Knowing how to calculate customer lifetime value (CLV) is crucial to a business’ marketing success. The CLV defines the present value of a brand’s or organization’s customer based on past or predicted purchases. Once the CLV is calculated, businesses can see a defined metric prediction of the value that a customer’s association will have on their future relationship; It can also help businesses determine their high-value customers and aid in guiding their marketing spend.

What is customer lifetime value, and how does it affect profit?

CLV is a fundamental part of customer relationship management (CRM) strategy, as it emphasizes the focus of the customer journey on the importance of long-term customer relationships.

As business owners know, the cost of acquiring new customers outweighs the cost of retaining existing customers. So, knowing the best ways to retain existing customers is essential for increasing profitability.

Two marketing analytics metrics directly affected by customer lifetime value are marketing mix modeling and marketing return on investment (ROI). Marketing mix modeling takes statistics and analyzes the impact that sets of marketing tactics have on sales. Marketing ROI helps businesses determine if their spend is being used efficiently. Knowing that CLV affects these areas (as well as customer satisfaction level (CSAT) and customer effort score (CES)) is vital for allocating resources, providing gap analysis, and understanding the behavior of existing and prospective customers.

The customer lifetime value model itself relies on a few different factors within predictive analytics techniques, with varying levels of sophistication and accuracy.

Learn more: Customer Satisfaction Survey Questionnaires + Templates

How to calculate customer lifetime value: methods and steps

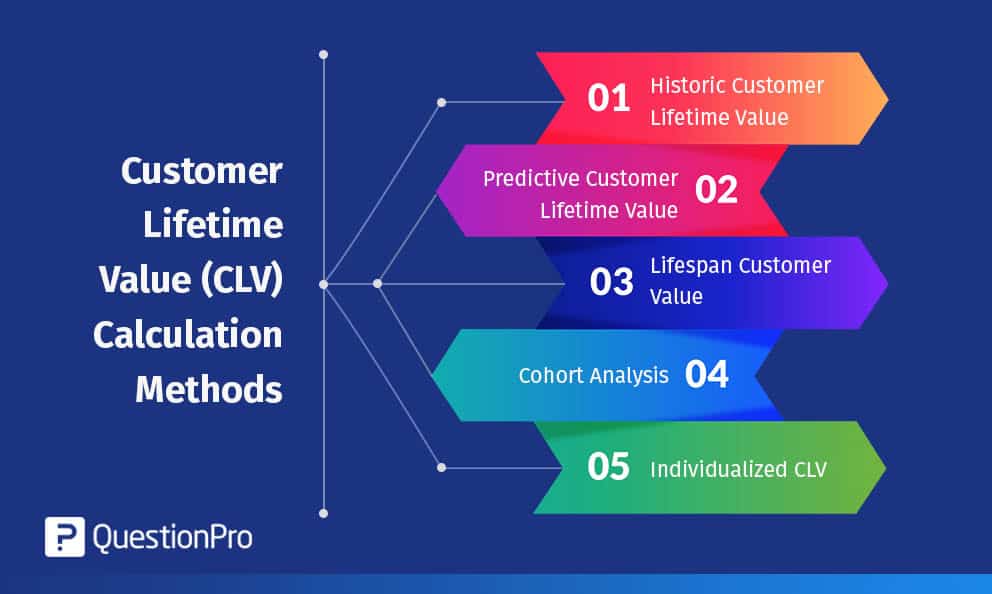

The best method from the list below will depend on which metrics a business uses to track success and how they track their data.

Some of the most widely used methods of calculating customer lifetime value are based on historic CLV, predictive CLV, lifespan CLV, cohort analysis, and individual CLV.

Historic CLV: customer lifetime value calculation

Historic CLV measures the value of transactions or the sum of gross profit from all past purchases made by an individual customer. This calculation requires access to existing customer data involving purchases from a specific time period.

To calculate the historic customer lifetime value, you can use the following formula:

Customer Lifetime Value (Historic)= (Transaction 1+ Transaction 2 + Transaction 3….+ Transaction N) * AGM

Where N is the last transaction made by the customer at your store.

Calculating the CLV prediction in this manner (based on net profit) gives businesses the actual profit that a customer contributes to the business. The historic customer lifetime value accounts for customer service cost, cost of returns, acquisition cost, marketing cost, etc.

The downside to calculating historic CLV is that determining the value on an individual basis can get incredibly complex, so it is better to consider groups of customers or to create a system to manage data.

Predictive customer lifetime value formula

The predictive CLV is a great indicator of the total value a customer will eventually give a business over their whole lifetime, as it uses more collected data.

In practice, determining the exact predictive CLV can be difficult when considering fluctuations in price, discounts, etc. For this reason, there are a couple of ways to calculate predictive CLV that vary in complexity and precision.

To calculate with the predictive CLV model, businesses must use transaction history and behavioral patterns to forecast how a customer’s value will evolve over time.

LEARN ABOUT: Behavioral Targeting

Simple predictive CLV can be calculated using the formula:

Customer lifetime value= ((Average monthly transactions * Average order value) Average gross margin) * Average customer lifespan

This equation becomes gross margin contribution per customer lifespan (GML). Therefore,

Customer lifetime value= Gross margin contribution * (Monthly retention rate/(1+Monthly discount rate-Monthly retention rate))

Learn more: Net Promoter Score (NPS) calculation

Lifespan customer value calculation steps

Another widely used method to calculate the CLV is the lifespan customer value calculation. This method requires you to have the customer value and multiply that by the customer lifespan. This CLV calculation method consists of five steps. They are:

- Calculate the average purchase value: This number can be derived by dividing the revenue of the organization by the total number of purchases in the year. This timespan should be of a fixed time, like one year or two years.

- Calculate the average frequency purchase rate: This number can be derived by dividing the number of purchases by the unique customers that made a purchase over that time period.

- Calculate the customer value: The average customer value can be derived by multiplying the average purchase value and the average frequency purchase rate.

- Calculate the average customer lifespan: The customer lifespan can be derived by averaging the number of years a customer buys from a business.

- The last step would be to multiply the customer value and the average customer lifespan together. This can help calculate how much revenue a customer can contribute in their life cycle with you.

LEARN ABOUT: Customer Lifecycle

The lifespan customer value calculation is similar to the predictive customer lifetime value calculation in that they are both popular predictive models. Although extensive, the lifetime CLV shouldn’t be considered a conclusive research method.

Cohort Analysis

The cohort analysis method collects current customers with similar characteristics and groups them together. Cohort analysis can help organizations draw conclusions between groups of people. To keep cohort analysis conclusive, organizations must be aware of any changes in market dynamics.

There are a few things to keep in mind when calculating cohort analysis, including determining what should be measured (subscription start/cancel dates), the specific cohorts that are relevant and how far they should be segmented (measuring start dates and the differences between each subscription plan types), and which method should be used to perform the analysis (excel or another platform).

Individualized CLV

Organizations may find the individualized CLV useful for considering a broader perspective. This value primarily helps to manage ROI by evaluating distribution methods, marketing methods, landing pages, campaigns, etc. One way that this CLV calculation can be used is to compare the spend of social media marketing to the spend of digital marketing.

These CLV calculation methods are used by a variety of businesses and organizations, depending on their data collection methods and reporting objectives.

The above methods for calculating CLV give businesses insight into which of their channels are the most efficient, who they should be targeting, where their marketing strategy falls flat, and how they can direct their customer service resources to propel their profits and get a better understanding of their customer base.

LEARN ABOUT: Average Order Value

However, none of these insights can be possible without a solid data collection strategy. Thankfully, the team here at QuestionPro CX is here to help! Master the best ways to understand your customer base or collect your data in one dashboard. Sign up for a free trial or book a demo.