Imagine filing an insurance claim after a stressful event and being put on hold for ages, given vague answers, and a process that leaves you more confused than comforted. You think, “Why is this so hard?”

This is where the Net Promoter Score (NPS) comes in. In insurance, NPS measures how well companies deliver peace of mind during life’s most challenging moments. Some insurers turn customers into advocates, while others can’t bridge the gap between satisfaction and loyalty.

In this article, we’ll explain how Progressive NPS highlights customer loyalty challenges in insurance, analyze why a company fails, and identify strategies for turning indifferent customers into passionate promoters.

What is NPS?

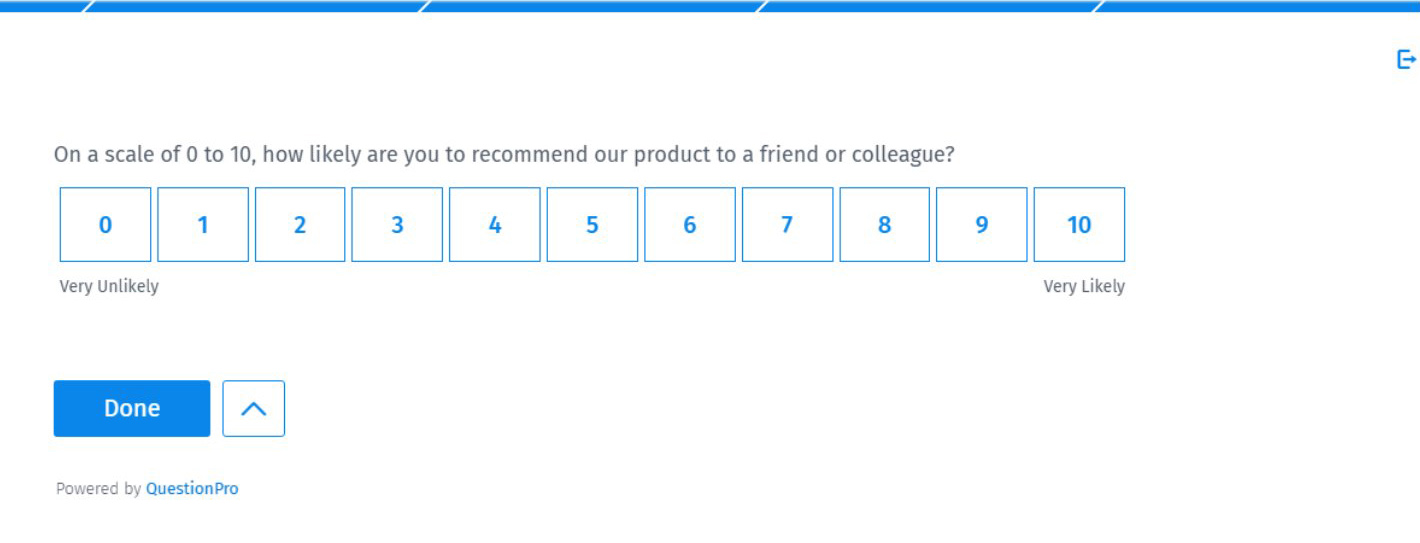

The Net Promoter Score (NPS) is a widely used metric for customer loyalty. It starts with a single question:

“On a scale of 0–10, how likely are you to recommend our products or services to a friend or colleague?”

Responses classify customers into three groups:

- Promoters (9–10): Loyal advocates who enthusiastically refer others.

- Passives (7–8): Satisfied but unenthusiastic; unlikely to promote the brand.

- Detractors (0–6): Unhappy customers who may share negative experiences.

You can calculate NPS by subtracting the percentage of Detractors from the percentage of Promoters:

NPS = % of Promoters – % of Detractors

NPS is calculated by subtracting the percentage of detractors from the percentage of promoters. A high score signals strong customer trust and satisfaction, while a low score reveals unmet needs or service gaps.

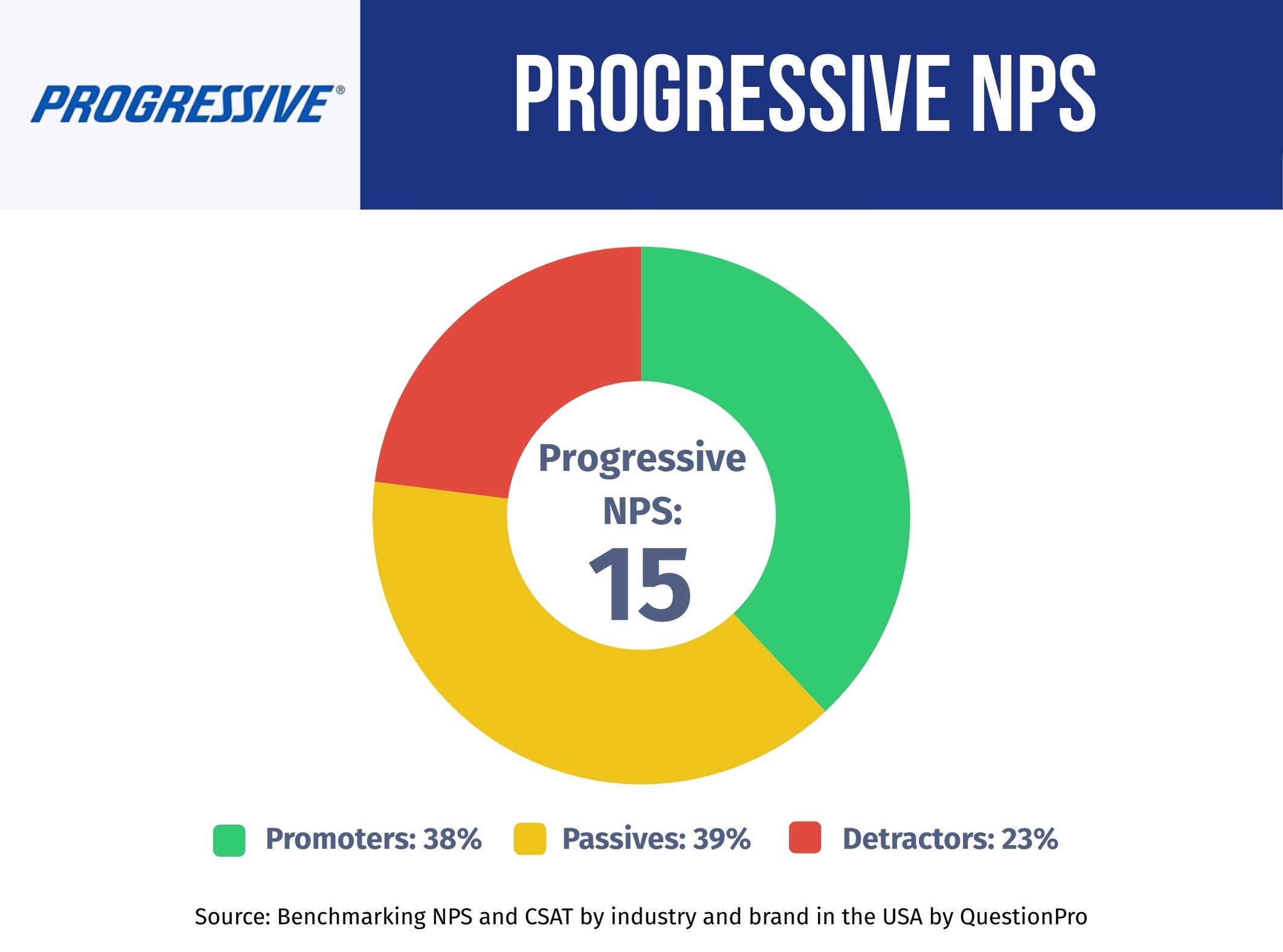

Progressive NPS Performance and Breakdown

According to QuestionPro’s Q1 2025 Benchmarking NPS and CSAT Report, Progressive’s NPS of 15 lags behind key competitors.

Here’s the breakdown:

- Promoters: 38%

- Passives: 39%

- Detractors: 23%

Only 38% of customers act as enthusiastic promoters, significantly below industry leaders, and the company faces a loyalty gap driven by low advocacy. A sizable 39% remain passively satisfied, representing untapped potential for conversion through proactive engagement.

How Does Progressive NPS Score Compare to Industry Benchmarks?

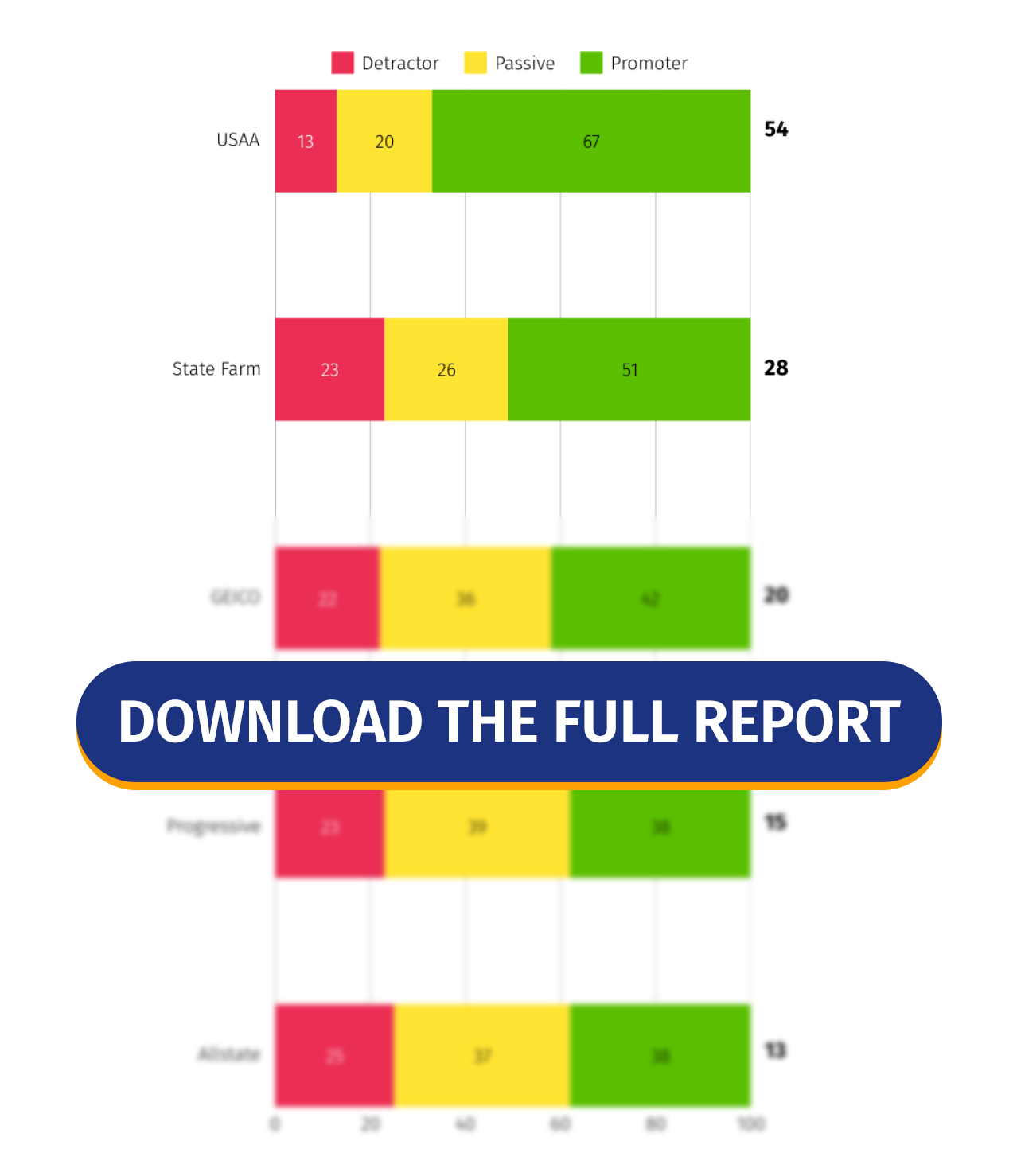

While competitors excel in turning policyholders into advocates, the company’s NPS score reveals gaps in loyalty-building strategies, compared to the insurance industry average of 23.

Why Progressive Falls Short:

- Impersonal Digital Focus: While digital innovation attracts tech-savvy users, a lack of human touch leaves customers undervalued during complex claims.

- Mixed Claims Experiences: Some customers report delays or opacity in claims resolution.

- Passive Indifference: High passives (39%) suggest policies meet basic needs but fail to inspire emotional loyalty, unlike USAA’s community-driven ethos or State Farm’s agent relationships.

These insights come from QuestionPro’s latest study, which surveyed 1,000 participants to measure NPS across leading companies and industries. The report is based on real customer feedback from Q1 2025 and is updated quarterly.

We invite you to download the full report. It’s a valuable resource for evaluating your company’s performance and determining your customers’ perceptions of you.

What’s Holding Back Progressive’s Customer Loyalty?

Progressive’s struggle to inspire customer advocacy stems from some core challenges. While competitors build loyalty through personalized care and emotional connections, the company’s focus on transactional efficiency often leaves policyholders feeling like numbers, not partners.

- Transactional Relationships: Progressive’s emphasis on price competitiveness often overshadows relationship-building. Customers see policies as commodities, not partnerships.

- Inconsistent Communication: Detractors cite gaps in post-purchase engagement (e.g., no proactive policy reviews or risk updates).

- Perceived Value Gaps: Bundling options and discounts exist, but unclear communication leaves customers unaware of long-term benefits.

Progressive must rethink how it communicates value and nurtures relationships to close this gap. Shifting from price-driven transactions to proactive, human-centered engagement can transform indifferent customers into loyal advocates.

How Can Progressive Improve Its NPS?

To close the loyalty gap, Progressive can learn from high performers:

- Humanize Digital Tools: Pair online convenience with accessible agent support for complex claims or policy questions.

- Streamline Claims Resolution: Invest in AI-driven updates and 24/7 assistance to reduce friction.

- Engage Passives: Launch loyalty rewards or personalized check-ins to convert indifferent customers into promoters.

- Build Community Trust: Sponsor local safety initiatives or driver education programs to foster emotional connections.

By balancing digital innovation with empathetic service and community-driven initiatives, Progressive can shift from transactional efficiency to trust-driven loyalty.

How to Measure and Enhance Your NPS?

Want to measure and boost your Net Promoter Score? With QuestionPro, the process is straightforward and designed to drive real outcomes. Here’s how to begin:

1. Launch an NPS Survey

Use QuestionPro’s ready-made NPS survey template, which includes the essential questions:

Add the AskWhy feature to uncover insights behind scores.

2. Distribute Your Survey Everywhere

Share your survey via email, SMS, QR codes, or direct links to reach customers on their preferred channels. Need a targeted audience? Use QuestionPro Audience to recruit respondents based on demographics, location, or behavioral traits.

3. Monitor Feedback

Watch your NPS auto-calculate as responses roll in. A clear, visual dashboard categorizes customers into Promoters, Passives, and Detractors; no manual analysis is required.

4. Act on Insights

Leverage customer feedback to refine experiences in critical areas. QuestionPro’s benchmarking tools also let you measure your NPS against industry standards, so you know exactly where you stand.

With QuestionPro, you’re not just tracking numbers. You’re fostering loyalty, enhancing service, and ensuring every customer interaction outperforms the last.

Stay Informed with the Latest NPS Trends

Want to know how leading Insurance companies earn loyalty and high NPS? Get the Q1 2025 NPS Benchmark Report to see how leading companies drive customer satisfaction and find strategies to keep their customers returning.

Want to increase your NPS? Contact the experts at QuestionPro for proper advice on measuring and improving customer satisfaction.