The grocery industry has seen some big changes in recent years. From shifting consumer habits to the rise of online shopping, grocery stores are constantly looking for ways to stay competitive and build lasting customer loyalty. One of the best ways to do that? Measuring customer satisfaction with Net Promoter Score (NPS).

NPS is a simple, effective tool that helps businesses gauge how likely customers are to recommend their brand to others. In the grocery industry, this metric can provide valuable insights into how well brands are doing and where they need to improve.

In this post, we’ll dive into the NPS benchmarks for the grocery industry in 2025, look at how the top brands are performing, and share some strategies for boosting your own NPS score.

What is NPS, and How Is It Calculated?

Net Promoter Score (NPS) is a customer loyalty metric that helps businesses understand how their customers feel about them. It’s based on one simple question:

“How likely are you to recommend [Brand X] to a friend or colleague?”

Customers answer on a scale from 0 to 10. Based on their scores, they fall into one of three categories:

- Promoters (9-10): These are your loyal fans who are excited to recommend your brand.

- Passives (7-8): These customers are satisfied but not overly enthusiastic.

- Detractors (0-6): These are the unhappy customers who might even tell others to stay away.

To calculate your NPS, subtract the percentage of Detractors from the percentage of Promoters:

NPS = % of Promoters – % of Detractors

The result is a score that ranges from -100 to +100. A higher score means more loyal customers and a better overall experience.

You can use our NPS calculator to calculate your company’s NPS automatically.

What’s a Good NPS Score for the Grocery Industry?

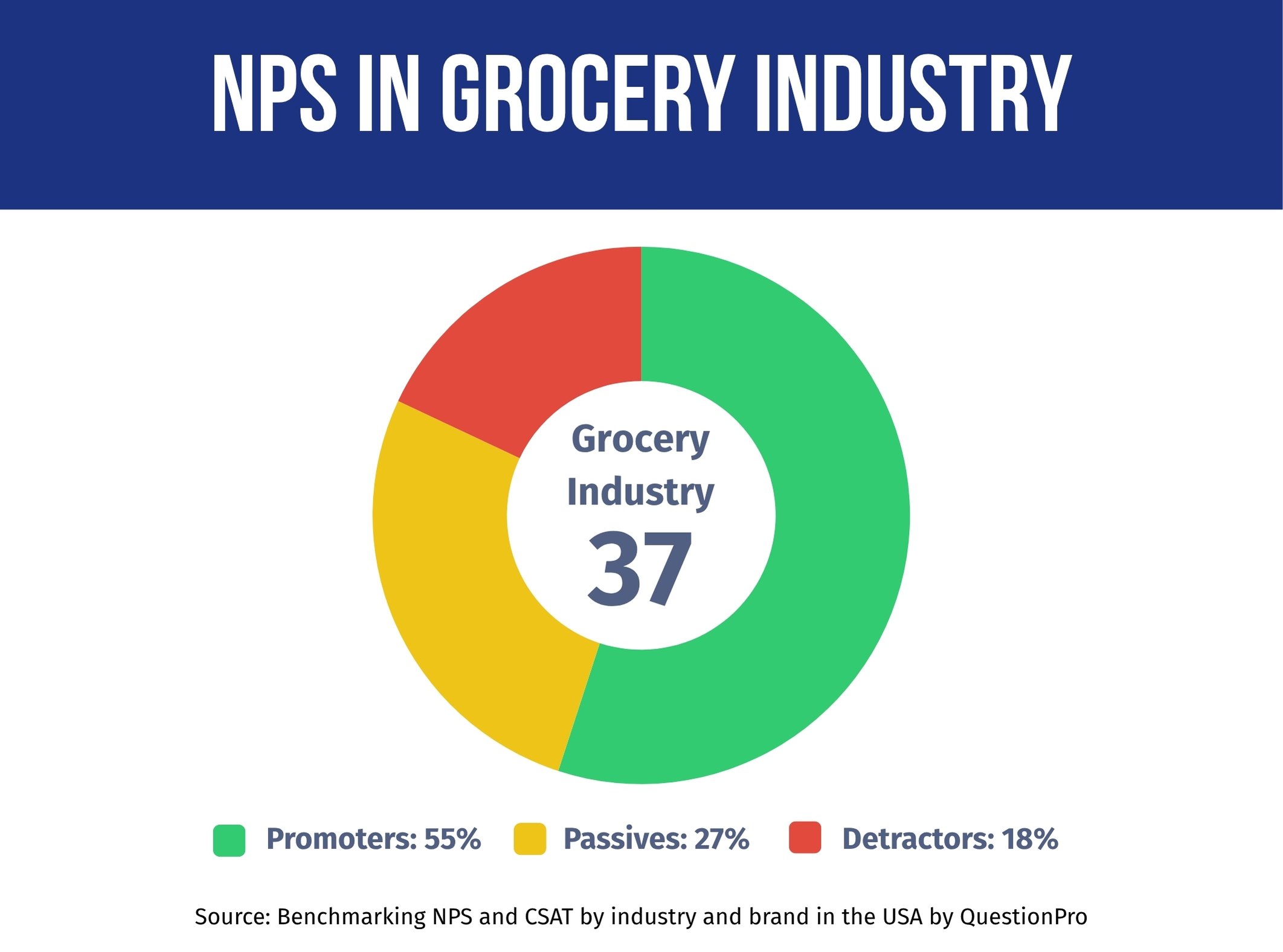

Based on the latest data from QuestionPro’s Q1 2025 Benchmarking NPS and CSAT Report, the grocery industry has an average NPS of 37. This places it in the “good performance” range, indicating solid customer satisfaction but also significant room for improvement.

Here’s how the grocery industry compares to other sectors:

- Hotel & Hospitality: 44 NPS

- Banking & Credit Unions: 41 NPS

- Automotive: 41 NPS

- Big Box Retail: 37 NPS

- Grocery Retail: 37 NPS

- Airlines: 33 NPS

- Insurance: 23 NPS

The grocery industry is performing well, but there’s a clear opportunity for brands to strengthen customer loyalty and move toward excellence.

NPS Benchmarks for the Grocery Industry in 2025

NPS in the grocery industry is 37. This score reflects a decent level of customer satisfaction, but it also highlights ample room for improvement, especially when compared to other industries like hospitality or banking.

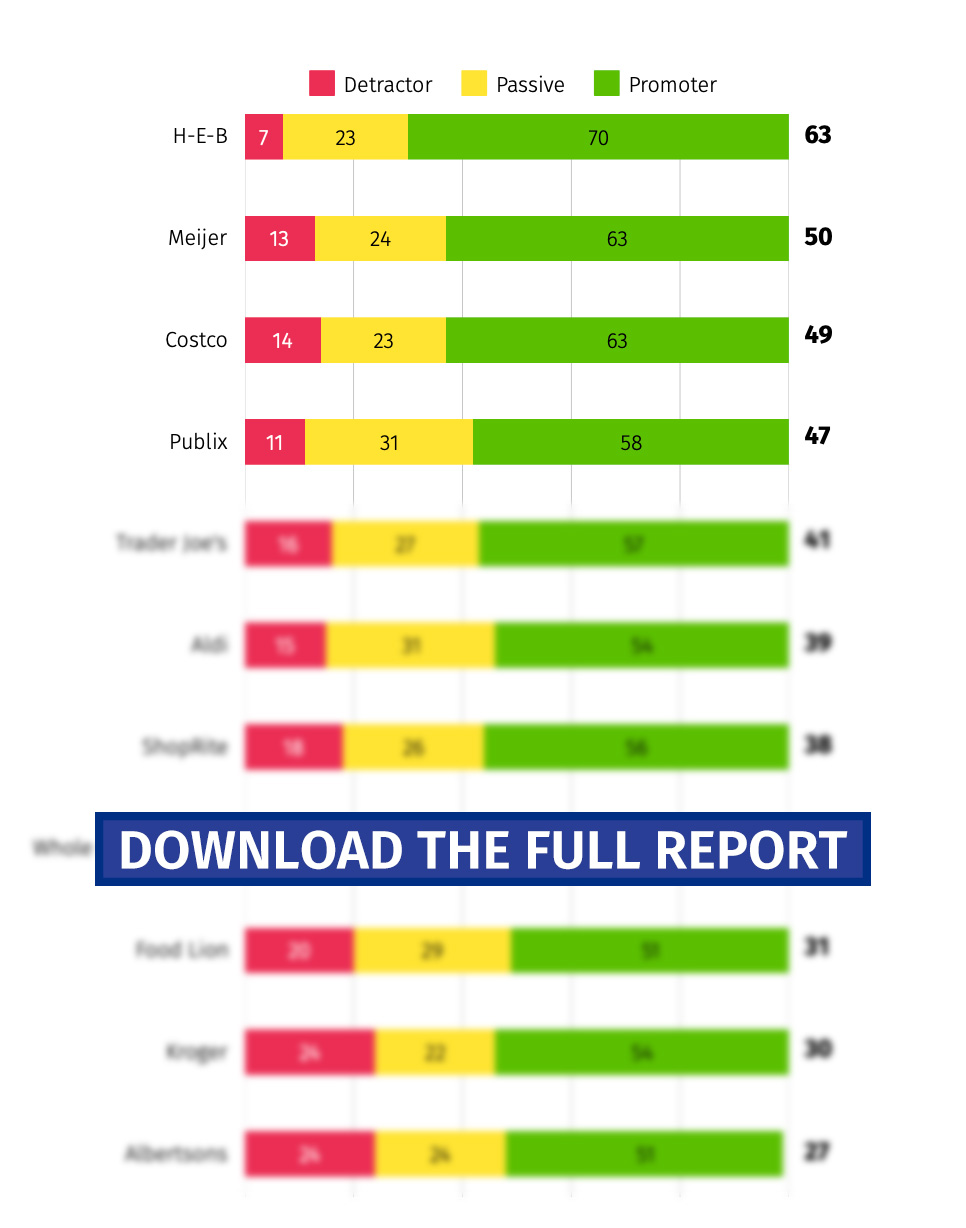

Here’s a glimpse of how some of the major grocery brands are performing:

| Brand | NPS |

| H-E-B | 63 |

| Meijer | 50 |

| Costco | 49 |

| Publix | 47 |

| Trader Joe’s | 41 |

| Aldi | 39 |

| Shoprite Supermarkets | 38 |

| Whole Foods Market | 35 |

| Food Lion | 31 |

| Kroger | 30 |

| Albertsons Companies | 27 |

| Safeway | 17 |

As you can see, H-E-B leads the pack with an impressive 63 NPS, followed by Meijer (50) and Costco (49).

On the other hand, brands like Kroger (30), Albertsons (27), and Safeway (17) fall behind, showing that there’s plenty of room for improvement in terms of customer loyalty.

It shows that most grocery brands are doing a decent job, but there’s still room to improve. When compared to other sectors, the grocery industry ranks fairly well; however, the gap between top and bottom performers highlights areas where grocery brands can improve.

These insights come from QuestionPro’s latest study, which surveyed 1,000 participants to measure NPS across leading companies and industries. The report is based on real customer feedback from Q1 2025 and is updated quarterly.

We invite you to download the full report. It’s a valuable resource for evaluating your company’s performance and determining your customers’ perceptions of you.

Discover What Major Brands are Doing to Achieve an Excellent NPS

Click here to access a detailed analysis of how the major grocery brands included in our study maintain customer satisfaction and how this has impacted their Net Promoter Score.

H-E-B NPS

With a standout NPS of 63, H-E-B leads the way in grocery retail. Their customer loyalty can be attributed to exceptional service, a strong community presence, and a focus on local produce. Customers feel valued and well taken care of, which results in their enthusiastic support and advocacy.

Meijer NPS

Meijer, with an NPS of 50, performs well by offering a strong product selection, competitive prices, and convenience. Their blend of traditional retail with modern, customer-first innovations helps build trust and satisfaction.

Costco NPS

Known for its value proposition and wholesale model, Costco scores highly with a 49 NPS. Their membership-driven model creates a sense of exclusivity and loyalty. Members appreciate the quality of the products and the competitive pricing, resulting in higher satisfaction levels and advocacy.

Publix NPS

Publix continues to shine with a score of 47. With their focus on excellent customer service and a friendly in-store environment, they create an emotional connection with shoppers. Their “where shopping is a pleasure” slogan truly reflects the experience customers have, fostering brand loyalty.

Trader Joe’s NPS

Trader Joe’s sits in the middle with a 41 NPS, thanks to its quirky product selection, affordable prices, and distinctive brand personality. Customers love the unique offerings and the in-store experience, though they may face some challenges in locations where the product range is more limited.

Aldi NPS

Aldi’s NPS of 39 highlights its appeal in providing no-frills, budget-friendly shopping. Although they may not have the extensive service or variety that some other brands offer, customers appreciate the simplicity and value.

Shoprite Supermarkets NPS

ShopRite lands just above the average with a 38 NPS. Its community-based ownership structure and competitive pricing help maintain customer loyalty in certain regions. However, inconsistency across stores and a more traditional retail experience may hold it back from achieving higher scores.

Whole Foods Market NPS

Whole Foods’ score of 35 places it slightly below the industry average. While the brand is known for premium products and a strong organic selection, some customers are put off by higher prices and a perceived lack of value. The acquisition by Amazon has brought digital innovation and delivery options, but the in-store experience has seen mixed reviews, particularly around service and product availability.

Food Lion NPS

Food Lion’s NPS of 31 is just a notch above Kroger, but still signals struggles with customer satisfaction. While some stores are praised for low prices and convenience, others report outdated environments and inconsistent service, creating a lack of brand cohesion that affects overall loyalty.

Kroger NPS

With an NPS of 30, Kroger finds itself at the lower end of the spectrum. While Kroger has strong brand recognition and an expansive footprint, it faces challenges in areas like customer service consistency and pricing.

Albertsons Companies NPS

Albertsons ranks near the bottom with an NPS of 27. Despite being one of the largest grocery chains in the U.S., it has yet to find a clear differentiator. Challenges in pricing transparency, customer engagement, and service speed contribute to the lower score.

Safeway NPS

Safeway’s NPS of 17 reflects a significant challenge in customer loyalty. Issues such as pricing concerns, inconsistent quality, and customer service could be contributing to lower satisfaction levels and a higher number of detractors.

How to Start Measuring and Improving Your NPS

To enhance customer loyalty and boost NPS, grocery brands should implement the following strategies:

- Set Baseline Metrics: Conduct regular NPS surveys to track your current performance and compare it to industry benchmarks.

- Segment Your Insights: Break down your NPS data by customer groups, product categories, and shopping touchpoints. Identify areas of excellence and opportunities for improvement.

- Track Progress Regularly: Conduct quarterly NPS tracking to monitor trends and evaluate the effectiveness of customer experience initiatives.

Tools like QuestionPro Customer Experience can make this process seamless by providing real-time insights and helping you close the feedback loop with your customers.

With QuestionPro Customer Experience, you can measure your Net Promoter Score in minutes, as well as implement initiatives and systems to maintain constant monitoring that allows you to keep your customers satisfied and stay on par with major leaders in your industry.

Conclusion

The grocery industry’s average NPS of 37 in 2025 shows that brands are doing a good job, but there’s still plenty of opportunity to grow. Leading brands like H-E-B, Meijer, and Costco demonstrate the power of personalized service, seamless shopping experiences, and competitive pricing in driving customer loyalty.

For grocery stores that are lagging behind, focusing on customer service, improving product offerings, and delivering a consistent experience across all touchpoints will be key to improving their NPS and fostering long-term customer loyalty.