Customer research is to conducted to gain knowledge about the market. Surveys must be designed accurately to collect reliable customer data and preferences from the right research audience. The collected data is analyzed and used to produce new insights.

The success or failure of the product or service can very well be determined based on the quality of information and insights from marketing research. If the sample selected for research does not match the research criteria, the survey analysis can lead to inaccurate results. Decisions taken based on can adversely affect the growth and success of a business.

The success or failure of the product or service can very well be determined based on the quality of information and insights from marketing research.

7 Risks of a bad research sample

Here are the risks of a bad research sample:

- Overlooking an important audience: Audiences are not just those that will buy products, enroll at school, donate to a cause, etc. It’s important to identify any stakeholders that are important to meeting the business goals. There can arise a scenario where a key audience could be overlooked and that could have a big impact on the success. It may also be discovered that the right audience may be a subset of a larger stakeholder group. Researchers may lose out on useful responses if the important audience is overlooked.

- Not prioritizing audience that matter most: Audiences of organizations are deemed as their employees, customers, stockholders, business partners, etc. However, they are not equally important all of the time. They cannot be contacted for every research product rolled out. The risk here is that in trying to consider everything and everyone, you don’t actually bring a benefit or value to anyone. By ignoring what’s important to the intended audience, organizations may not be able to design marketing strategies and tailor tech product to their needs.

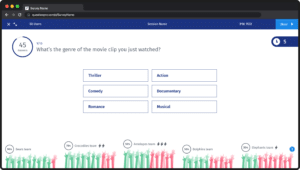

- Survey bias: Research studies bring with them a lot of survey bias. Researchers might believe, for example, that they have created an online survey to appeal to respondents of all ethnic backgrounds. But the survey questions and even its images might favor one ethnic group possibly offend the other ethnic groups. The style of the survey should be acceptable to all audiences from which researchers attempt to gather information. If not, the responses gathered will be totally biased and the research goal will not be attained.

- Survey nonresponse: One market research issue relates to how the survey is offered to the target population. Even targeting the accurate population is an issue. Researchers design a survey and target respondents who choose not to respond to. They try to find out why people hesitate to participate. Conclusions like too much effort needed by the participants or that the incentives do not appeal to respondents are drawn. Targeting the right survey responses in the right fashion helps eliminate the risk of non-response.

- Time: When you have limited time, survey without using sampling becomes impossible. An accurate sample allows researchers to get results with higher accuracy in much lesser time. Time is of the essence when it comes to decision-based market research. The market changes constantly. If sampling is not conducted accurately before researching, researchers may spend additional time targeting and collecting responses from respondents. If time is spent on gathering the information and then re-gathering it after rectifying the sample, the market conditions may change resulting in either decision taken too late or decisions taken when the time is not favorable.

- Money: Running a survey from scratch to the decision making phase involves some level of investment. The level of investment solely depends on the type and size of the research activity. Some researchers also choose to buy samples from vendors. It is important to target the right sample in the first go in order to avoid re-running the research and spending more money on the research activities. Also, any incentives offered initially will be as good as a dead investment as no concrete decision can be drawn from the research activity.

- Data accuracy: Data accuracy is probably the most important factor any researcher looks at while conducting research and avoiding the risks of a bad research sample. Collecting gamer reviews from pet owners will not get you the quality of data required to launch a game. Yes, you will probably encounter some gamers among the pet owners, but the majority of them may not be gamers. This will directly impact the data quality of the research. If you ask the wrong people to answer your questions, your whole analysis can be flawed. While a bad question stands out, it’s not as immediately obvious when you have a poor sampling.

Always remember:

- Always define your sample at the start. Write out who you want to talk to and why.

- Define and design guidelines on who should be included in the audience.

- Decide whether the sample must be divided into smaller groups. This helps further analysis or cross-comparison between the sub-groups.

- Be clear about the quality that you want from your sample. This is increasingly important as the rise of access panels has meant that it is often not questioned whether they have professional respondents.

- Even if it means spending a few extra dollars, always partner with a professional sample provider like QuestionPro Audience.