product, respondents build their own by choosing from a menu of items. For example, in a fast-food study, they might select a burger, drink, and side each with different attribute levels. It is best for studying purchase processes where people mix and match, such as telecom plans, software subscriptions, or restaurant meals.

- Traditional Conjoint (Full-Profile): This older method asks respondents to rank or rate full product profiles, each showing all attributes at once. It works well for smaller studies with just a few product attributes or when you need a simple conjoint analysis example to explain the concept.

- MaxDiff (Best-Worst Scaling): Although slightly different from conjoint, MaxDiff is often grouped with these techniques. Respondents are shown a list of features or benefits and asked to choose the most and least important. It is deal for narrowing down customer needs or deciding which features to prioritize before running a more detailed conjoint analysis study.

By selecting the right conjoint techniques, market researchers can design better products or services, run reliable market simulations, and make smarter strategic decisions.

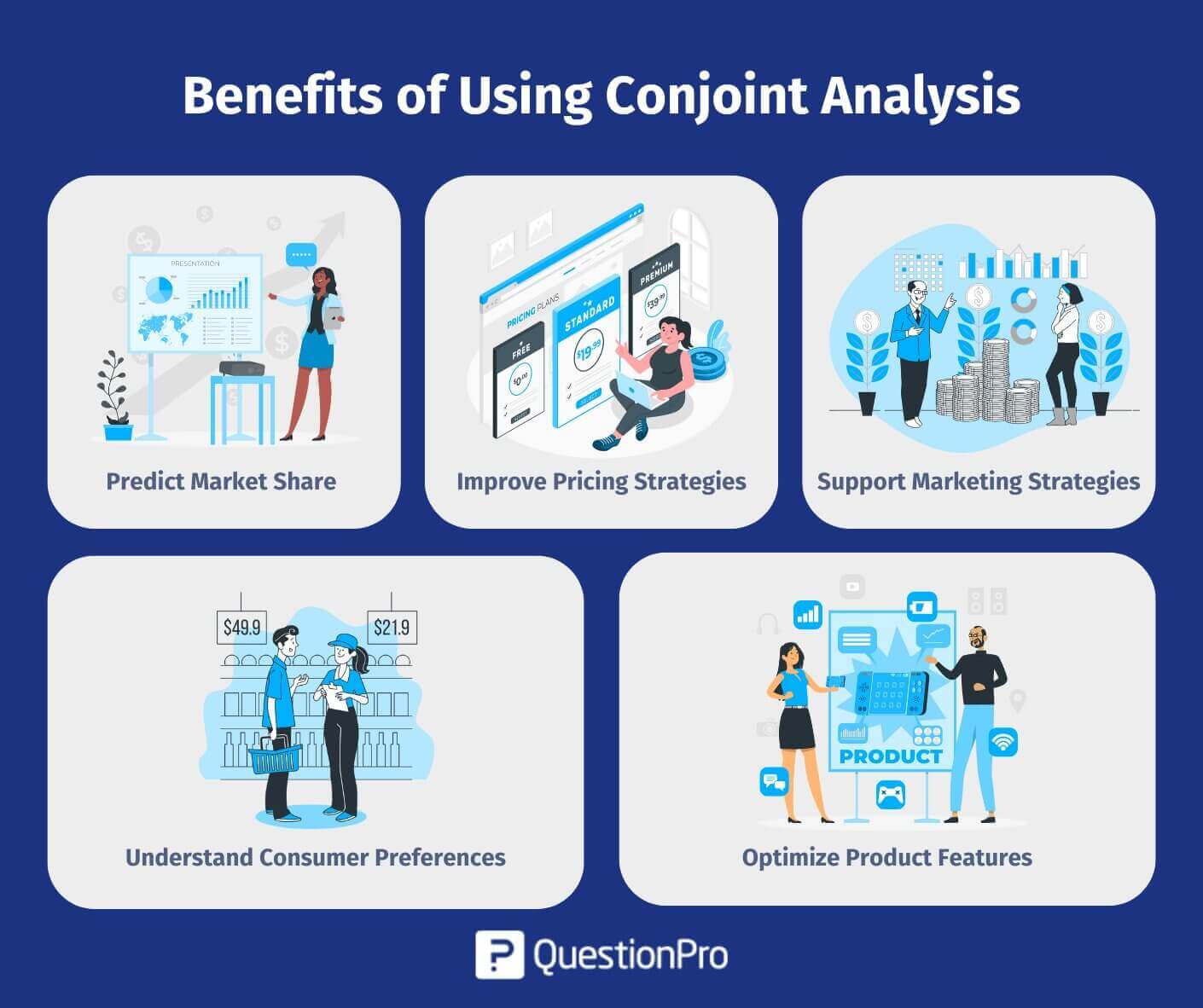

Benefits of Using Conjoint Analysis

Conjoint analysis offers significant advantages for market researchers and businesses seeking a deeper understanding of their target audience. It shows what truly drives purchase decisions and how customers assign perceived value to different product attributes.

- Predict Market Share: By running market simulations, companies can test different market scenarios and estimate how new product concepts will perform. This helps predict market share before launch and lowers risk in strategic decisions.

- Improve Pricing Strategies: Conjoint analysis shows the maximum customers are willing to pay for specific attribute levels. This gives a practical way to design smarter pricing strategies that balance revenue with satisfaction.

- Support Marketing Strategies: Insights from a conjoint study can guide marketing campaigns by pinpointing which features or benefits matter most. This ensures messaging connects directly with customer needs.

- Understand Consumer Preferences: Rather than relying on general survey responses, conjoint analysis reveals how customers actually make choices. It highlights the relative importance of features people care about most, such as price, brand reputation, or unique product characteristics.

- Optimize Product Features: With clear conjoint analysis results, businesses can design product configurations that meet the real customer needs. This helps optimize features to deliver maximum value to the target customers.

Conjoint analysis turns complex choice data into valuable insights that help businesses design stronger products, create better campaigns, and make confident strategic decisions.

How QuestionPro Can Help Conduct Conjoint Analysis?

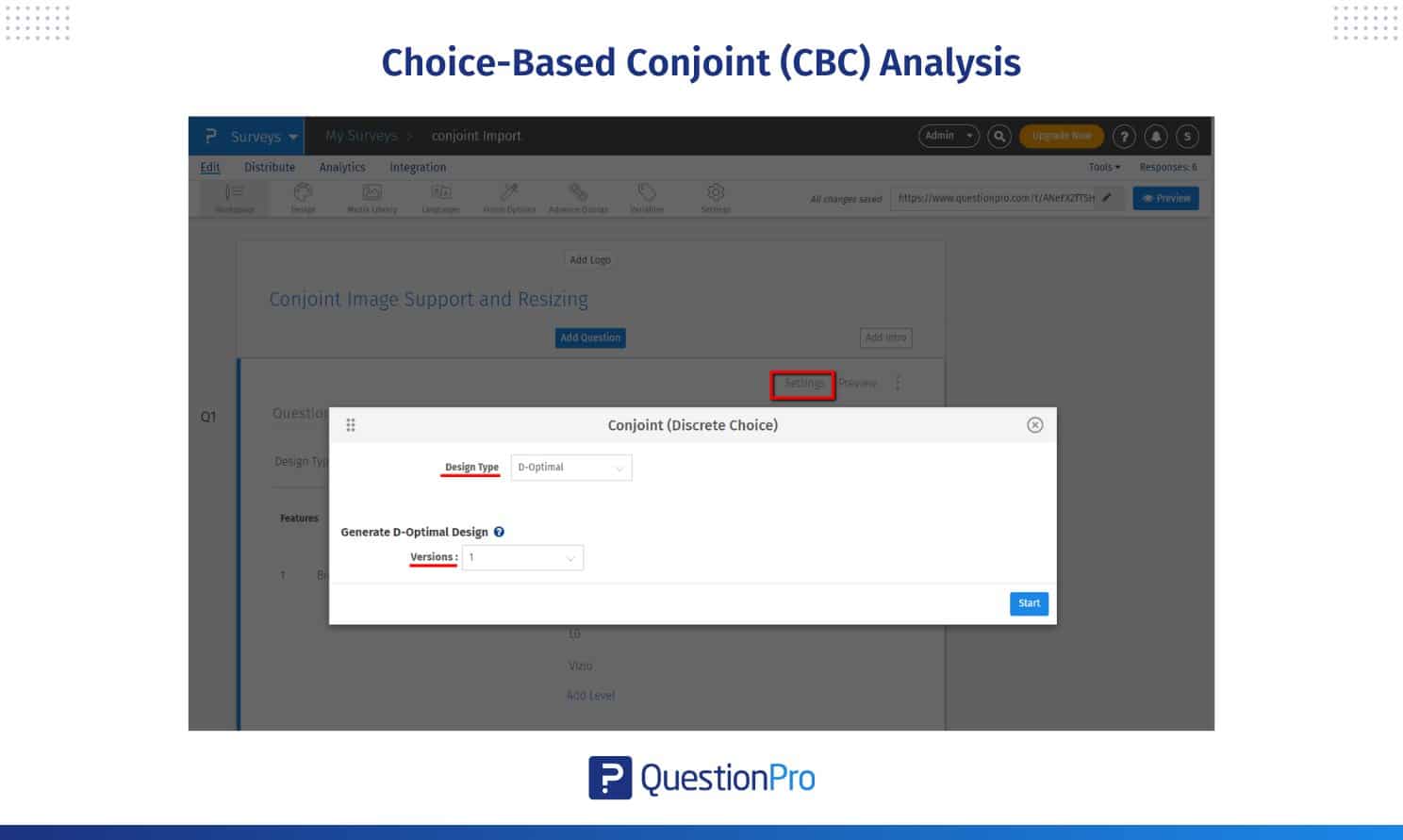

Running a conjoint analysis study can feel complex, but QuestionPro makes the process simple with built-in tools that guide you step by step.

Instead of manually designing product profiles and calculating results, the platform provides an intuitive Conjoint Task Creation Wizard, which allows you to quickly set up features (such as price, size, or brand) and define attribute levels for each.

With flexible design parameters, you can:

- Select the number of tasks and profiles for each task.

- Add advanced settings, such as fixed tasks or prohibited combinations.

- Select from multiple design types such as Random, D-Optimal, or even import your own.

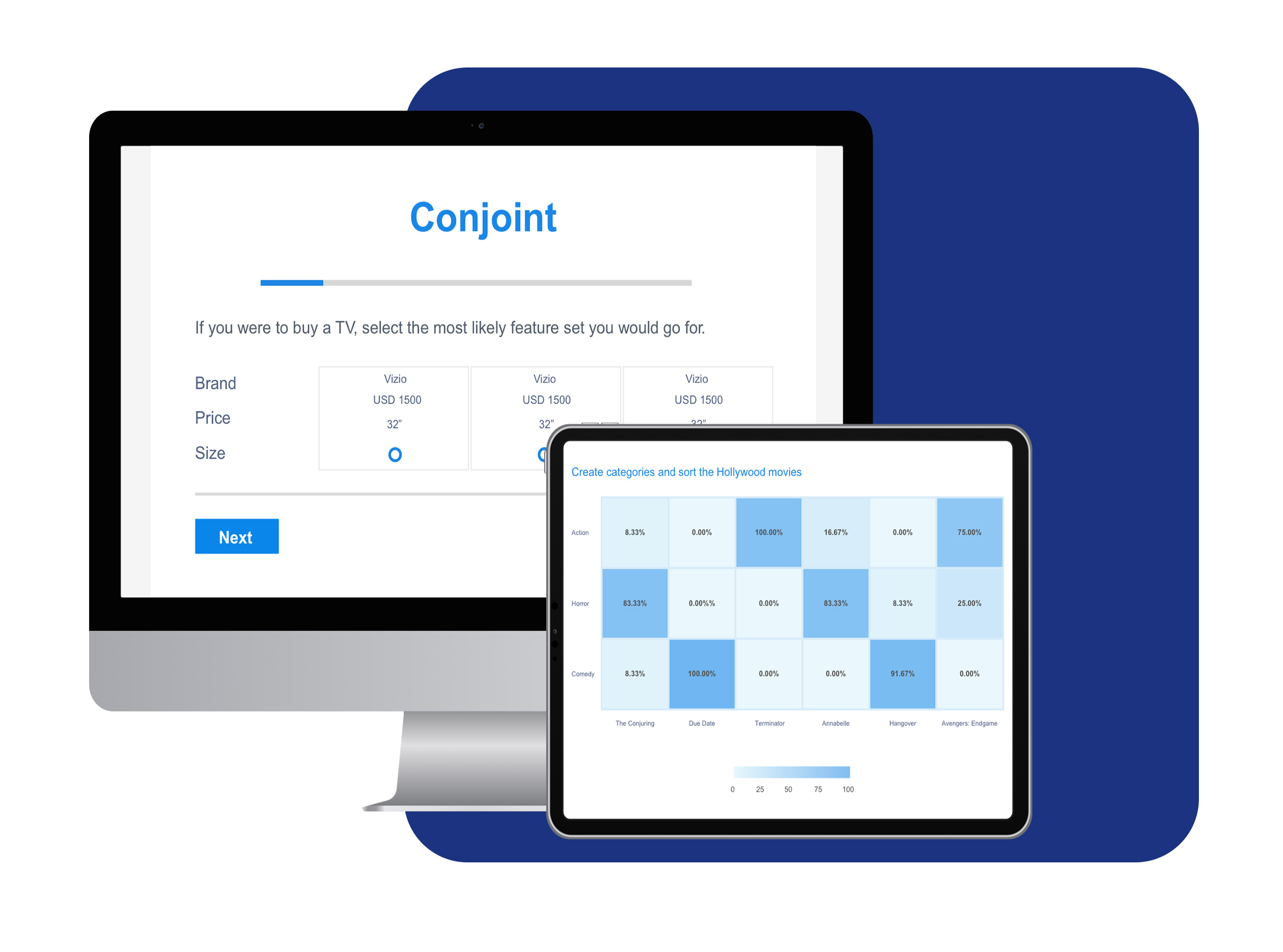

Once your conjoint survey is live and survey respondents have provided answers, QuestionPro’s reporting tools automatically handle the heavy lifting. The system calculates utility values for each attribute, highlights their relative importance, and even supports market simulations to predict how your target audience might respond under different market scenarios.

You can segment the data by customer groups and filter results for specific respondent preferences. For deeper statistical analysis, you can download the reports in multiple formats:

- Excel

- CSV

- HTML

QuestionPro not only makes it easy to create conjoint surveys but also ensures you walk away with valuable insights from understanding consumer preferences to designing pricing strategies and product features that meet real market demand.

Conclusion

Conjoint analysis goes beyond simple surveys by recreating real-world trade-offs to reveal what truly drives purchase decisions. From product design to pricing strategies, it provides a structured way to understand how customers assign perceived value to different product attributes.

In this article, we explored the main types of conjoint analysis, how they work with practical examples, and how platforms like QuestionPro make it easier to design and analyze conjoint studies.

With advanced tools like QuestionPro, researchers can design conjoint surveys, run accurate market simulations, and obtain clear, actionable insights. The future of understanding consumer preferences lies in methods like conjoint analysis, and businesses that embrace it will stay ahead in meeting market demand.

Frequently Asked Questions (FAQs)

Answer: Because it recreates real-life trade-offs, conjoint analysis shows how customers actually make choices, rather than just what they say they prefer.

Answer: By analyzing the choices of survey respondents, researchers can calculate utility values that show the importance of each attribute.

Answer: It mimics real shopping behavior by asking people to choose between product options, making it a strong predictor of market share.

Answer: Yes, it reveals the maximum price customers are willing to pay for specific features, enabling businesses to design more effective pricing strategies.

Answer: It’s ideal for situations where customers build their own product bundles, like telecom plans, meal combos, or subscription packages.

Answer: It offers a Conjoint Task Creation Wizard, flexible design options, automatic utility calculation, and reporting tools that make analysis fast and actionable.