Imagine filing an insurance claim after a stressful event, a car accident, a home emergency, or a health scare. Instead of endless paperwork and frustrating calls, you’re met with a swift, empathetic response. Your agent guides you through the process, and soon enough, you think, “This company actually cares. I need to tell others about the insurance company.”

That’s the power of a strong Net Promoter Score (NPS). For insurers like USAA, NPS measures how likely customers are to recommend their services, reflecting trust, satisfaction, and loyalty.

In this article, we’ll break down USAA NPS, why it’s a benchmark for customer loyalty in insurance, and how the company turns policyholders into passionate advocates.

What is NPS?

The Net Promoter Score (NPS) is a simple way to measure customer satisfaction and whether they would recommend your company to others.

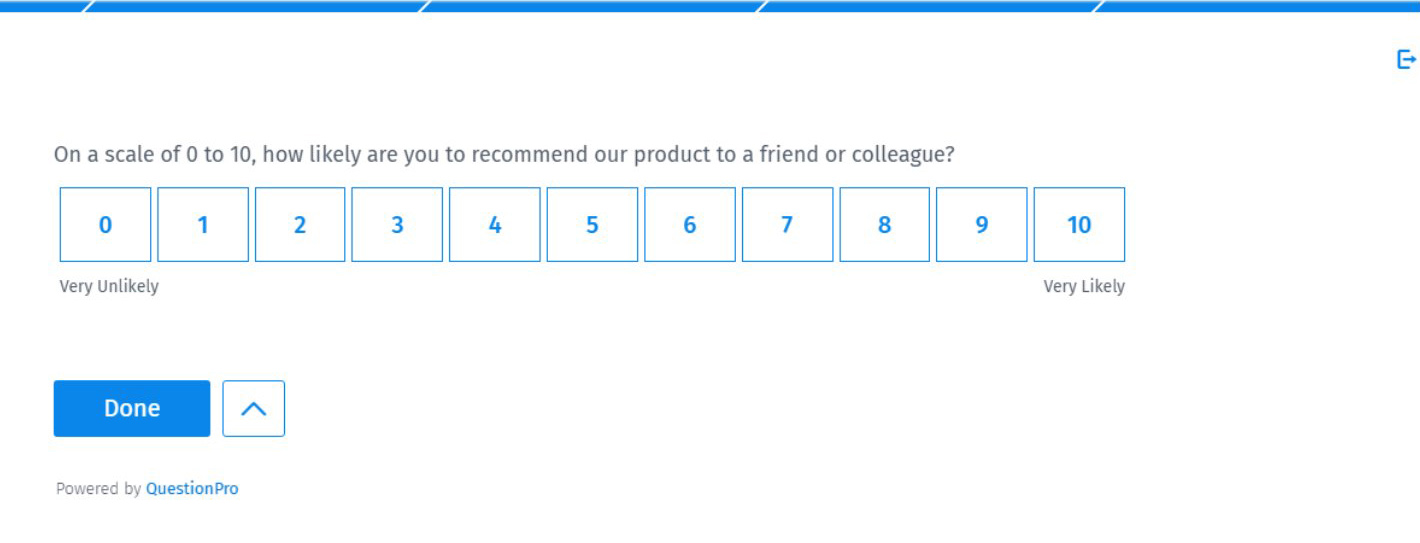

The NPS process is based on a question that may seem simple, but when combined with an analysis of the results, it helps to have a clear picture of customer satisfaction levels. It’s all based on a single question:

“On a scale of 0–10, how likely are you to recommend [COMPANY] to a friend or colleague?”

Responses categorize customers into three groups:

- Promoters (9–10): Loyal advocates who enthusiastically recommend USAA.

- Passives (7–8): Satisfied but indifferent, unlikely to promote the brand.

- Detractors (0–6): Unhappy customers who may share negative feedback.

You can calculate Net Promoter Score using the formula:

NPS = % of Promoters – % of Detractors

For insurers like USAA, NPS highlights how well they deliver peace of mind, transparency, and support during critical moments.

USAA NPS Score Performance and Breakdown

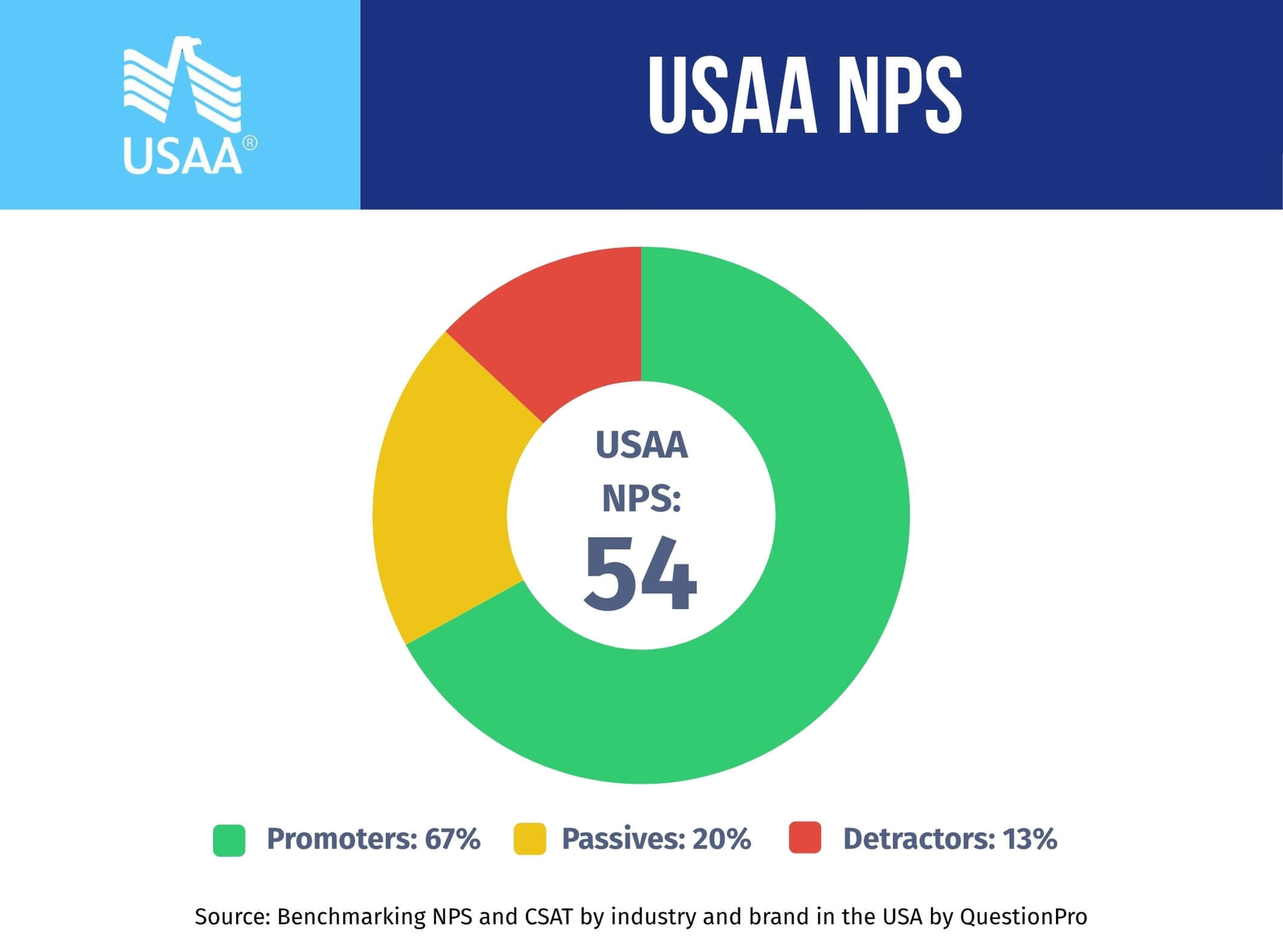

According to QuestionPro’s Q1 2025 Benchmarking NPS and CSAT Report, USAA’s NPS is 54, far exceeding the insurance industry average.

Breakdown of USAA NPS:

- Promoters: 67%

- Passives: 20%

- Detractors: 13%

The company presents exceptional customer loyalty, with nearly 70% of customers eager to recommend USAA and minimal detractors. This reflects its ability to turn complex insurance processes into seamless, stress-free experiences.

How Does USAA Compare to Industry Benchmarks?

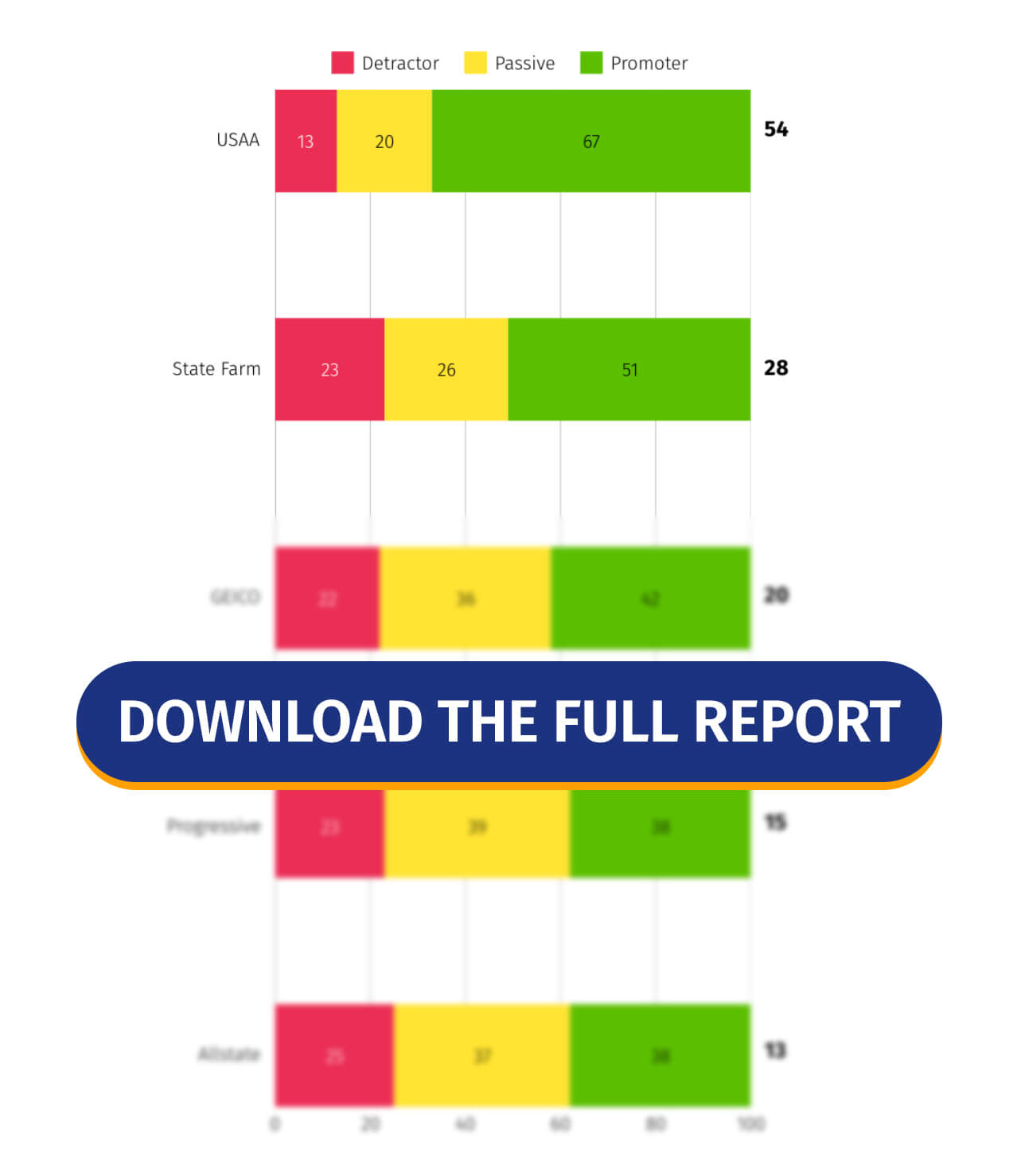

While many insurance companies struggle with low customer trust and satisfaction, USAA NPS score of 54 sets it apart.

Here’s how they earn customer loyalty:

- Trusted Guidance: Agents prioritize education, helping customers choose tailored policies.

- Rapid Claims Resolution: Streamlined processes and empathetic support during emergencies.

- Transparency: No hidden fees or confusing terminology, just clear terms and pricing.

- Community Focus: Strong support for military families and veterans, deepening emotional connections.

These strengths help USAA build loyalty in an industry where trust is hardly earned.

These insights come from QuestionPro’s latest study, which surveyed 1,000 participants to measure NPS across leading companies and industries. The report is based on real customer feedback from Q1 2025 and is updated quarterly.

We invite you to download the full report. It’s a valuable resource for evaluating your company’s performance and determining your customers’ perceptions of you.

What’s Driving USAA’s High NPS And CSAT?

USAA’s loyalty isn’t accidental; it’s built on pillars that resonate with policyholders:

- Human-Centered Service: USAA agents prioritize personalized care over scripted responses, tailoring support to meet individual needs. They proactively adjust coverage during life changes, such as marriages, moves, or milestones, ensuring policies grow with customers.

- Speed and Reliability: Claims are resolved quickly with 24/7 support, minimizing stress during crises. The intuitive app lets users manage policies, track claims, and get instant updates without delays or confusion.

- Ethical Practices: There are no hidden fees or fine-print traps. USAA advocates for policyholders in disputes, offering transparent pricing and terms that build trust, not skepticism.

By blending empathy, speed, and integrity, USAA transforms policies into partnerships built on trust.

How to Measure and Enhance Your NPS?

Want to know how to measure and improve your Net Promoter Score (NPS) like USAA? With QuestionPro, the process is simple and built to move real results. Here’s how to get started:

1. Launch an NPS Survey

Use the QuestionPro NPS survey template, which includes the following key questions:

Add the AskWhy feature to uncover insights behind scores.

Reach customers wherever they are via email, SMS, QR codes, or a direct link. Want to target a specific audience? Use QuestionPro Audience to find respondents based on demographics, travel habits, or location.

3. Track Responses in Real Time

Your NPS is automatically calculated as results come in. A clean, visual dashboard lets you see who your Promoters, Passives, and Detractors are. There is no guesswork, just real, actionable feedback.

4. Turn Feedback Into Action

Use what your customers tell you to improve the experience where it matters most. QuestionPro’s benchmarking tools also help you compare your NPS with others in your industry to understand how you stack up.

With QuestionPro, you’re not just measuring scores. You’re building stronger relationships, improving service, and making every customer experience better than the last.

Stay Informed with the Latest NPS Trends

Want to know how leading Insurance companies earn loyalty and high NPS? Get the Q1 2025 NPS Benchmark Report to see how leading companies drive customer satisfaction and find strategies to keep their customers returning.

Want to increase your NPS? Contact the experts at QuestionPro for proper advice on measuring and improving customer satisfaction.