Real-time survey data allows organizations to see customer and employee feedback the moment it is shared. Instead of waiting for surveys to close and reports to be compiled, insights surface instantly while experiences are still happening.

For US businesses operating in fast-moving, competitive markets, real-time survey data helps them respond earlier, reduce risk, and make decisions based on what people are experiencing right now, not weeks ago.

This article explains what real-time survey data is, how it works, and how it supports smarter customer experience decisions when used with discipline and context.

What is real-time survey data?

Real-time survey data refers to survey responses that are captured, processed, and made visible immediately after submission. As soon as someone completes a survey, the data appears in dashboards, reports, or alerts without delay.

Key characteristics include:

- Continuous updates as new responses arrive

- Immediate visibility into metrics and comments

- Live filtering and segmentation

- Automated alerts based on predefined conditions

Real-time survey data often appears through tools such as live polls and rating polls, where poll results update instantly as responses come in. This allows businesses to see trends forming in real time instead of waiting for surveys to close.

Real-time does not mean final or statistically complete. It means available instantly, allowing businesses to monitor experience signals while journeys are still active.

How does real-time feedback collection work?

Real-time feedback collection is event-driven, not schedule-based. Instead of sending surveys on fixed dates, surveys are triggered by specific customer actions, which keeps feedback closely tied to the actual experience.

In many real-time setups, businesses use polls to capture instant feedback during or immediately after an interaction. Whether it’s a quick multiple-choice poll or a short ranking poll, the goal is to collect fast signals that reflect the experience while it is still fresh.

Step-by-step flow of real-time feedback collection

A typical real-time setup follows a clear sequence:

- A customer completes a key action

This could be a purchase, delivery, support interaction, onboarding step, or appointment.

- A short survey is triggered immediately

The survey is delivered through email, SMS, in-app messaging, or an on-site prompt while the experience is still fresh.

- The response is submitted and processed instantly

As soon as the survey is completed, the data enters the system without waiting for fieldwork to close.

- Metrics and comments update in live dashboards

Scores, trends, and open-ended feedback refresh automatically, giving businesses immediate visibility. When displaying poll results in real time, businesses often rely on simple visual formats such as:- Live charts showing response distribution

- Word cloud views to summarize open-ended feedback

- Tables that update automatically as new responses arrive

Modern survey platforms automate the technical work required to make real-time feedback usable:

- Identity matching links responses to the correct customer or interaction

- Timestamps preserve the exact moment feedback was given

- Data validation filters incomplete or low-quality responses

This ensures real-time feedback collection produces reliable insights, not just fast data.

How real-time feedback analysis differs from traditional analysis

Traditional analysis begins after data collection ends. Real-time feedback analysis happens while responses are still coming in.

The difference goes beyond speed:

- Traditional analysis explains what already happened

- Real-time analysis helps influence what happens next

Businesses prioritize directional signals, consistency across segments, and repeated themes in comments rather than waiting for perfect statistical confidence.

When handled carefully, real-time feedback collection becomes a powerful decision tool rather than a source of false alarms.

Why is real-time survey data valuable for US businesses?

In the USA, customer expectations around speed and responsiveness are high. People expect brands to notice problems quickly and fix them before frustration escalates.

Real-time survey data is valuable because it:

- Shortens the gap between experience and action

- Helps businesses detect issues before they affect large customer segments

- Supports rapid adjustment during product launches or campaigns

- Improves coordination across distributed teams and time zones

For businesses operating nationally, live visibility helps identify whether an issue is isolated to one region or spreading across markets.

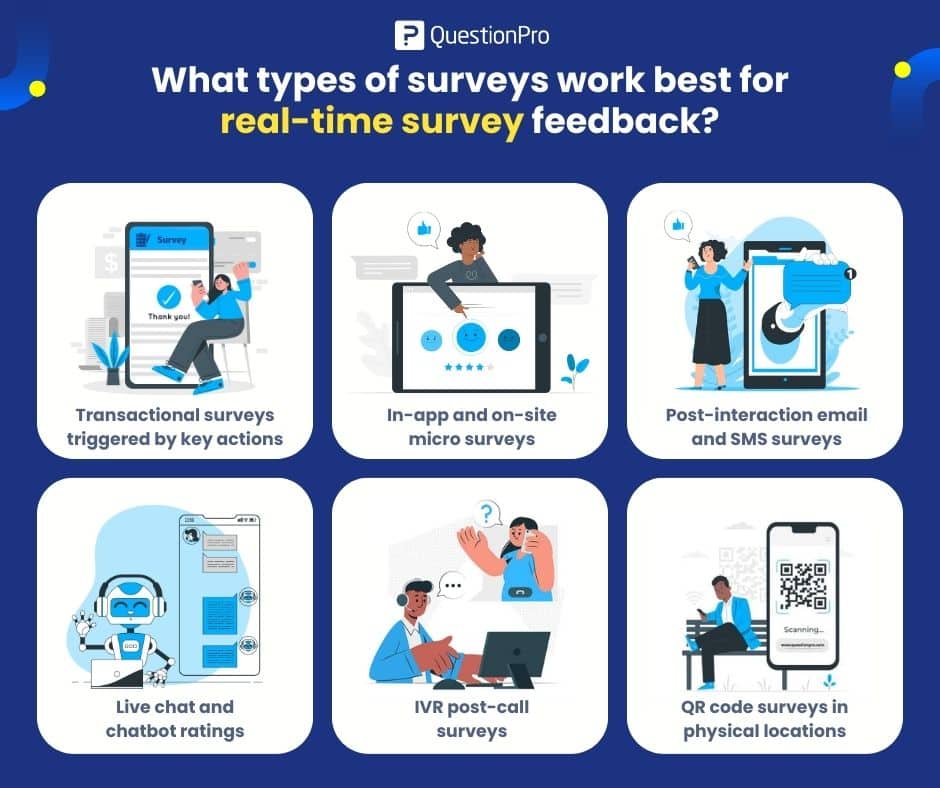

What types of surveys work best for real-time survey feedback?

Real-time survey feedback works best when surveys are short, contextual, and tied to a specific moment in the experience. The closer the feedback is to the action that triggered it, the easier it is to interpret and act on. Long or exploratory surveys rarely benefit from instant analysis because they are designed for reflection, not immediate decisions.

Many real-time feedback programs rely on a poll maker to deploy lightweight formats such as rating polls, ranking polls, and multiple-choice polls. These formats reduce response effort while still producing clear, actionable poll results.

Below are the survey types that consistently perform best for real-time use.

Transactional surveys triggered by key actions

Transactional surveys are the backbone of real-time survey feedback. They are sent immediately after a specific interaction, so the experience is still fresh.

Common examples include:

- After checkout or payment completion

- After delivery or service fulfillment

- After a customer support interaction

These surveys usually measure CSAT, Customer Effort Score (CES), or satisfaction with one to three questions. Because the trigger is clear, teams know exactly which part of the journey the feedback refers to.

In-app and on-site micro surveys

In-app and website microsurveys capture feedback while users are actively engaging with a product or page.

Typical formats include:

- One-question pop-ups after onboarding steps

- Quick ratings after feature use

- Passive feedback buttons that users can click at any time

These surveys work well because they are highly contextual and require minimal effort. They are especially effective for digital products and SaaS platforms used heavily in the USA. These micro-surveys often serve as live polls, providing businesses with instant feedback without disrupting the user experience.

Post-interaction email and SMS surveys

Email and SMS surveys are effective when they are sent immediately after an interaction, not hours or days later.

Strong use cases include:

- Post-support CSAT or effort surveys

- Delivery confirmation feedback

- Appointment or service completion surveys

Timing is critical. When messages are sent immediately, response rates and accuracy are much higher than delayed follow-ups.

Live chat and chatbot ratings

Live chat and chatbot feedback captures sentiment right after a conversation ends.

Common formats:

- Star or emoji ratings after chat closure

- One open-ended question asking what worked or did not

This method is valuable for monitoring agent performance and identifying recurring support issues in near-real-time.

IVR post-call surveys

IVR surveys collect feedback immediately after a phone call using an automated voice system.

Typical use cases include:

- Rating customer support calls

- Measuring resolution satisfaction

Because the survey happens right after the call, recall bias is low, and the feedback reflects the actual interaction, not memory decay.

QR code surveys in physical locations

QR code surveys are effective for real-time feedback in physical environments.

Examples include:

- In-store experience feedback

- Event or conference surveys during sessions

- On-site service evaluations

Customers scan the code and respond on their phones while they are still at the location, making the feedback timely and actionable.

The goal is to collect just enough information to support immediate decisions. Overloading respondents slows response time, reduces completion rates, and weakens data quality. Real-time survey feedback succeeds when relevance is prioritized over volume.

Tips for designing short and interesting surveys to improve data quality & engagement.

How does real-time survey data improve CX optimization?

Customer experience optimization focuses on reducing friction and improving outcomes across journeys. Real-time survey data strengthens this process by showing where experiences break down in real time.

It improves CX optimization by:

- Surfacing friction at specific touchpoints immediately

- Allowing businesses to test fixes and observe the impact quickly

- Preventing small issues from turning into long-term dissatisfaction

For example, if effort scores increase right after a new onboarding flow goes live, businesses can adjust messaging or steps before churn rises. This short feedback loop makes improvement more precise and less risky.

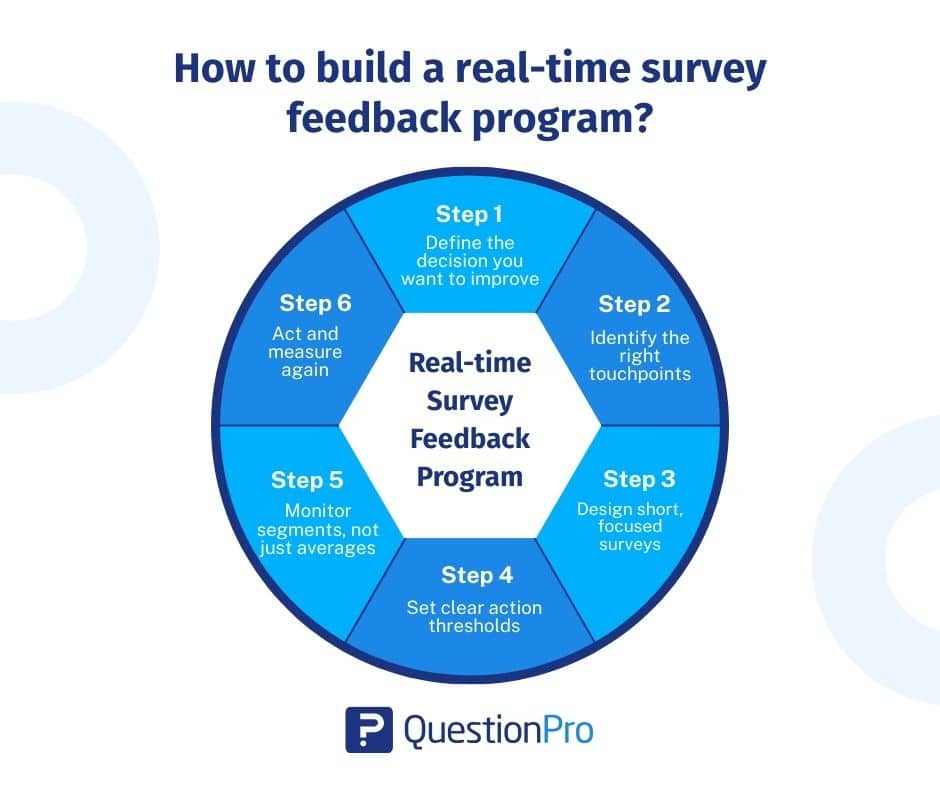

How to build a real-time survey feedback program?

Building a real-time survey feedback program is not about collecting more data faster. It is about creating a clear system that connects live feedback to specific decisions businesses are ready to act on. Without structure, real-time signals quickly turn into noise. With the right setup, they become one of the most reliable inputs for day-to-day CX decision making.

A strong program follows a simple, repeatable process.

- Define the decision you want to improve

Start with a specific decision, such as reducing early churn, improving delivery satisfaction, or lowering support effort. - Identify the right touchpoints

Choose moments where feedback reflects a real experience, not a distant memory.

- Design short, focused surveys

Limit questions to those that support the decision. One to three questions are usually enough.

- Set clear action thresholds

Decide in advance what triggers investigation, escalation, or immediate action.

- Monitor segments, not just averages

Compare results by channel, region, device, or customer type to avoid false conclusions.

- Act and measure again

Make small changes and watch the same signals to confirm whether the action worked.

This approach turns real-time survey data into a controlled feedback system rather than a stream of noise,

Best practices to take smarter customer experience decisions using real-time survey data

Smarter CX decisions come from structure, not speed alone.

Best practices include:

- Do not act on early results without checking the response volume

- Combine scores with open-text feedback to understand context

- Focus on one CX decision at a time

- Document actions taken and their impact

- Train teams to distinguish between normal variation and real change

When paired with behavioral data and customer journey analytics, real-time survey data helps businesses understand not only what customers feel but where and when those feelings emerge in the journey.

How QuestionPro helps to collect real-time survey data for making decisions

QuestionPro helps businesses collect real-time survey data by making feedback available the moment a response is submitted and connecting it directly to decision-ready tools. The focus is not just speed, but relevance, clarity, and actionability.

Here is how QuestionPro supports real-time decision-making in practice:

- AI-powered survey creation

QuestionPro AI helps businesses design surveys faster by suggesting relevant questions and improving clarity. This is especially useful when surveys need to be launched quickly after a product change, campaign, or operational update. - Customizable survey templates: Businesses can use and adapt ready-made templates for transactional surveys, pulse surveys, event feedback, and CX programs, reducing setup time and ensuring consistency.

- Advanced question types: QuestionPro supports formats well-suited for real-time survey data, including rating scales, CSAT, CES, emojis, single-choice questions, and short open-text responses. These keep surveys lightweight while capturing meaningful signals.

- Event-based survey triggers across channels: Surveys can be triggered automatically via email, SMS, in-app prompts, web embeds, or QR codes, ensuring feedback is collected at the exact moment an experience occurs.

- Real-time dashboards: Responses appear immediately in live dashboards. Businesses can monitor trends, review recent comments, and track CX metrics without waiting for surveys to close.

- Live filtering, segmentation, and alerts: Results can be segmented by channel, region, device, or customer type as data arrives. Alerts flag sudden drops in CSAT or spikes in negative feedback so teams can act early.

Together, these capabilities turn real-time survey data into a practical decision system, helping businesses act while there is still time to influence outcomes.

Final note

Real-time survey data is not about reacting faster to everything. It is about seeing experience signals early enough to act thoughtfully. When used with clear goals, short surveys, and disciplined interpretation, it:

- Feeds early signals into broader analysis

- Helps businesses prioritize what deserves deeper study

- Improves alignment between insights and operations

QuestionPro supports this approach by providing a single platform to collect, analyze, and act on real-time feedback without disrupting existing workflows. Live dashboards, event-based triggers, and built-in CX metrics help businesses focus on the signals that matter, while segmentation and alerts reduce the risk of reacting to noise.

By combining real-time survey data with structured research and ongoing measurement, QuestionPro helps organizations turn feedback into a continuous decision system. The strongest CX programs and voice of the customer programs use real-time data to guide action and periodic research to guide strategy.

Frequently Asked Questions (FAQs)

Answer: It means survey responses are visible immediately after submission, allowing businesses to monitor experience signals while interactions are still active.

Answer: It can be, but businesses should wait until sufficient volume and segment consistency are achieved before making high-impact decisions.

Answer: Typically one to three. Short surveys reduce friction and improve response quality.

Answer: Retail, SaaS, healthcare, financial services, logistics, and events benefit most due to fast-changing customer experiences.

Answer: No. It complements long-term programs by providing early signals that guide where deeper analysis is needed.